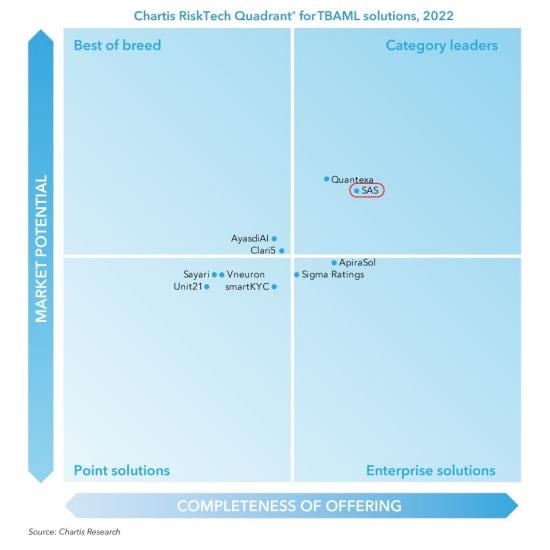

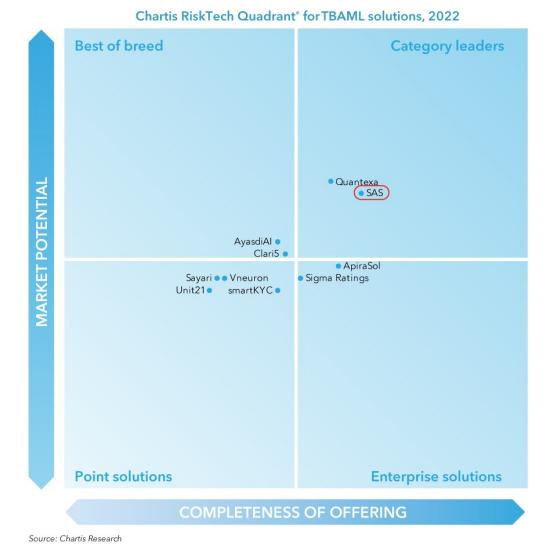

SAS IS A CATEGORY LEADER

Chartis RiskTech Quadrant® for Trade-Based AML Solutions, 2022

SAS offers its TBAML clients a fully featured solution that enables end-to-end process automation. The SAS solution is notable for combining data extraction, data fusion, document and transactional analytics, KYC/AML analytics and workflow management. In particular, the integration of analytics for trade documents – to extract text from images and to perform various checks for trade fraud and AML risk indicators – stood out.

Explore More SAS Resources

To browse resources by type, select an option below.

-

- Select resource type

- Аналитический отчет

- E-Book

- Технический документ

- Технический документ

- Article

- Blog Post

- Book Excerpt

- Case Study

- Infographic

- Interview

- Research

- Series

- Video

- Вебинар

- Customer Story

- Технический документ How AI and Machine Learning Are Redefining Anti-Money LaunderingMachine learning can play a big role in the defense against money laundering, either to automate tasks that formerly required human intervention, such as managing the data to train models, or detect more financial crimes risk that rules and more basic analytic techniques might miss.

- Article Мобильные платежи, смурфы и новые угрозыИнновации охватили весь мир – даже где-нибудь в глухой кенийской деревне мобильный телефон служит местному жителю виртуальным кошельком. Но почему эта новая технология может стать потенциальным препятствием в борьбе с отмыванием доходов?

- Технический документ Rethinking customer due diligenceHelp evaluate your organization's CDD processes and technology relative to current industry risks and regulatory requirements.

- E-Book Fight money laundering with these 5 next-gen game changers from SASEffectively battling dynamic financial crime threats requires new capabilities for AML defense – such as artificial intelligence, machine learning, intelligent automation and advanced visualization.

- Технический документ AML ModernizationThis white paper explores current organizational challenges, outlines the benefits of new AML technology adoption, and identifies how to embark on a journey of discovery and modernization.

- Технический документ Banking in 2035: three possible futuresThis paper explores how the major forces affecting banks may evolve between now and 2035, seen through the lens of three potential scenarios.

- Аналитический отчет Matrix: Leading Fraud & AML Machine Learning PlatformsSAS is a best-in-class vendor in the most recent Datos Insights report, Matrix: Leading Fraud & AML Machine Learning Platforms.

- Аналитический отчет Chartis RiskTech Quadrant for Trade-Based AML Solutions 2022SAS is named a category leader in the Chartis RiskTech Quadrant for Trade-Based AML Solutions, 2022.

- Технический документ Banking in 2035: global banking survey reportWhat trends do banking leaders consider to be the greatest risks and the greatest opportunities? What internal and external barriers stand in their way? What technologies will help them harness the opportunities ahead? Download the report to explore.

- Технический документ Proactive anti-financial crime strategies to improve compliance and reduce riskIn today’s fast-changing landscape, become more effective across all stages of AML investigations by following this framework and shift to a proactive, risk-based approach.

- Технический документ Next-generation AMLSix tips to modernize your fight against money laundering.

- Customer Story Fast analytical defenseDeutsche Kreditbank AG combats fraud and money laundering with SAS.

- Аналитический отчет SAS is a Leader in The Forrester Wave™: Anti-Money Laundering Solutions, Q3 2022SAS Anti-Money Laundering, which helps fight money laundering and terrorist financing with AI, machine learning, intelligent automation and advanced network visualization, is named a Leader in The Forrester Wave.

- Технический документ Fighting Money Laundering with Intelligent AutomationThe world of money laundering and other financial crimes is changing rapidly. This International Institute for Analytics research brief shows how fraudsters and money launderers keep getting more sophisticated.

- Customer Story Preventing crime and ensuring compliance at 120 Nordic banksSDC enables small and medium financial institutions in four Nordic countries to stay compliant.

- Аналитический отчет IDC MarketScape: Worldwide Responsible Artificial Intelligence for Integrated Financial Crime Management Platforms 2022 Vendor AssessmentLearn why SAS is positioned in the Leaders category in the 2022 IDC MarketScape for worldwide responsible artificial intelligence for integrated financial crime management platforms.