SAS Fraud Decisioning

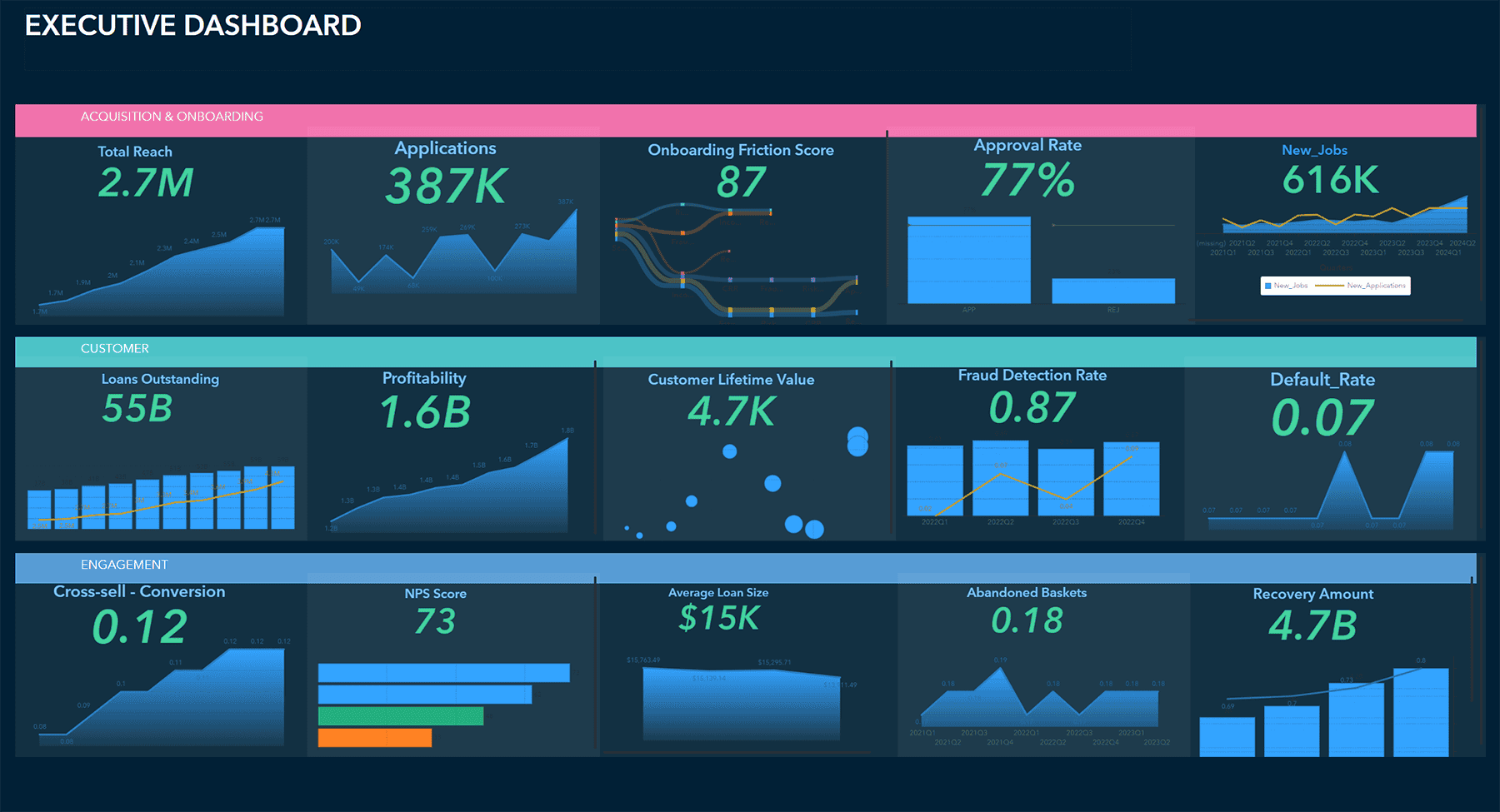

SAS Fraud Decisioning on SAS Viya delivers real-time decisioning, customer service automation and predictive analytics underpinned by machine learning so you can quickly identify emerging fraud threats and attack vectors to reduce your risk exposure.

