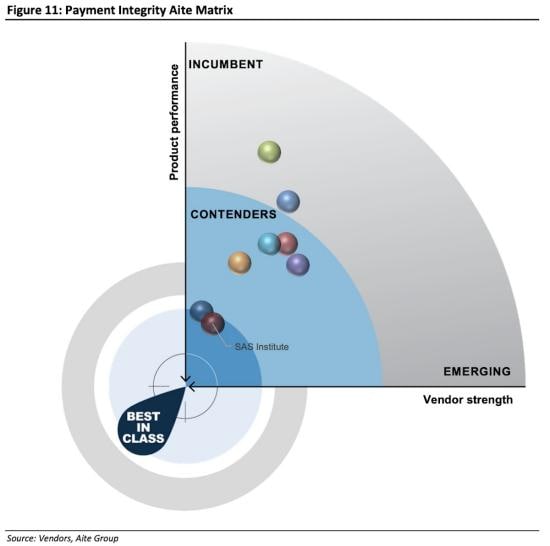

SAS RANKS BEST IN CLASS

Matrix: Payment Integrity in Healthcare

SAS’ legacy and strength in data analytics and aggregation come into play at a time when health plans can benefit from robust analytics capabilities to uncover irregular claim submissions. Building on its core competence, SAS analyzes healthcare claims data using a package of over 1,400 scenarios that trigger alerts, accompanied with a risk value. The company’s stability as a vendor, its brand recognition, and its desirable product features outpace those of its peers.

Explore More SAS Resources

To browse resources by type, select an option below.

-

- Select resource type

- Analyst Report

- E-Book

- White Paper

- White Paper

- Article

- Blog Post

- Book Excerpt

- Case Study

- Infographic

- Interview

- Research

- Series

- Video

- Webinar

- Customer Story

- Article 6 ways big data analytics can improve insurance claims data processingWhy make analytics a part of your insurance claims data processing? Because adding analytics to the claims life cycle can deliver a measurable ROI.

- Customer Story Fighting financial crime through a global anti-money laundering platformBangkok Bank uses advanced analytics from SAS to meet expanding anti-money laundering requirements for global operations and ensure compliance keeps pace with dynamic regulatory frameworks.

- White Paper Protect the Integrity of the Procurement FunctionProcurement fraud affects nearly one-third of organizations, and it is often perpetrated by the most trusted, longtime employees, the ones you’d least suspect. Learn from two white-collar crime specialists about common flavors of procurement fraud, striking examples from recent headlines, four fundamental ways to get better at detecting and preventing fraud, and how to take procurement integrity to the next level.

- Customer Story Managing mergers and analytics: Ensuring reliable energy by eliminating riskWhen the Belgian grid operators Eandis, Infrax and Integan merged into Fluvius, the new company turned to SAS for an analytics solution to screen its procurement systems and identify risks at an early stage.

- Webinar Wake-Up Call: Modernizing Public Health PracticesNow is the time to recognize trends and changes in public health and face down challenges by adapting and modernizing

- Article Online fraud: Increased threats in a real-time worldOnline and mobile banking is convenient for customers -- and an opportunity for fraudsters. With fraud methods constantly evolving, an analytical approach is a must for banks seeking early, accurate detection.

- White Paper The Speed of Digital Disruption: Sustaining Transformation in Health Care and Life SciencesAn expert study investigating the challenges, successes and hopeful future state of the health care and life sciences industry.

- Customer Story Maximizing the reach and impact of an eHealth hubMedical research facility Black Dog Institute partners with SAS to support health care workers’ mental well-being.

- White Paper Keeping Fraud Detection Software Aligned With the Latest ThreatsLearn how SAS enables end users to keep fraud detection software current and able to detect new threats.

- E-Book Integrating data. Enhancing decisions. Improving lives. Find out how cloud-based analytics and AI is transforming health care.

- Analyst Report IDC MarketScape: Worldwide Responsible Artificial Intelligence for Integrated Financial Crime Management Platforms 2022 Vendor AssessmentLearn why SAS is positioned in the Leaders category in the 2022 IDC MarketScape for worldwide responsible artificial intelligence for integrated financial crime management platforms.

- Article How can analytics change the world of 'Narcos'?Surveillance, wire-taps, interrogations, informants… all valuable intelligence gathering techniques. But modern law enforcement and federal agents are now aided by a new technology to zero in on drug trafficking: analytics.

- Customer Story Providing the best medical care via analyticsCrouse Hospital improves patient outcomes with data-driven approach.

- Customer Story Transforming mental health care in California, turning data into insight California's Mental Health Services Oversight and Accountability Commission uses analytics and data management to better serve residents and increase community well-being.

- Customer Story Advanced analytics and machine learning help Poste Italiane identify and stop fraud in real time while enhancing customer experienceItaly’s largest service distribution network relies on predictive analytics from SAS to detect fraud with greater precision and reduce losses.

