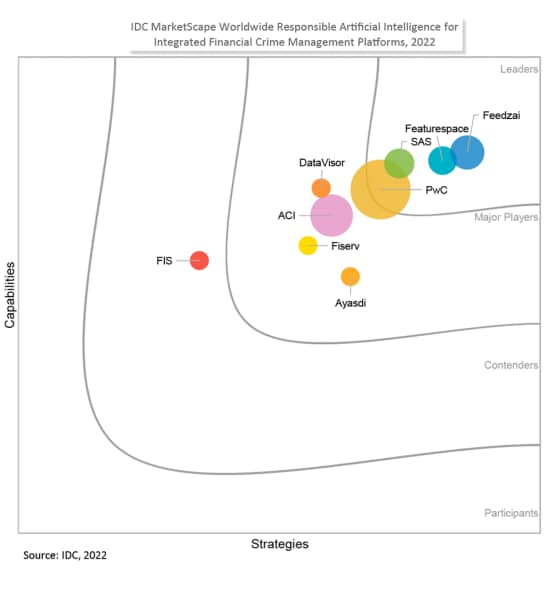

SAS has achieved a strong strategy functionality and offering, growth, and capabilities in trustworthy and ethical AI and customer satisfaction.

Explore More SAS Resources

To browse resources by type, select an option below.

-

- Select resource type

- REPORTE DEL ANALISTA

- E-book

- White Paper

- White Paper

- Artículo

- Entrada en el blog

- Extracto del libro

- Caso de estudio

- Infografía

- Entrevista

- ESPECIAL

- Series

- video

- Webinar

- HISTORIA DE CLIENTE

- White Paper How AI and Machine Learning Are Redefining Anti-Money LaunderingMachine learning can play a big role in the defense against money laundering, either to automate tasks that formerly required human intervention, such as managing the data to train models, or detect more financial crimes risk that rules and more basic analytic techniques might miss.

- HISTORIA DE CLIENTE Fast analytical defenseDeutsche Kreditbank AG combats fraud and money laundering with SAS.

- Artículo How to uncover common point of purchaseBanks that want to stay ahead of CPP and contain the costs of fraud need to implement advanced anti-fraud techniques.

- White Paper AML ModernizationThis white paper explores current organizational challenges, outlines the benefits of new AML technology adoption, and identifies how to embark on a journey of discovery and modernization.

- Artículo Top prepaid card fraud scamsThe margin for prepaid cards is slim, so it's particularly important to root out the scams. Here are some tips for combating and mitigating prepaid card fraud.

- HISTORIA DE CLIENTE Fighting financial crime through a global anti-money laundering platformBangkok Bank uses advanced analytics from SAS to meet expanding anti-money laundering requirements for global operations and ensure compliance keeps pace with dynamic regulatory frameworks.

- REPORTE DEL ANALISTA SAS is a Leader in The Forrester Wave™: Anti-Money Laundering Solutions, Q3 2022SAS Anti-Money Laundering, which helps fight money laundering and terrorist financing with AI, machine learning, intelligent automation and advanced network visualization, is named a Leader in The Forrester Wave.

- REPORTE DEL ANALISTA SAS is a Leader in The Forrester Wave™: Enterprise Fraud Management, Q2 2024

- REPORTE DEL ANALISTA Chartis RiskTech100 2024

- White Paper Proactive anti-financial crime strategies to improve compliance and reduce riskIn today’s fast-changing landscape, become more effective across all stages of AML investigations by following this framework and shift to a proactive, risk-based approach.

- Artículo 4 strategies that will change your approach to fraud detectionAs fraudulent activity grows and fighting fraud becomes more costly, financial institutions are turning to anti-fraud technology to build better arsenals for fraud detection. Discover four ways to improve your organization's risk posture.

- White Paper Leveraging Analytics to Combat Digital Fraud in Financial OrganizationsInternational Institute for Analytics summarizes key questions and answers about financial fraud in the digital age.

- White Paper Balancing Fraud Detection and the Customer Experience Customers of a digital business create an intricate online footprint as they transact online. Businesses that capture and truly understand a complete identity based on online and offline attributes can seamlessly authenticate good customers and reliably spot the fraudulent or hijacked identities – in real time.

- Artículo Strengthen your payment fraud defenses with stronger authenticationThe rapid growth of digital wallets and payment applications ushered in many new payment fraud threats. Today, it’s more critical than ever to authenticate users. Learn four innovative to ways strengthen your authentication defenses while reducing false positives and protecting customers’ assets.