Choose SAS: A leader in fraud detection & prevention

Detect payment fraud threats resulting from scams

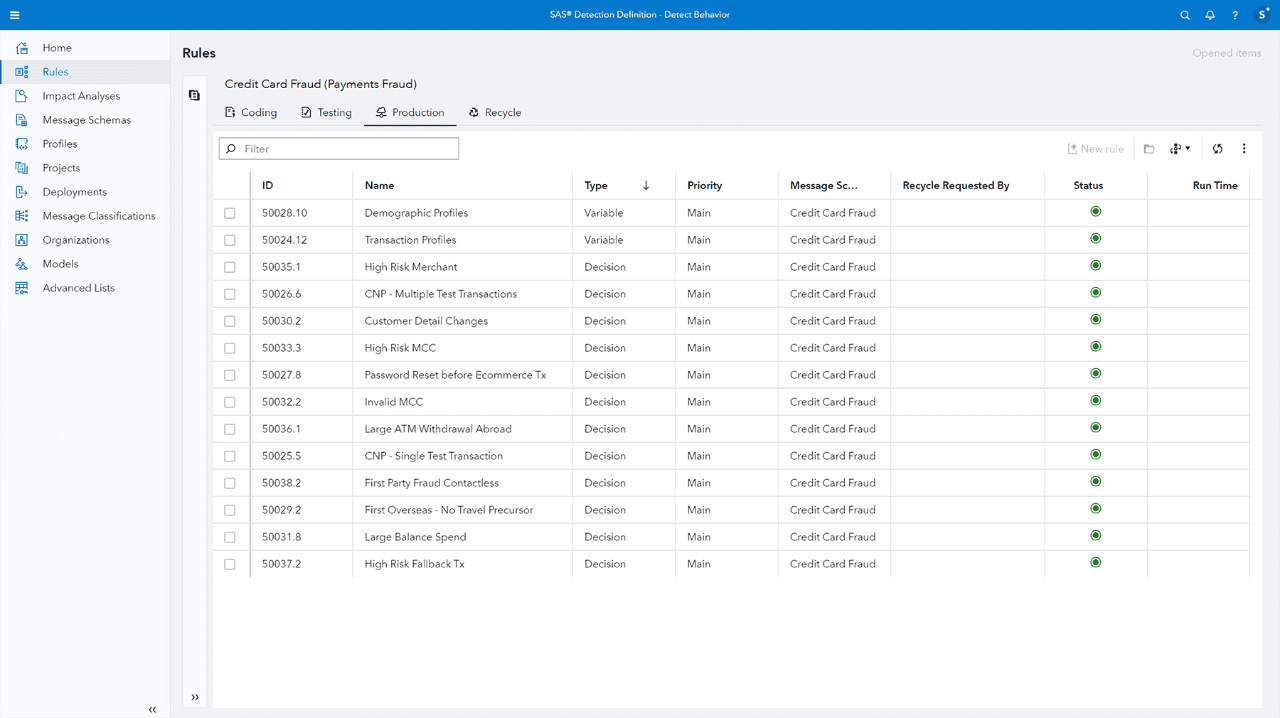

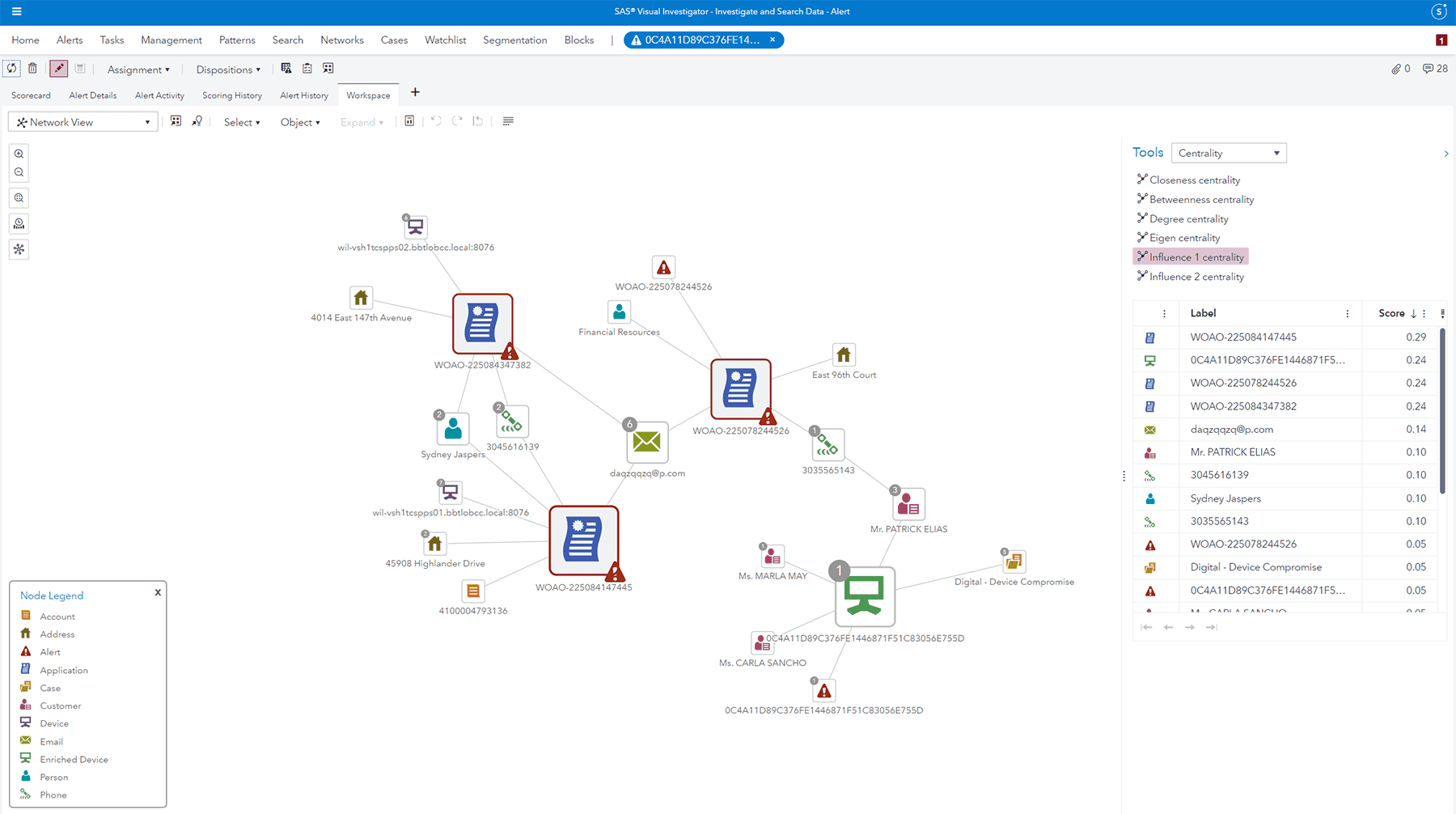

Use industry-leading fraud analytics and machine learning to monitor payments, nonmonetary transactions and events to detect payment fraud, payment scams and social engineering.

Uncover money mules & funnel accounts in real time

Detect account takeover fraud before it exposes you to regulatory risk by monitoring both customer activities and account maintenance events as they are initiated across channels.

Catch synthetic fraud faster in new-to-bank relationships

Go beyond traditional identity verification and authentication to take immediate action when parts of an identity are suspected to be false.

Prevent check fraud loss & exposure

Quickly access all data relevant to making a risk assessment of a check transaction, including past customer activity, transaction details and check image analysis discoveries.

Avoid giving criminals access to more credit via application fraud

Prevent bust-out fraud before it arises by assessing the risk of new-to-bank credit applications with a lower referral rate and straight-through processing.

Stop accepting fraudulent e-commerce payments

Detect fraudulent commerce across merchants and third-party payment processors.

Maximize remote identity verification

Providers of third-party data are growing by using A/B testing of data and service providers, so you can deploy what works best in seconds.

