SAS Enterprise Guide

Empower users to be self-sufficient with guided access to the analytical power of SAS.

Key Features

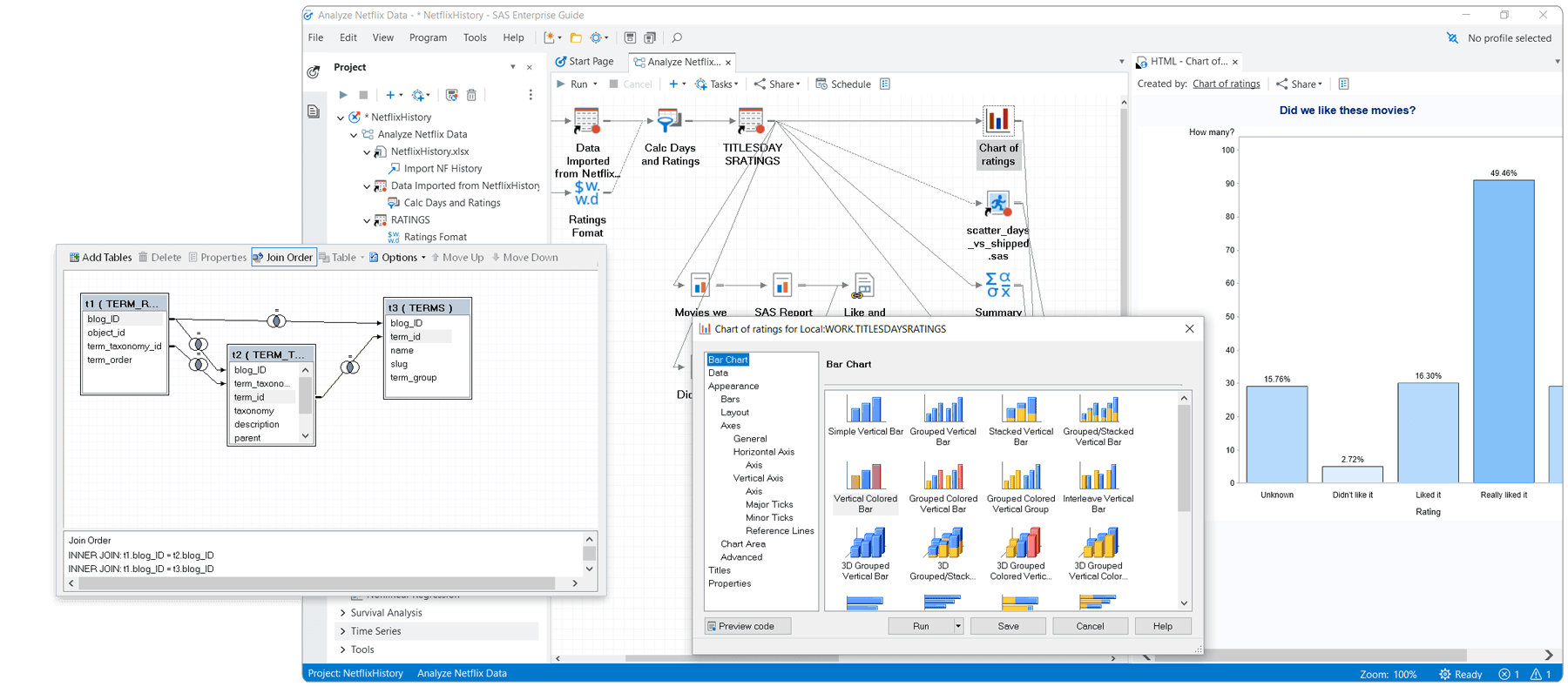

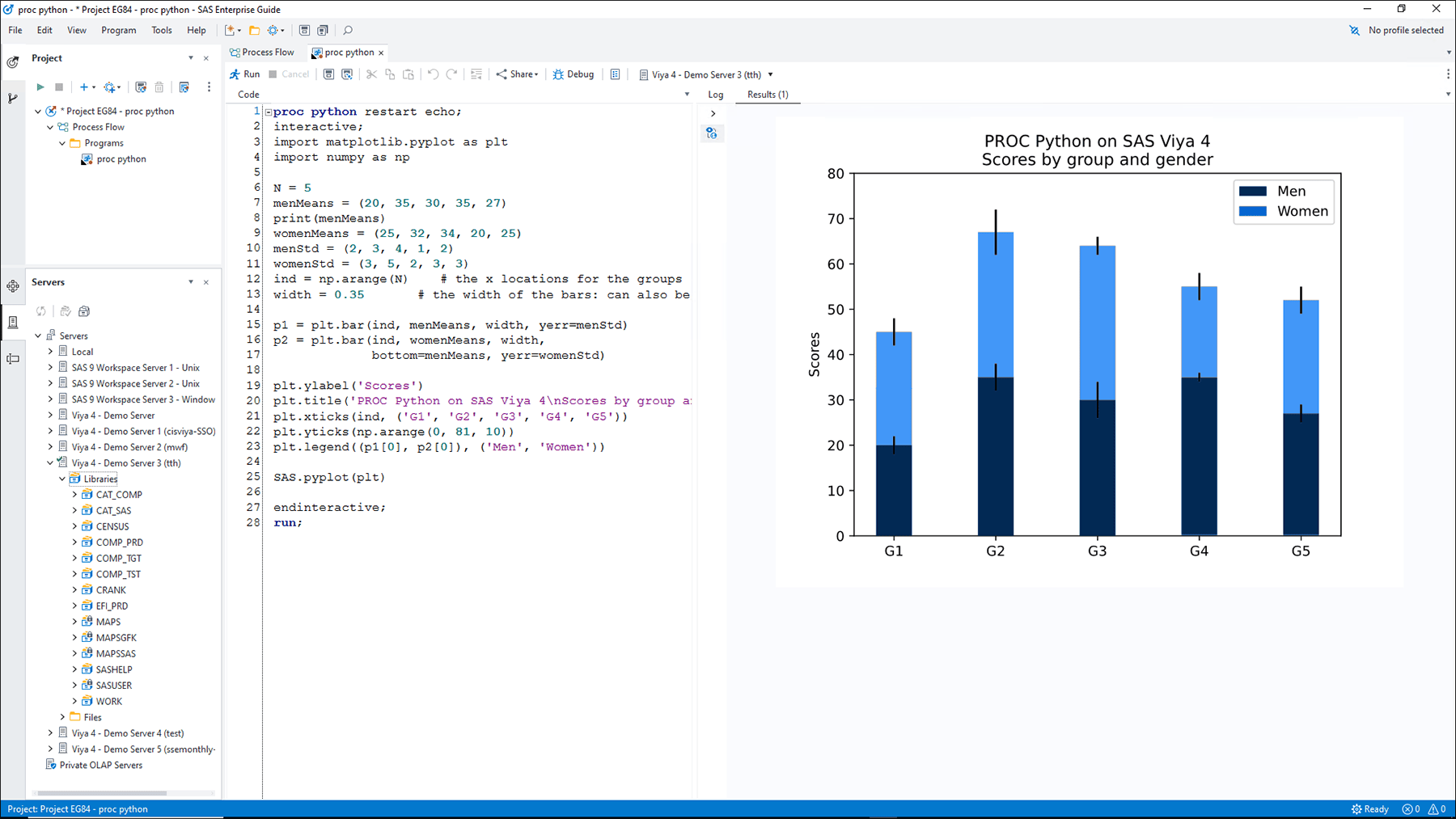