- Customer Story Analytics helps major public health system run efficient programs and improve patient careThe Los Angeles County Department of Health Services relies on advanced analytics from SAS to meet federal regulations, ensure financial viability and better serve a diverse population of more than 10 million people.

- White Paper 2021 State of Insurance Fraud Technology StudyAs fraud continues to frustrate survey respondents, it's not surprising that the adoption of insurance anti-fraud technologies among respondents grew since the 2018 survey.

- Article How to uncover common point of purchaseBanks that want to stay ahead of CPP and contain the costs of fraud need to implement advanced anti-fraud techniques.

- Analyst Report Chartis RiskTech Quadrant for Watchlist and Adverse Media Monitoring 2024

- Customer Story Protecting policyholders through better fraud analysisEthniki Insurance prevents fraud, reduces costs and increases customer satisfaction with SAS Detection and Investigation for Insurance.

- White Paper Fraud in CommunicationsIn a digital world where everything is available via the web, there’s a whole new level of fraud. Today’s communications providers must be vigilant. This white paper explains how organizations can implement the tools and methods to detect and combat emerging fraud methods.

- Article Finding COVID-19 answers with data and analyticsLearn how data plays a role in optimizing hospital resources, understanding disease spread, supply chain forecasting and scientific discoveries.

- Analyst Report Chartis RiskTech Quadrant for Trade-Based AML Solutions 2022SAS is named a category leader in the Chartis RiskTech Quadrant for Trade-Based AML Solutions, 2022.

- Customer Story Knowing the who, informs the whatThe New Zealand Ministry of Health established the Virtual Data Registry to more accurately identify diabetes sufferers and citizens likely to contract diabetes. They'll use the database to inform policy and spending decisions that will ensure better care for those patients.

- Customer Story Advanced analytics helps hospital put patients at the heart of improved outcomes San Martino Polyclinic Hospital uses SAS Visual Analytics on SAS Viya for more patient-focused operations and decisions.

- Article Detect and prevent banking application fraudCredit fraud often starts with a falsified application. That’s why it’s important to use analytics starting at the entrance point. Learn how analytics and machine learning can detect fraud at the point of application by recognizing the biggest challenge – synthetic identities.

- White Paper AML ModernizationThis white paper explores current organizational challenges, outlines the benefits of new AML technology adoption, and identifies how to embark on a journey of discovery and modernization.

- Article What do drones, AI and proactive policing have in common?Law enforcement and public safety agencies must wrangle diverse data sets – such as data from drones – in their proactive policing operations. To be most effective, they need modern tools that support AI techniques like machine learning, computer vision and natural language processing.

- Customer Story A data-driven approach to whole person careRiverside County relies on data integration and analytics from SAS to improve the health and well-being of vulnerable Californians.

- Article Analytics leads to lifesaving cancer therapiesA long-shot treatment offers hope to 10-year-old Harrison after he learns the DNA profile of his cancer is resistant to chemo. Find out how data and analytics play a role in cancer research and cancer treatments that are saving lives.

- White Paper Banking in 2035: three possible futuresThis paper explores how the major forces affecting banks may evolve between now and 2035, seen through the lens of three potential scenarios.

- White Paper Top Trends: Why Tax Administrators Are Adopting New Data and Analytics StrategiesDespite best efforts, governments lose several trillion dollars annually to the economic crimes of tax evasion and noncompliance. Learn about the top five trends shaping the future for tax administrators.

- Analyst Report Chartis RiskTech100 2024SAS climbs to No. 2 in the prestigious Chartis RiskTech 100®, 2024, and bested seven technology award categories, including AI for Banking, Behavioral Modeling and Enterprise Stress Testing.

- Article Big data in health careThere's enormous potential for big data in health care: Individualized medical treatment, improved processes, reduced waste and so much more. See how three health care organizations are leading the way.

- White Paper Managing the Intelligence Life CycleBecause terrorists and other criminals are already using technology to carry out their missions, intelligence professionals need to access all available, appropriate information, to extract important elements and process, analyze and disseminate it quickly to keep ahead of potential threats.

- White Paper Safer communities, trusted law enforcementThrough an analytics-based approach to officer readiness, SAS can help law enforcement ensure public safety and reestablish a culture of trust.

- Article The transformational power of evidence-based decision making in health policyState health agencies are under pressure to deliver better health outcomes while minimizing costs. Read how data and analytics are being used to confront our biggest health care challenges head on.

- Article How to prevent procurement fraudPerpetrated in several ways, procurement fraud is difficult to detect. Arm yourself with hybrid analytics that offer various approaches for cross-pollination of data and analysis.

- White Paper Using Modern Analytics to Save Government Programs MillionsNext-generation analytic tools from SAS cut across data and program silos and empower investigators to go on the offensive with fraud operators – without disrupting the efficient and timely delivery of benefits, services or tax refunds.