Analyst perspectives – SAS named a leader in these analyst evaluations

Key features

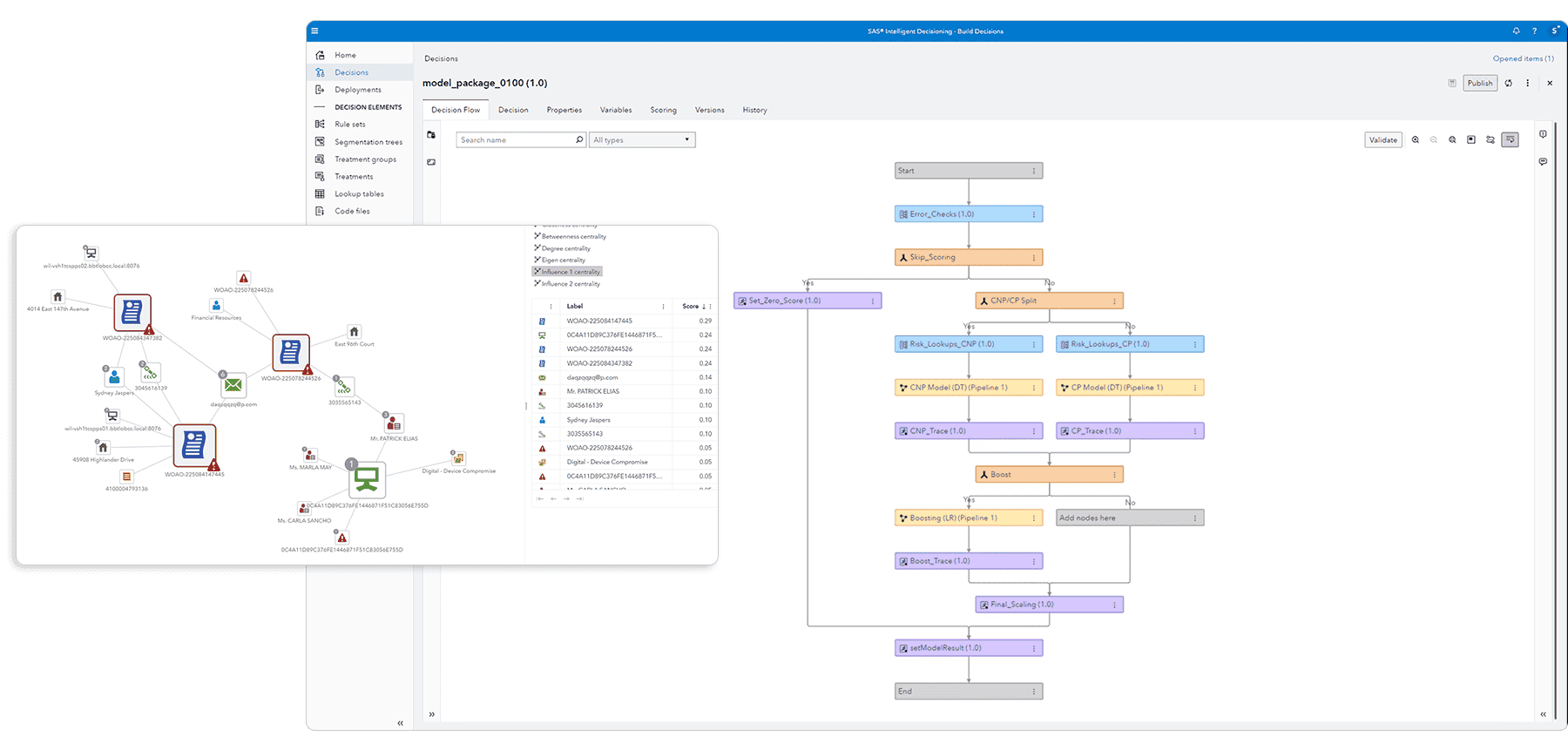

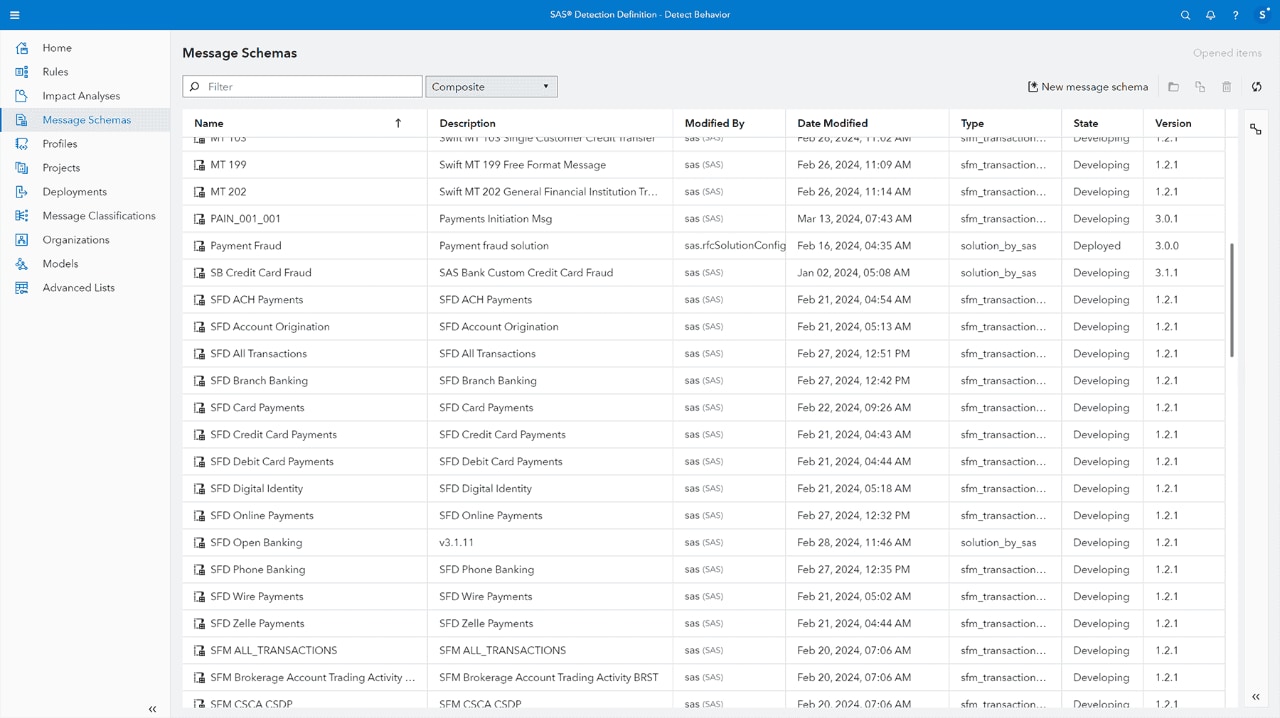

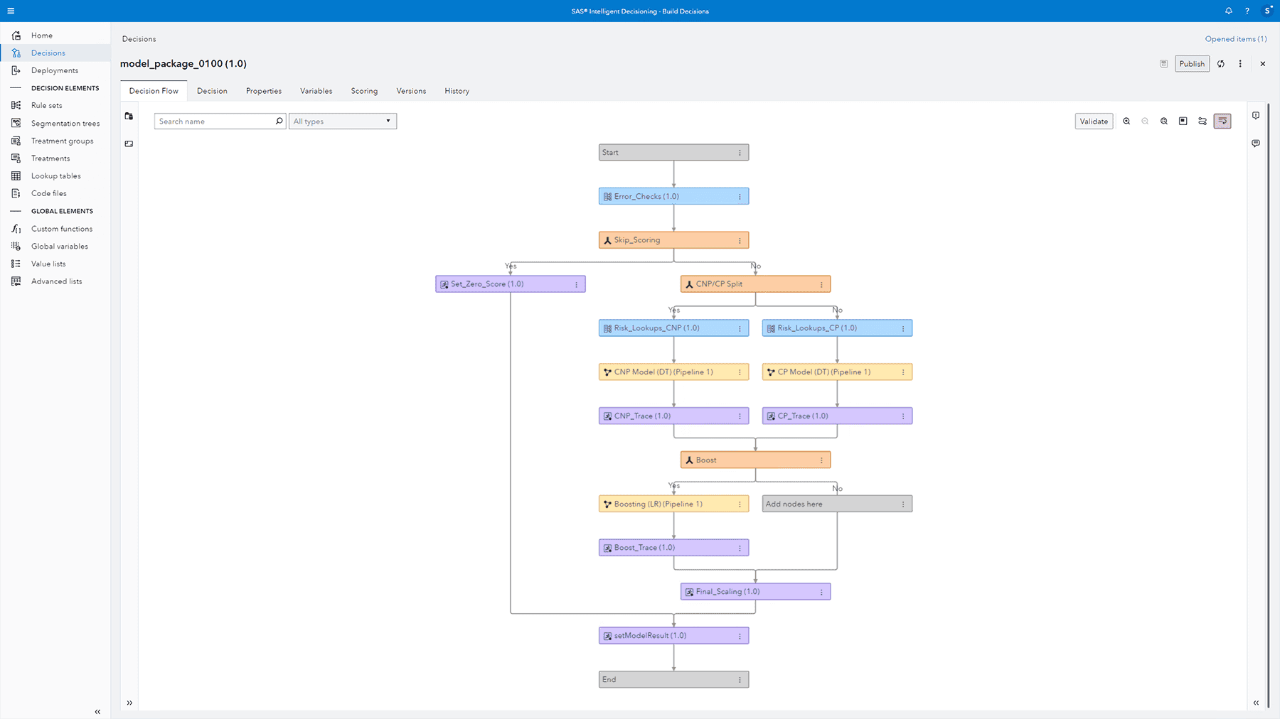

Next-generation SAS Fraud Decisioning combines real-time data enrichment, orchestration and decisioning; model management, governance and development; rapid alert triage; case management; dashboards; and reporting – all on a cloud-native platform.

Cloud-native technology

Enable confident decisions, maximum value, faster outcomes and open integration. Meet changing business needs by scaling up for expansion and high-traffic peaks or scaling down to ensure optimized cost management.

Real-time profiling, scoring & decisioning