- HISTORIA DE CLIENTE Fighting loan application fraud with cutting-edge analyticsBausparkasse Schwäbisch Hall uses SAS® Viya® to identify forged income documents

- REPORTE DEL ANALISTA Matrix: Leading Fraud & AML Machine Learning PlatformsSAS is a best-in-class vendor in the most recent Datos Insights report, Matrix: Leading Fraud & AML Machine Learning Platforms.

- HISTORIA DE CLIENTE eezor, líder europeo de BaaS, se asocia con SAS para reforzar su vigilancia contra el blanqueo de capitales y el fraudeTreezor utiliza SAS® Anti-Money Laundering para detectar e investigar riesgos AML-CFT & Fraude en SAS Viya.

- White Paper Next-generation AMLSix tips to modernize your fight against money laundering.

- HISTORIA DE CLIENTE Stopping payment fraud in real timeThe Bank of East Asia uses SAS Fraud Management for payment fraud detection and prevention.

- White Paper Fighting Money Laundering with Intelligent AutomationThe world of money laundering and other financial crimes is changing rapidly. This International Institute for Analytics research brief shows how fraudsters and money launderers keep getting more sophisticated.

- HISTORIA DE CLIENTE Preventing payment card fraud one transaction at a timeSAS helps Nets achieve the lowest payment card fraud levels in Europe.

- White Paper Managing Fraud Risk in the Digital Age The rise of mobile and online transactions introduces new fraud risks. Retailers and payment processors must adapt their anti-fraud defenses, augmenting them with stronger, analytics-driven authentication, proactive detection and mitigation tools.

- White Paper Machine Learning Use Cases in Financial CrimesLearn 10 proven ways machine learning can boost the efficiency and effectiveness of fraud and financial crimes teams – from data collection to detection to investigation and reporting.

- White Paper Anti-Fraud Technology As criminals find new ways to exploit technology and target potential victims, anti-fraud professionals must adopt new technologies to effectively navigate the evolving threat landscape.

- White Paper Detect and Prevent Identity Theft The explosion in e-commerce and online account opening has created new convenience and choice for consumers. At the same time, large-scale data breaches have created new opportunities for fraudsters, fueling an 8-percent increase in identity theft in a single year. Find out how to fight back, without hindering your good customers.

- White Paper Banking in 2035: three possible futuresThis paper explores how the major forces affecting banks may evolve between now and 2035, seen through the lens of three potential scenarios.

- White Paper Fighting Insurance Application Fraud Learn about the advantages of using analytics-driven methods for authenticating applicants to reveal customer gaming, agent gaming and potential future claims fraud.

- Artículo Online fraud: Increased threats in a real-time worldOnline and mobile banking is convenient for customers -- and an opportunity for fraudsters. With fraud methods constantly evolving, an analytical approach is a must for banks seeking early, accurate detection.

- REPORTE DEL ANALISTA IDC MarketScape: Worldwide Responsible Artificial Intelligence for Integrated Financial Crime Management Platforms 2022 Vendor AssessmentLearn why SAS is positioned in the Leaders category in the 2022 IDC MarketScape for worldwide responsible artificial intelligence for integrated financial crime management platforms.

- Artículo Rethink customer due diligenceTo streamline compliance and protect against financial and regulatory risk, re-examine your customer due diligence processes and technologies regularly. With new analytical tools, you can monitor customer transactions or personal information in real time, and accurately segment customers by the risk they represent.

- Artículo How AI and advanced analytics are impacting the financial services industryTop SAS experts weigh in on topics that keep financial leaders up at night – like real-time payments and digital identity. See how advanced analytics and AI can help.

- Artículo Managing fraud risk: 10 trends you need to watchSynthetic identities, credit washing and income misrepresentation – these are just some of the trends to watch if you’re trying to understand how to manage fraud risk. Find out what’s on the top 10 list of trends according to experts like Frank McKenna and Mary Ann Miller.

- E-book Fight money laundering with these 5 next-gen game changers from SASEffectively battling dynamic financial crime threats requires new capabilities for AML defense – such as artificial intelligence, machine learning, intelligent automation and advanced visualization.

- White Paper Payments Without BordersMitigating fraud risks in cashless payments by holistically understanding your customers across all channels.

- Artículo Mobile payments, smurfs and emerging threatsM-payment remittances are replacing traditional banks and money services that have historically charged high fees for small transfers. Former US Treasury Special Agent John Cassara maps what he sees in the road ahead and gives advice for protecting your firm.