- E-Book Faces of FraudLearn how strong, AI-enabled fraud detection can help businesses rise to their customers’ expectations and gain a competitive edge.

- Customer Story Stopping payment fraud in real timeThe Bank of East Asia uses SAS Fraud Management for payment fraud detection and prevention.

- White Paper An Analytic PrescriptionAt the May 2014 SAS Health Analytics Executive Conference, industry leaders from Dignity Health, Highmark Health, Eli Lilly Company, and SAS shared what they have done to prove the value of analytics to their business leaders and develop an analytic culture in their organizations.

- White Paper Proactive anti-financial crime strategies to improve compliance and reduce riskIn today’s fast-changing landscape, become more effective across all stages of AML investigations by following this framework and shift to a proactive, risk-based approach.

- Article Know your blind spots in tax fraud preventionTax agencies sometimes miss fraud that's happening right under their noses – despite robust external fraud prevention efforts. Find out where traditional tax fraud prevention and detection efforts fall short, and how analytics can change that.

- Customer Story Automated laboratories improve uptime with analyticsPredictive service and maintenance keeps Siemens Healthineers lab tests running on time.

- White Paper Fighting the Rising Tide of Medicaid FraudMedicaid fraud has jumped dramatically in the era of COVID, as increasing complexity of delivery and payment models, along with increased funding, has created openings for fraudsters, including organized crime.

- Article Stop contract and procurement fraudFraud affects an estimated 30 percent of organizations' procurement processes. Beyond business rules and anomaly detection, analytics can detect and prevent fraud and preserve the integrity of the procurement process.

- Article When it matters: Safeguarding your organization from the insideWith evolving threats, fraud detection technologies have to be flexible and nimble, and automated risk detection is a crucial component of decision advantage.

- Article The best gift you can give to thieves this holiday season? Your identity.While the use of EMV in cards has helped to mitigate fraud perpetrated at retail stores, undeterred fraudsters have focused their efforts online. Find out how advanced analytics and machine learning help combat this threat.

- White Paper The road to health equityHow data and analytics contribute to improving outcomes for all.

- Article Using analytics to prevent deadly infections Dignity Health’s Bio-Surveillance Program predicts new sepsis cases, allowing early intervention and saving lives.

- Article Taking pre-emptive action to stem the tide of VAT fraud lossesEU countries lost an estimated €159.5 billion in VAT revenues to VAT fraud in 2014. The solution? Hybrid fraud analytics technology.

- White Paper Fraudsters love digitalBy incorporating fraud analytics as a first line of defense, insurers can build in safeguards for all of their digital programs. In turn, they can spot emerging fraud rings, emerging fraud trends, and make real-time decisions on claims recovery to reduce leakage.

- Customer Story Advanced analytics can detect and prevent insurance fraud before losses occur

- Customer Story Fighting loan application fraud with cutting-edge analyticsBausparkasse Schwäbisch Hall uses SAS® Viya® to identify forged income documents

- Article Next generation anti-money laundering: robotics, semantic analysis and AIAnti-money laundering taken to its next level is sometimes referred to as AML 2.0 or AML 3.0. What does this next wave of AML technology look like? What can it do that you can’t do with traditional AML? See the results innovative financial institutions around the globe are already getting.

- White Paper Procurement integrity powered by continuous monitoringWhy do many otherwise well-intentioned employees feel tempted to commit fraud – and end up being successful for so long? See why you can't afford to wait to take action.

- White Paper Fighting Insurance Application Fraud Learn about the advantages of using analytics-driven methods for authenticating applicants to reveal customer gaming, agent gaming and potential future claims fraud.

- White Paper Government Procurement OfficesFind better ways to address fraud, waste and abuse – and respond more effectively to budget cuts – by using SAS to help you achieve new levels of fiscal responsibility.

- Analyst Report Chartis RiskTech Quadrant for Enterprise Fraud Solutions, 2023: Vendor AnalysisChartis RiskTech Quadrant for Enterprise Fraud Solutions, 2023 has named SAS a category leader for enterprise fraud solutions.

- White Paper Anti-Fraud Technology As criminals find new ways to exploit technology and target potential victims, anti-fraud professionals must adopt new technologies to effectively navigate the evolving threat landscape.

-

Customer Story fluvius uses sas procurement cockpit

- Article Mobile payments, smurfs and emerging threatsM-payment remittances are replacing traditional banks and money services that have historically charged high fees for small transfers. Former US Treasury Special Agent John Cassara maps what he sees in the road ahead and gives advice for protecting your firm.

- White Paper What Lies BeneathThe prevalence of and approaches to procurement fraud in global business.

- Article Bad debt and fraud... It’s all the same, right?In the case of application fraud in banking, or subscription fraud in telecommunications, a large proportion of fraud is typically misclassified as bad debt.