Build customer trust by profiling, scoring and decisioning transactions in real time with millisecond response time for immediate insight on how to respond. Defend against fraud loss while protecting customer loyalty.

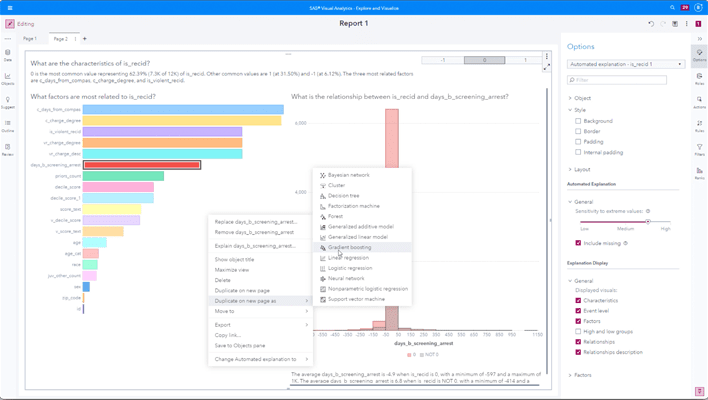

Industry-leading advanced analytics capabilities

Industry-leading analytics techniques, including adaptive machine learning methods, identify emerging threats and automatically suggest new rules and scenarios in real time for the most accurate transaction risk assessment and better fraud management.

Flexible data orchestration

Orchestrate all internal and external data in a single solution, regardless of format or source. Get faster results from growing data volumes using in-memory processing. Easily integrate with case management and reporting systems.

Customizable data integration

Configurable data enrichment augments customer data, as well as rules and decisions, using data from one or more third-party information providers. You can define your own path for how each incoming transaction is transformed, enriched and validated before being sent to the fraud management system.

Continuous approach improvement

Compare approaches to your identity strategy using champion and challenger models and A/B testing of data and service providers, so you can deploy what works best in seconds. Determine the effectiveness of new strategies through impact analysis so you can continuously improve your approaches and adapt to changes in consumer behavior.

SAS Viya is cloud-native and cloud-agnostic

Consume SAS how you want – SAS managed or self-managed. And where you want.