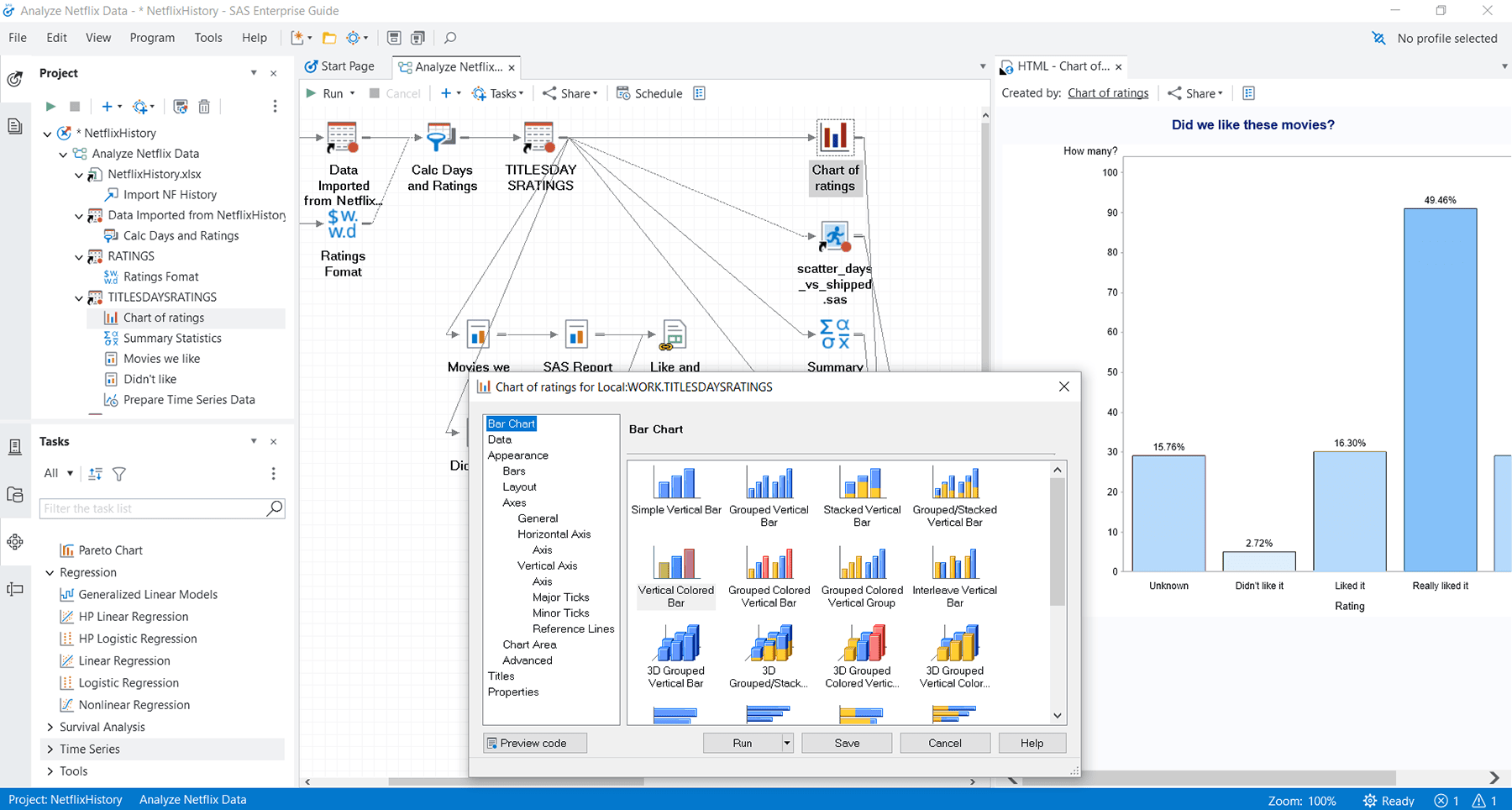

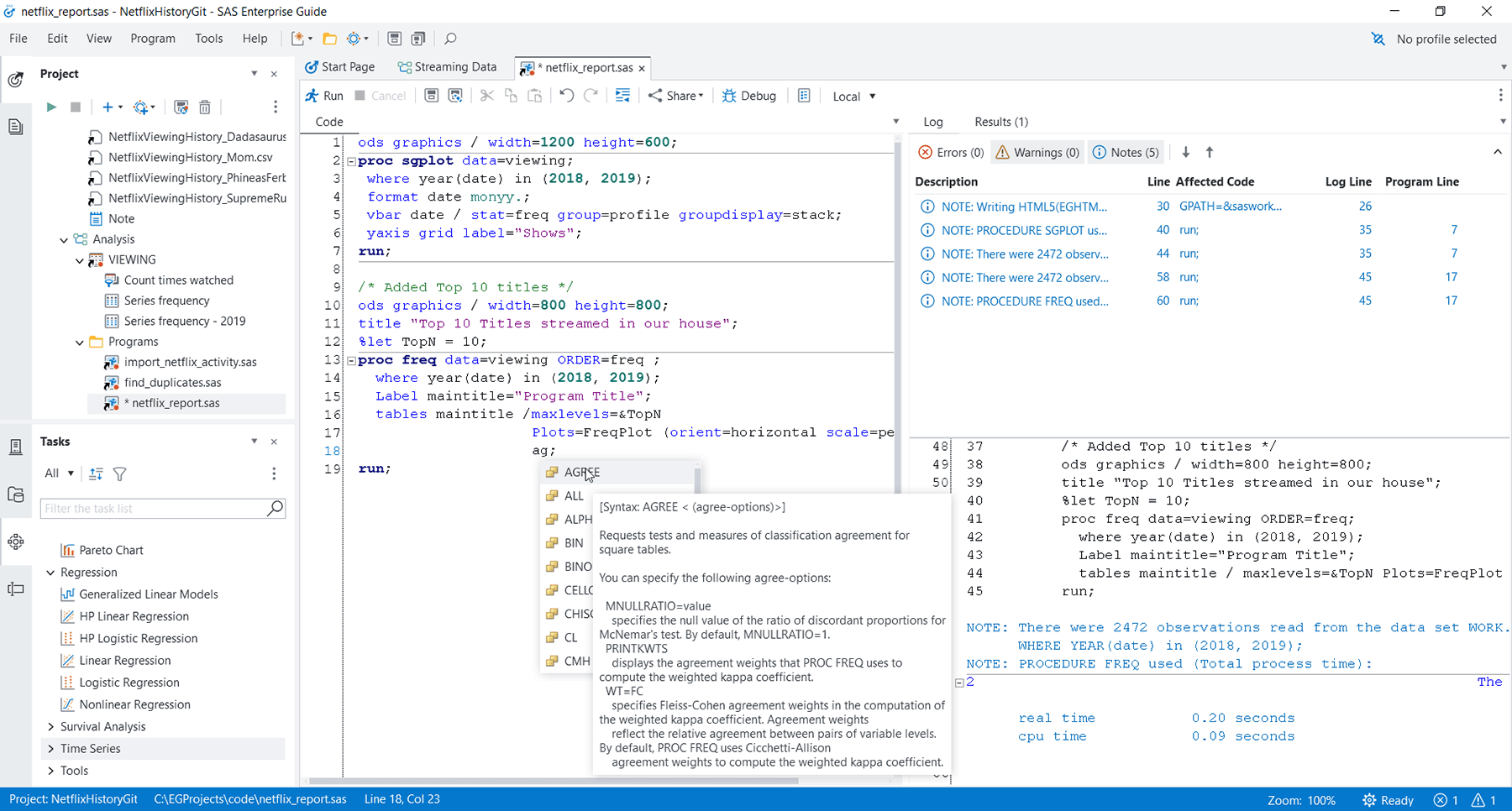

An easy-to-use menu- and wizard-driven tool for analyzing data and publishing results.