- White Paper Detect and Prevent Identity Theft The explosion in e-commerce and online account opening has created new convenience and choice for consumers. At the same time, large-scale data breaches have created new opportunities for fraudsters, fueling an 8-percent increase in identity theft in a single year. Find out how to fight back, without hindering your good customers.

- Customer Story Revolutionizing fraud detection at TechcombankAward-winning Vietnamese bank slashes time needed for fraud detection to mere seconds using a SAS enterprise fraud solution.

- Customer Story SAS Viya and open source: Innovation through collaborationHealth insurer Techniker Krankenkasse works with SAS to build innovative pattern recognition capabilities.

- Article How researchers are fighting cancer with analyticsThanks partly to analytics, cancer survival rates are higher, treatments are more personalized and cancer research continues to expand.

- Analyst Report Matrix: Payment Integrity In HealthcareAccording to this 2021 report on healthcare payment integrity from Aite, SAS' stability as a vendor, its brand recognition and its desirable product features outpace those of its peers.

- E-Book Data-driven health careThe use of technology and data in the health care ecosystem continues to evolve. An extreme emphasis has been placed on digital health, AI, and the need for interoperability across various stakeholders in the healthcare ecosystem. Interoperability of different health care systems and devices to seamlessly exchange information is crucial to provide stronger health outcomes and patient engagement opportunities, enhance patient safety and operational efficiency, and reduce duplicated effort and potential for error. Discover how health care powered by data and technology will be the springboard to the future.

- Article 10 tips for Life Insurance Companies and AMLLife insurance companies have AML challenges that are both simple and complex. The challenges are simple as there are less products and channels available compared to banks. Here are 10 tips to consider to stay ahead of the international crime syndicates.

- Webinar What Is a Next-Gen AML System?Learn how AI, machine learning and robotic process automation can help the global banking industry and financial firms transform the fight against money laundering.

- White Paper How Public Sector Agencies Can Use Analytics to Lead Through CrisisWhen public service leaders need to make vital decisions quickly – to guide people through a crisis and save lives – data analytics is essential.

- Analyst Report SAS is a Leader in The Forrester Wave™: Anti-Money Laundering Solutions, Q3 2022SAS Anti-Money Laundering, which helps fight money laundering and terrorist financing with AI, machine learning, intelligent automation and advanced network visualization, is named a Leader in The Forrester Wave.

- Article IoT in health care: Unlocking true, value-based careGiven the potential of IoT – and the challenges of already overburdened health care systems around the world – we can’t afford not to integrate IoT in health care.

- White Paper Machine Learning Use Cases in Financial CrimesLearn 10 proven ways machine learning can boost the efficiency and effectiveness of fraud and financial crimes teams – from data collection to detection to investigation and reporting.

- White Paper Data and Analytics to Combat the Opioid EpidemicThis research brief from the International Institute for Analytics and SAS explores how data and predictive analytics can help develop better treatment protocols, both for initial pain and for remediation when patients become dependent on the drugs.

- Article Uncover hidden financial crime riskEscalating threats call for a financial crime risk framework that uses powerful, visual, interactive techniques to proactively identify hidden risks.

- Article Analytics: A must-have tool for leading the fight on prescription and illicit drug addictionStates and MFCUs now have the analytics tools they need to change the trajectory of the opioid crisis by analyzing data and predicting trouble spots – whether in patients, prescribers, distributors or manufacturers. The OIG Toolkit with free SAS® programming code makes that possible.

- Article Who is committing procurement fraud in Australia and New Zealand?The global estimates for procurement fraud and abuse of procurement supply chain are significant – but as it’s usually internal fraud, are we avoiding the problem? The impact of fraud on the business are more than financial – reputation, loss of management time and loss of human capital. Removing the temptation may benefit everyone.

- Article Managing fraud risk: 10 trends you need to watchSynthetic identities, credit washing and income misrepresentation – these are just some of the trends to watch if you’re trying to understand how to manage fraud risk. Find out what’s on the top 10 list of trends according to experts like Frank McKenna and Mary Ann Miller.

- Article How health care leaders deployed analytics when crisis hitDuring the COVID-19 pandemic, some health care providers were well-positioned to respond to rapid changes in demand. The factor that most distinguished them was that they already had a strong capacity in place for using data to inform decisions. Read about three key takeaways from their experiences.

- Article Situational awareness guides our responses – routine to crisisMany circumstances call for situational awareness – that is, being mindful of what’s present and happening around you. The COVID-19 pandemic heightened this need, as leaders across industries used analytics and visualization to gain real-time situational awareness and respond with fast, critical decisions.

- Article Small-time cheats and organized crime: Benefits fraud re-examinedTo combat benefits fraud, better utilize resources and improve ROI, analytics can detect organized crime rings rather than just small-time fraudsters.