- White Paper Rethinking customer due diligenceHelp evaluate your organization's CDD processes and technology relative to current industry risks and regulatory requirements.

- White Paper The Escalation of Digital FraudThis Javelin Research report is based on 120 independent interviews of payment and security executives in 20 countries and delivers a clear picture of how digital fraud has changed the global operating environment for financial institutions.

- White Paper Data, analytics and machine learning: The new frontier of fraud preventionThe Economist explores how global financial institutions are using advanced technologies such as machine learning to support fraud and security intelligence.

- Artículo Online payment fraud stops hereBillions of dollars each year are lost to online payment fraud through channels that provide convenient – yet vulnerable – ways to shop and bank. See how to fight back and win with advanced analytics.

- White Paper Using Digital Identity To Unleash Organizational DataCustomer experience focuses on speed and ease of access, lowering friction where possible. However, this approach has the potential to open up an organization to fraudulent attacks.

- HISTORIA DE CLIENTE Combating financial crime and terrorism financing with real-time sanctions screeningOrange Bank stays ahead of emerging risks and changing regulations with a cloud-based sanctions-screening solution from SAS and Neterium.

- White Paper Detect and prevent digital banking fraudDiscover how banks can fight identity-based fraud attacks using proven analytical methods to detect the fraudsters while expediting service for legitimate customers.

- Artículo El fraude en pagos evoluciona rápidamente: ¿podemos adelantarnos?El fraude en pagos se produce cuando un delincuente roba la información de pago privada de una persona y luego la utiliza para una transacción ilegal. A medida que las tendencias de pago evolucionan, también lo hacen los estafadores. Los bancos y los proveedores de servicios de pago pueden contraatacar con técnicas de análisis avanzado que se adaptan rápidamente para detectar anomalías en el comportamiento.

- White Paper AI Is at the Forefront of Reducing Money Laundering and Combating the Financing of Terrorism See how artificial intelligence (AI), machine learning (ML) and robotic process automation (RPA) are helping firms overcome the challenges, improve results and make AML/CFT programs more efficient and effective.

- REPORTE DEL ANALISTA Chartis RiskTech Quadrant for Trade-Based AML Solutions 2022SAS is named a category leader in the Chartis RiskTech Quadrant for Trade-Based AML Solutions, 2022.

- White Paper Banking in 2035: global banking survey reportWhat trends do banking leaders consider to be the greatest risks and the greatest opportunities? What internal and external barriers stand in their way? What technologies will help them harness the opportunities ahead? Download the report to explore.

- Artículo Detect and prevent banking application fraudCredit fraud often starts with a falsified application. That’s why it’s important to use analytics starting at the entrance point. Learn how analytics and machine learning can detect fraud at the point of application by recognizing the biggest challenge – synthetic identities.

- REPORTE DEL ANALISTA Cuadrante Chartis RiskTech para soluciones de fraude empresarial, 2023: Análisis de proveedoresChartis RiskTech Quadrant for Enterprise Fraud Solutions, 2023 ha nombrado a SAS líder de su categoría en soluciones contra el fraude empresarial.

- White Paper Protect the Integrity of the Procurement FunctionProcurement fraud affects nearly one-third of organizations, and it is often perpetrated by the most trusted, longtime employees, the ones you’d least suspect. Learn from two white-collar crime specialists about common flavors of procurement fraud, striking examples from recent headlines, four fundamental ways to get better at detecting and preventing fraud, and how to take procurement integrity to the next level.

- White Paper Developing Trust: Uniting Fraud and Consumer Experience Through Digital IdentityFraud and CX used to have a contentious relationship. But with strong foundational digital identity infrastructure, fraud efforts can provide greater insight into the user to enable CX teams to build improved services and offerings.

- White Paper Advanced Analytics For Dissolving Data SilosThe growing need for data storage has heightened the proliferation of data silos. Readers will learn how organizations can apply machine learning and artificial intelligence to battle fraud, confirm customer identities and build data systems to avoid potential silos.

- HISTORIA DE CLIENTE Advanced analytics and machine learning help Poste Italiane identify and stop fraud in real time while enhancing customer experienceItaly’s largest service distribution network relies on predictive analytics from SAS to detect fraud with greater precision and reduce losses.

IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of ICT suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s position within a given market. The Capabilities score measures vendor product, go-to-market and business execution in the short-term. The Strategy score measures alignment of vendor strategies with customer requirements in a 3-5-year timeframe. Vendor market share is represented by the size of the icons.