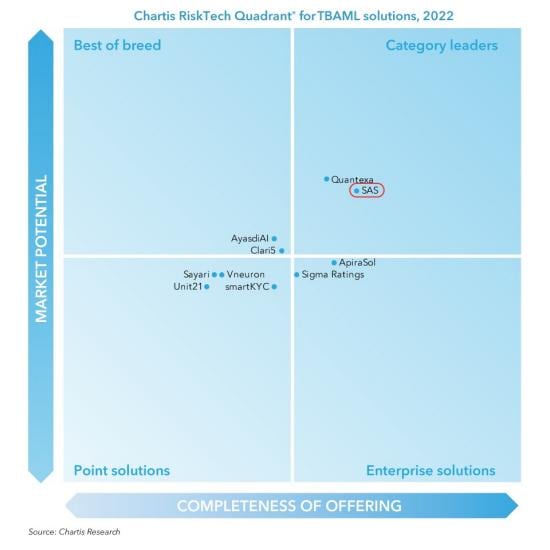

SAS IS A CATEGORY LEADER

Chartis RiskTech Quadrant® for Trade-Based AML Solutions, 2022

SAS offers its TBAML clients a fully featured solution that enables end-to-end process automation. The SAS solution is notable for combining data extraction, data fusion, document and transactional analytics, KYC/AML analytics and workflow management. In particular, the integration of analytics for trade documents – to extract text from images and to perform various checks for trade fraud and AML risk indicators – stood out.

Explore More SAS Resources

To browse resources by type, select an option below.

-

- Select resource type

- Analyst Report

- E-Book

- White Paper

- White Paper

- Article

- Blog Post

- Book Excerpt

- Case Study

- Infographic

- Interview

- Research

- Series

- Video

- Webinar

- Customer Story

- Customer Story Fighting financial crime through a global anti-money laundering platformBangkok Bank uses advanced analytics from SAS to meet expanding anti-money laundering requirements for global operations and ensure compliance keeps pace with dynamic regulatory frameworks.

- Customer Story Fast analytical defenseDeutsche Kreditbank AG combats fraud and money laundering with SAS.

- Analyst Report IDC MarketScape: Worldwide Responsible Artificial Intelligence for Integrated Financial Crime Management Platforms 2022 Vendor AssessmentLearn why SAS is positioned in the Leaders category in the 2022 IDC MarketScape for worldwide responsible artificial intelligence for integrated financial crime management platforms.

- Customer Story Preventing crime and ensuring compliance at 120 Nordic banksSDC enables small and medium financial institutions in four Nordic countries to stay compliant.

- Webinar What Is a Next-Gen AML System?Learn how AI, machine learning and robotic process automation can help the global banking industry and financial firms transform the fight against money laundering.

- White Paper Next-generation AMLSix tips to modernize your fight against money laundering.

- Analyst Report Chartis RiskTech Quadrant for Trade-Based AML Solutions 2022SAS is named a category leader in the Chartis RiskTech Quadrant for Trade-Based AML Solutions, 2022.

- White Paper Rethinking customer due diligenceHelp evaluate your organization's CDD processes and technology relative to current industry risks and regulatory requirements.

- White Paper How AI and Machine Learning Are Redefining Anti-Money LaunderingMachine learning can play a big role in the defense against money laundering, either to automate tasks that formerly required human intervention, such as managing the data to train models, or detect more financial crimes risk that rules and more basic analytic techniques might miss.

- Customer Story European Banking-as-a-Service leader strengthens its AML/CFT and fraud surveillance system with SASTreezor uses SAS Anti-Money Laundering to stay ahead of emerging risks, improve operational efficiency and expedite investigations.

- Analyst Report Matrix: Leading Fraud & AML Machine Learning PlatformsSAS is a best-in-class vendor in the most recent Datos Insights report, Matrix: Leading Fraud & AML Machine Learning Platforms.

- White Paper AML ModernizationThis white paper explores current organizational challenges, outlines the benefits of new AML technology adoption, and identifies how to embark on a journey of discovery and modernization.

- Article Mobile payments, smurfs and emerging threatsM-payment remittances are replacing traditional banks and money services that have historically charged high fees for small transfers. Former US Treasury Special Agent John Cassara maps what he sees in the road ahead and gives advice for protecting your firm.

- Analyst Report SAS is a Leader in The Forrester Wave™: Anti-Money Laundering Solutions, Q3 2022SAS Anti-Money Laundering, which helps fight money laundering and terrorist financing with AI, machine learning, intelligent automation and advanced network visualization, is named a Leader in The Forrester Wave.

- White Paper Proactive anti-financial crime strategies to improve compliance and reduce riskIn today’s fast-changing landscape, become more effective across all stages of AML investigations by following this framework and shift to a proactive, risk-based approach.

- White Paper Banking in 2035: three possible futuresThis paper explores how the major forces affecting banks may evolve between now and 2035, seen through the lens of three potential scenarios.

- White Paper Banking in 2035: global banking survey reportWhat trends do banking leaders consider to be the greatest risks and the greatest opportunities? What internal and external barriers stand in their way? What technologies will help them harness the opportunities ahead? Download the report to explore.

- Article Rethink customer due diligenceTo streamline compliance and protect against financial and regulatory risk, re-examine your customer due diligence processes and technologies regularly. With new analytical tools, you can monitor customer transactions or personal information in real time, and accurately segment customers by the risk they represent.

- E-Book Fight money laundering with these 5 next-gen game changers from SASEffectively battling dynamic financial crime threats requires new capabilities for AML defense – such as artificial intelligence, machine learning, intelligent automation and advanced visualization.

- Article 4 strategies that will change your approach to fraud detectionAs fraudulent activity grows and fighting fraud becomes more costly, financial institutions are turning to anti-fraud technology to build better arsenals for fraud detection. Discover four ways to improve your organization's risk posture.