- White Paper Behavioral Health in the Health Care IT EcosystemThe imperative to advance infrastructure and analytics to move toward whole-person care

- White Paper Effective fraud analytics: 10 steps to detect and prevent insurance fraudInsurers that follow the 10 steps outlined in this paper offer the best chance for detecting both opportunistic and organized fraud.

- Article Applying technology to ensure voter integrity in electionsVoter integrity is becoming a serious concern for many elections. Recent disclosures of foreign influence campaigns using social media highlight the potential impact on the integrity of the democratic process. In monitoring your systems, technology can identify both legitimate and fraudulent activity; the balancing act is to minimize the impact on legitimate activity while preventing acts of cyber-criminals and fraudsters.

- Article Proactive detection – A new approach to counter terrorTo counter terror, investigative teams can better utilize the data they already have by applying a fresh approach with these steps to proactive detection.

- Article Continuous monitoring: Stop procurement fraud, waste and abuse nowProcurement fraud, waste and abuse silently robs businesses an average of 5% of spend annually. And even when organizations invest in detection methods, they’re often let down by their techniques. Learn what continuous monitoring is and why this proven analytical method is key to fighting back.

- Article Public health infrastructure desperately needs modernizationPublic health agencies must flex to longitudinal health crises and acute emergencies – from natural disasters like hurricanes to events like a pandemic. To be prepared, public health infrastructure must be modernized to support connectivity, real-time data exchanges, analytics and visualization.

- Webinar Understanding Your Customer in a Digitised LandscapeExperts from SAS and Javelin Strategy & Research discuss the pandemic-driven increase in digital banking and its effects on the fraud landscape and the customer experience.

- Article Unemployment fraud meets analytics: Battle lines are clearly drawnMany fraudsters seized opportunities presented by the COVID-19 pandemic. During the crisis, unemployment fraud became a battleground between international criminal networks and government agencies. Learn how analytics can save billions – and deliver benefits to those truly in need.

- Article Medicaid and benefit fraud in 2018 and beyondTo curb the growing amount of Medicaid and benefit fraud and improper payments, agencies and their commercial counterparts need fraud and abuse detection systems with data management and analysis that can keep up and even stay one step ahead.

- E-Book Powering Health Innovation with AIThere is no doubt: AI has the potential to transform health care. The most recent SAS Hackathon showcased how the transformative power of analytics can spark health care innovation. The Hackathon was entirely conducted on a Microsoft Azure cloud infrastructure to facilitate the agile analysis and visualization of big data.

- White Paper AI Is at the Forefront of Reducing Money Laundering and Combating the Financing of Terrorism See how artificial intelligence (AI), machine learning (ML) and robotic process automation (RPA) are helping firms overcome the challenges, improve results and make AML/CFT programs more efficient and effective.

- Webinar From Idea to Action: The Keys to Real-World Evidence and AnalyticsReal-world data is the latest industry buzz, but is it that valuable? Without the power of analytics, it might not be.

- Article Are you covering who you think you’re covering? Payers often don't focus enough on healthcare beneficiary fraud in public and private healthcare plans. Before paying a claim, payers need to ensure beneficiaries are eligible. Advanced analytics applied to a broad range of data can help them accurately detect and prevent beneficiary fraud.

- E-Book High velocity decisions. Trusted outcomes.Protecting against fraud, money laundering and public security challenges requires making intelligent decisions that guide swift, effective actions.

- White Paper Detect and prevent digital banking fraudDiscover how banks can fight identity-based fraud attacks using proven analytical methods to detect the fraudsters while expediting service for legitimate customers.

- White Paper Value and Opportunity: An Executive Guide to Procurement IntegrityProcurement integrity (PI) represents a broader problem and bigger opportunity than most businesses recognize. Comprehensive PI programs continuously validate purchasing transactions, using data and analytics to trace patterns, spot anomalies, and reduce fraud, waste and abuse.

- Article Online payment fraud stops hereBillions of dollars each year are lost to online payment fraud through channels that provide convenient – yet vulnerable – ways to shop and bank. See how to fight back and win with advanced analytics.

- E-Book The Future of Energy & Utilities: Transform Through InnovationThe Energy & Utilities sector is on a countdown to reinvention. The surge in demand for advanced technology, smart cities and electric mobility is converging with the need for renewable energy sources and sustainability.

- White Paper Next-generation AMLSix tips to modernize your fight against money laundering.

- Customer Story Predictive analytics helps save lives during COVID-19 pandemicFPS Public Health uses SAS to forecast hospital bed occupancy, predict infection rates and ensure sufficient medical staffing during global health crisis.

- Article 5 steps to sustainable GDPR complianceFollow these steps to achieve GDPR compliance by the May 2018 deadline – and get added benefits along the way.

- White Paper Managing Fraud Risk in the Digital Age The rise of mobile and online transactions introduces new fraud risks. Retailers and payment processors must adapt their anti-fraud defenses, augmenting them with stronger, analytics-driven authentication, proactive detection and mitigation tools.