Guided analysis & reporting

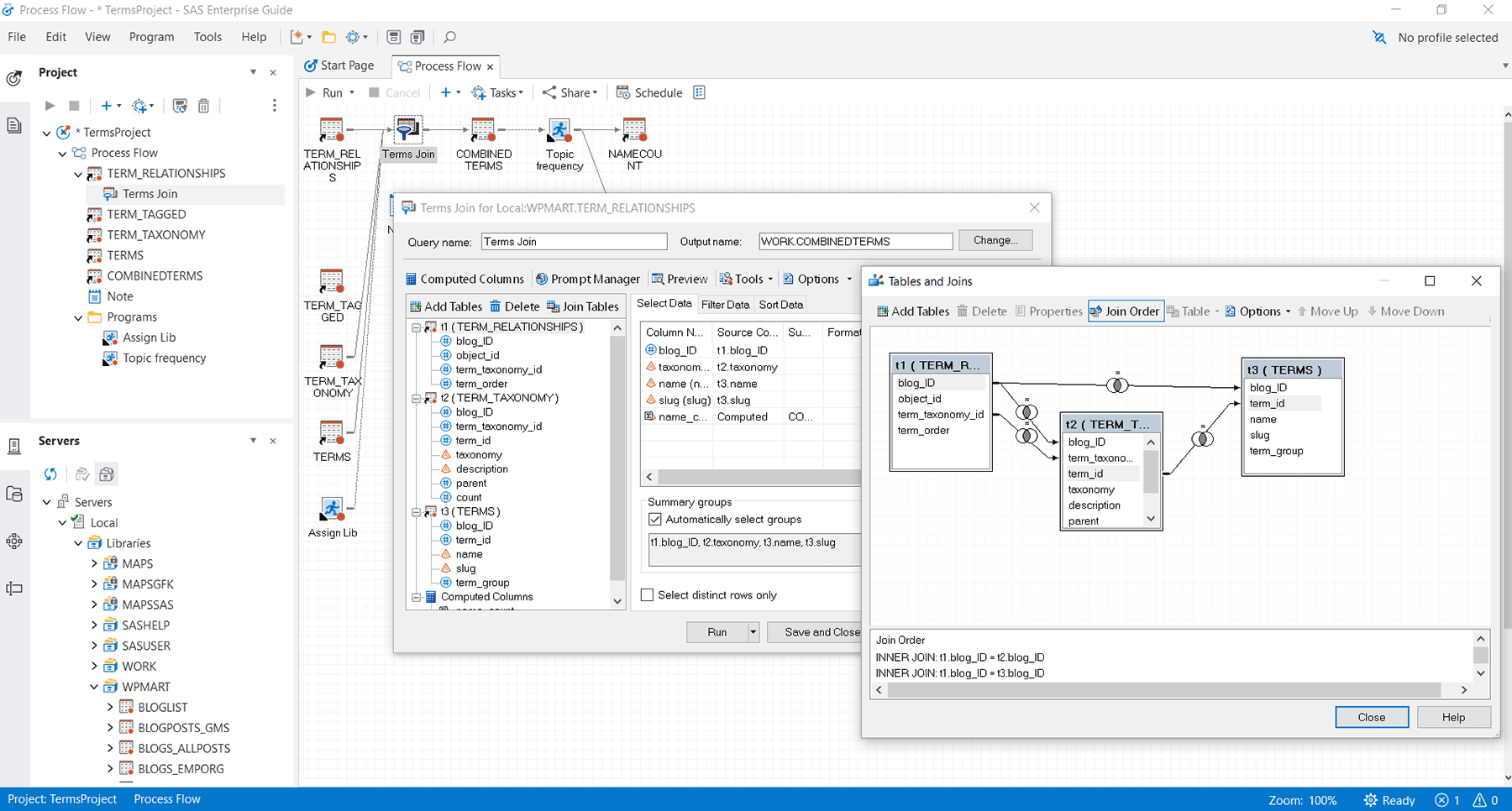

Includes a graphical interface that provides easy access to SAS data integration, preparation, analytics and reporting, while process flows help you visually organize and maintain your projects.

Visual data access & management

Provides transparent access to SAS and external data, with the ability to export results to other Windows and server-based applications – making it easy for management to consume SAS in a familiar environment.

Result distribution & sharing

Lets you distribute results by publishing to multiple channels, including printers, Microsoft Office documents and email. When using a SAS 9 connection, you can also publish results to the SAS BI report/content repository and the SAS Stored Process Server.

High-performance computing

Delivers high-performance computing for analyzing large data sets with a SAS Viya connection using SAS Cloud Analytics Services. With a SAS 9 connection, it automatically detects the availability of a grid environment for more efficient processing, and lets you configure process flow branches to run in parallel on different grid nodes.

Administration & security

Provides automated management of the computing grid with dynamic load balancing, resource assignment and job prioritization when deployed with SAS Grid Manager (SAS 9 connections only).

Recommended Resources

Related Products & Solutions

- SAS® Analytics ProAccess, manipulate, analyze and present information with a comprehensive analytical toolset that combines statistical analysis, reporting and high-impact visuals.

- SAS® Enterprise Miner™Streamline the data mining process to create highly accurate predictive and descriptive models based on large volumes of data.