- Customer Story A risk-based approach to combat money laundering in IsraelSAS Anti-Money Laundering helps Ayalon Insurance monitor suspicious activity and meet challenging regulatory requirements.

- Article Detecting health care claims fraudHealth care claims fraud could represent as much as 10 percent of total claims cost. Learn how to fight back with analytics.

- Article Shut the front door on insurance application fraud!Fraudsters love the ease of plying their trade over digital channels. Smart insurance companies are using data from those channels (device fingerprint, IP address, geolocation, etc.) coupled with analytics and machine learning to detect insurance application fraud perpetrated by agents, customers and fraud rings.

- Article How AI and advanced analytics are impacting the financial services industryTop SAS experts weigh in on topics that keep financial leaders up at night – like real-time payments and digital identity. See how advanced analytics and AI can help.

- Article 5 Hurdles to effective cybersecurityIn the battle against cybercrime, it often seems that the threats are like tentacles of an octopus – as soon as you think you are safe from one, the other comes in to get you. The obstacles to staying ahead of the threats are numerous. Jen Dunham and Chris Smith discuss five they think are the most pressing.

- White Paper Banking in 2035: global banking survey reportWhat trends do banking leaders consider to be the greatest risks and the greatest opportunities? What internal and external barriers stand in their way? What technologies will help them harness the opportunities ahead? Download the report to explore.

- E-Book Fight money laundering with these 5 next-gen game changers from SASEffectively battling dynamic financial crime threats requires new capabilities for AML defense – such as artificial intelligence, machine learning, intelligent automation and advanced visualization.

- Customer Story Optimizing cancer patient care with advanced analyticsSAS Viya helps create custom care pathways for Oscar Lambret Center cancer patients.

- White Paper How AI and Machine Learning Are Redefining Anti-Money LaunderingMachine learning can play a big role in the defense against money laundering, either to automate tasks that formerly required human intervention, such as managing the data to train models, or detect more financial crimes risk that rules and more basic analytic techniques might miss.

- Article Intelligent policing: Data visualization helps crack down on crimeLearn how data visualization can give police real-time views of locations enriched with other data to help them make intelligent, fact-based decisions.

- Article Rethink customer due diligenceTo streamline compliance and protect against financial and regulatory risk, re-examine your customer due diligence processes and technologies regularly. With new analytical tools, you can monitor customer transactions or personal information in real time, and accurately segment customers by the risk they represent.

- Article 4 strategies that will change your approach to fraud detectionAs fraudulent activity grows and fighting fraud becomes more costly, financial institutions are turning to anti-fraud technology to build better arsenals for fraud detection. Discover four ways to improve your organization's risk posture.

- Webinar AI in Health Care: Enhance Clinical and Operational Decision MakingAI is revolutionizing the health care sector. Join SAS and Microsoft to explore innovative AI solutions for better patient outcomes and efficient care delivery.

- Customer Story A data-driven approach to suicide prevention in Australia

- White Paper Artificial Intelligence for ExecutivesThis paper outlines the SAS approach to AI and explains key concepts. It also provides process and implementation tips if you are considering adding AI technologies to your business and analytical strategies.

- E-Book Innovation driven by strategyFrom curing diseases to studying the sun, innovative uses of analytics are changing the world. Download this e-book to see where tomorrow’s technologies are happening today. You’ll find out how analytics technologies are being used for cybersecurity, machine learning, the Internet of Things and more. If you’re looking for inspiration, see where this e-book takes you.

- Article 4 ways data analytics is changing and benefiting healthcareThe healthcare industry has long been a pioneer in adopting new technology, but how has embracing analytics improved the sector? Let's take a look.

- Analyst Report Celent Insurance Fraud Detection Solutions: Property and Casualty Insurance, 2022 EditionSAS is a Luminary in Celent's Insurance Fraud Detection Solutions: Property and Casualty Insurance, 2022 Edition.

- E-Book Protecting the PaymentsAs unemployment insurance claims increased dramatically because of pandemic job losses, incidents of fraud have also grown exponentially in federal and state government systems.

- E-Book On the Road to Accelerating Claims AutomationMore than ever, insurance companies need to provide customers with seamless interactions that save them time, minimize hassle, and make them feel seen, understood, and cared for. Many are also exploring the use of AI for claims prevention – for example, by creating new risk mitigation services. All of this requires investment in digital technologies that work together to enable intuitive, Amazon-like customer experiences. This ebook explores how insurers can make the leap to digitally transformed, intelligent claims processes that customers love and increase operational efficiency and reduce costs.

- Customer Story Fast analytical defenseDeutsche Kreditbank AG combats fraud and money laundering with SAS.

- Analyst Report Celent: Insurance Fraud Detection Solutions: Health Insurance, 2022 EditionSAS was named a Luminary in Celent's Insurance Fraud Detection Solutions: Health Insurance, 2022 Edition, excelling in both Advanced Technology and Breadth of Functionality.

- Article Strengthen your payment fraud defenses with stronger authenticationThe rapid growth of digital wallets and payment applications ushered in many new payment fraud threats. Today, it’s more critical than ever to authenticate users. Learn four innovative to ways strengthen your authentication defenses while reducing false positives and protecting customers’ assets.

- White Paper Balancing Fraud Detection and the Customer Experience Customers of a digital business create an intricate online footprint as they transact online. Businesses that capture and truly understand a complete identity based on online and offline attributes can seamlessly authenticate good customers and reliably spot the fraudulent or hijacked identities – in real time.

- White Paper Achieving program integrity for health care cost containmentLearn how taking an enterprise approach to payment integrity – one that combines advanced data management and sophisticated analytics – can help payers detect and prevent fraud; effect positive change in how providers, employees and patients behave; and substantially reduce health care costs.

- Article Improve child welfare through analyticsWith tremendous potential for child welfare agencies to use data and analytics to prevent child abuse and improve outcomes for children and families, child welfare advocates discuss the benefits of using data and establishing a data-driven culture to advance practice and policy.

- Article Putting an end to pay and chaseSophisticated technology-driven approaches can not only root out fraud in social benefits programs, but find it before payment is made. A proactive approach can reduce the 5 to 7 percent of government dollars that end up in fraudsters’ pockets.

- Article Market Abuse and Advanced AnalyticsHolistic Trader and Trader Surveillance are what the Risk and Compliance departments are crying out for. What’s the role of Predictive Analytics and Machine Learning in Market Abuse Solutions?

- White Paper The Road to Value-Based Health CareThis paper describes the transformative tools that use advanced analytics to help health care organizations balance the goals of cost reduction and quality improvement through analysis of episodes of care.

- Article Three considerations for your next generation tax compliance platformCRS is truly global, extending to any customer who is a tax resident in a reportable country. Don’t view this as just another “tick in the box” exercise. Tackling this with a manual process or even cobbling together a semi-automated system, as many have done for FATCA, just won’t cut it. While it may seem like another situation to throw valuable resources, time and money at meeting a new compliance, I also see this as a real opportunity.

- White Paper Data, analytics and machine learning: The new frontier of fraud preventionThe Economist explores how global financial institutions are using advanced technologies such as machine learning to support fraud and security intelligence.

- Customer Story Italy’s second-largest hospital uses advanced analytics for effective pandemic responseGemelli University Hospital uses SAS solutions to predict admissions of patients in the intensive care units and impacts on the organization, from staffing hospital wards to effectively scheduling and managing COVID-19 vaccine administration.

- Article Can data sharing lead to cancer discoveries?Clinical trials can bring new drugs – and new hope – to the market for cancer patients. Now, a new data sharing platform for clinical trial data brings even more hope.

- Customer Story Automated safety reporting protects hospital patients in NorwayHelse Nord uses SAS to automate its hospitals’ processes and halves their workload.

- Customer Story European Banking-as-a-Service leader strengthens its AML/CFT and fraud surveillance system with SASTreezor uses SAS Anti-Money Laundering to stay ahead of emerging risks, improve operational efficiency and expedite investigations.

- Analyst Report SAS is a Leader in The Forrester Wave™: AI Decisioning Platforms, Q2 2023.The Forrester Wave™: AI Decisioning Platforms, Q2 2023 recognizes SAS for seamlessly integrating world-class analytics for decisioning.

- White Paper Generative AI in Health Care: Opportunities and CautionsLearn how GenAI will affect all aspects of health care, from cost containment to patient care., and the importance for organizations to recognize both the potential and the limits of this new technology and be alert to how it’s being used to perpetrate fraud.

- White Paper Leveraging Analytics to Combat Digital Fraud in Financial OrganizationsInternational Institute for Analytics summarizes key questions and answers about financial fraud in the digital age.

- Customer Story Turkish insurer achieves real-time fraud detectionAksigorta uses advanced analytics to increase fraud detection rate by 66 percent.

- Article Why you should care about episode analyticsThe future of value-based health care requires a better understanding of how patients are treated for thousands of conditions. Only episode analytics can uncover the insights payers and providers need.

- Article Analytics at the edgeStreaming data from automobiles, medical devices, location apps and other "things" lives at the edge of the network, where it can be used to monitor existing conditions and evaluate future scenarios. Learn how organizations in multiple industries are finding opportunity in analyzing this data from the Internet of Things.

- White Paper Data-Driven PerformanceAgency program executives need to know a lot about their programs beyond whether the spending rate results in a balanced budget execution.

- White Paper Payments Without BordersMitigating fraud risks in cashless payments by holistically understanding your customers across all channels.

- Article Top prepaid card fraud scamsThe margin for prepaid cards is slim, so it's particularly important to root out the scams. Here are some tips for combating and mitigating prepaid card fraud.

- White Paper Modernizing Healthcare Analytics on the Cloud: Experiences from the Front LinesDramatic changes in the health care industry over the past decade have ratcheted up the demand for big data analytics while simultaneously highlighting the information risks associated with data protection and the benefits of utilizing advanced analytics to improve health outcomes, equity and quality. Many organizations are turning to cloud computing to modernize their analytics life cycle, yet sometimes they face unexpected roadblocks along the way.

- White Paper Text Analytics for ExecutivesThis paper looks at how organizations in banking, health care and life sciences, manufacturing and government are using SAS text analytics to drive better customer experiences, reduce fraud and improve society.

- Customer Story Advancing mental health care with predictive analyticsCanada’s Centre for Addiction and Mental Health uses SAS Analytics to improve care and streamline hospital operations.

- Article Australian Superannuation at RiskWith over $2tn of assets, Australians’ retirement savings are under attack from Fraudsters and Hackers, even more so as Superannuation providers move into Digital with customer portals and faster processing. However, it is not all doom and gloom as behavioural signals of fraud are typically there well before the actual fraud occurs.

- Analyst Report dbInsight: SAS Viya is living large on AzureLearn how Azure provides the onramp to a new customer base to take advantage of SAS capabilities without having to make big enterprise software commitments.

- Article Health care cost containment through big data analyticsHealth insurers are plagued by fraud, waste and abuse. For health care cost containment, an enterprise approach to payment integrity using data management and analytics can help. With this approach, payers can detect and prevent fraud; influence provider, employee and patient behavior; and substantially reduce costs.

- Analyst Report Matrix: Leading Fraud & AML Machine Learning PlatformsSAS is a best-in-class vendor in the most recent Datos Insights report, Matrix: Leading Fraud & AML Machine Learning Platforms.

- Customer Story Combating financial crime and terrorism financing with real-time sanctions screeningOrange Bank stays ahead of emerging risks and changing regulations with a cloud-based sanctions-screening solution from SAS and Neterium.

- Article Containing health care costs: Analytics paves the way to payment integrityTo ensure payment integrity, health care organizations must uncover a broad range of fraud, waste and abuse in claims processing. Data-driven analytics – along with rapid evolutions in the use of computer vision, document vision and text analytics – are making it possible.

- White Paper The Escalation of Digital FraudThis Javelin Research report is based on 120 independent interviews of payment and security executives in 20 countries and delivers a clear picture of how digital fraud has changed the global operating environment for financial institutions.

- Customer Story Preventing crime and ensuring compliance at 120 Nordic banksSDC enables small and medium financial institutions in four Nordic countries to stay compliant.

- White Paper Enforcing Tax Compliance in a Turbulent WorldIIA spoke with SAS experts to explore innovative ways to use data and analytics to improve operational efficiency, taxpayer engagement, and smart decisions throughout the revenue and compliance process.

- Article Analytics for prescription drug monitoring: How to better identify opioid abusePrescription drug monitoring programs (PDMPs) are a great start in combating abuse of prescription drugs, but they could be doing much more. Better data and analytics can inform better treatment protocols, provider education and policy decisions – and save lives.

- Article Payment fraud evolves fast – can we stay ahead?Payment fraud happens when a criminal steals a person’s private payment information, then uses it for an illegal transaction. As payment trends evolve, so do the fraudsters. Banks and PSPs can fight back with advanced analytics techniques that adapt quickly to spot anomalies in behavior.

- White Paper Rethinking customer due diligenceHelp evaluate your organization's CDD processes and technology relative to current industry risks and regulatory requirements.

- Customer Story Hospitals save time and money with real-time medical device tracking Jan Yperman Hospital uses Blyott and SAS Visual Analytics on SAS Viya to monitor hospital asset locations and ensure optimal purchasing decisions.

- E-Book Public service of the futureNever before have governments been asked to do so much, so fast, while facing considerable pressures – rising customer service expectations, fiscal constraints, overstretched organizations and workforce fatigue. Technologies like AI and generative AI are shifting the limits of what is possible – enabling fresh ideas about how public sector organizations can deliver services and helping to rethink what services are offered. From national to local government, law enforcement to health and defense to education, great strides are being made to deliver better outcomes and experiences. In this e-book, you will discover six considerations for improving productivity and ensuring public servants have the time to focus on what matters. Here's a sneak peek: · How do different demographics engage with public services and how do you serve everyone? · Are traditional processes meeting your organization’s needs? Would updating and modernizing help you achieve increased operational efficiency? · How AI is a catalyst for organizational transformation.

- Article Fraud detection and machine learning: What you need to knowMachine learning and fraud analytics are critical components of a fraud detection toolkit. Discover what you’ll need to get started defending against fraud – from integrating supervised and unsupervised machine learning in operations to maintaining customer service.