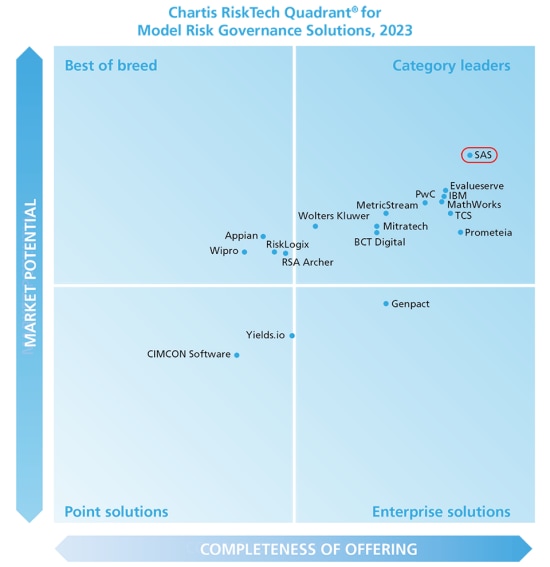

10th YEAR AS A CATEGORY LEADER

Chartis names SAS a leader in both Model Risk Governance and Model Validation, 2023

SAS’s category leader position reflects a combination of features and functionality across the entire model lifecycle. SAS Model Risk Management enables users to deploy models at scale, integrate multiple data sources and support an app API-centric architecture. SAS’s position as a category leader is also supported by risk modeling visualization capabilities that support model testing/experimentation and validation process, while the ability to share parameters and integration with in-house development helps to create an efficient validation environment.

Explore More SAS Resources

To browse resources by type, select an option below.

-

- Select resource type

- Analyst Report

- E-Book

- White Paper

- White Paper

- Article

- Blog Post

- Book Excerpt

- Case Study

- Infographic

- Interview

- Research

- Series

- Video

- Webinar

- Customer Story

- White Paper Pioneering Ethical AI: The Crucial Role of Property and Casualty InsurersInsurers have long been global leaders in addressing risks and protecting people and businesses. As artificial intelligence continues to revolutionize how business gets done, it is redefining how insurers can deliver on their promises. Read this paper to learn from industry veterans and AI experts alike about: • The state of AI regulations globally. • The multifaceted role insurers can play in developing AI ethics. • Why insurers are uniquely qualified to use AI (and GenAI) – and how they’re using these technologies today. • An approach to an ethical AI framework that any insurer can follow to establish their own AI narrative.

- White Paper Compete and win with better model risk managementAs explored in this paper, models can degrade over time, and sound model risk management (MRM) is the key to managing this risk.

- E-Book Unifying Model Management Across the BankHow banks can empower all departments to manage model risk effectively across the entire model life cycle.

- Analyst Report Chartis RiskTech100 2024SAS climbs to No. 2 in the prestigious Chartis RiskTech 100®, 2024, and bested seven technology award categories, including AI for Banking, Behavioral Modeling and Enterprise Stress Testing.

- Analyst Report Chartis RiskTech100 2025SAS ranks #2 overall in the prestigious Chartis RiskTech100, 2025. Six category wins are AI for Banking, Balance Sheet Risk Management, Behavioral Modeling, Enterprise Stress Testing, IFRS 9 and Model Risk Management.

- White Paper Machine Learning Model GovernanceBanks are rapidly expanding their use of machine learning-enabled (ML) models, because they can provide step-level improvements in accuracy. But ML models need even more rigorous governance than traditional models. This paper explores what's required to implement effective ML model governance.

- Customer Story Making faster, smarter credit decisions while elevating customer experienceAutomated credit risk management process puts ABBANK at the forefront of Vietnam’s credit revolution.

- Event Collateral White Paper Model Risk Management: Today's Governance and Future DirectionsA GARP-SAS Survey on Model Risk in the Age of Artificial Intelligence and Machine Learning.

- Analyst Report Chartis names SAS a leader in both Model Risk Governance and Model Validation, 2023.Chartis names SAS a leader in both Model Risk Governance and Model Validation, 2023.

- Customer Story A model solutionTD Bank uses SAS Model Risk Management to stay on top of regulatory requirements, facilitate cross-functional collaboration and drive business value.

- Article What is a risk model?Banks use multiple models to meet a variety of regulations (such as IFRS 9, CECL and Basel). With increased scrutiny on model risk, bankers must establish a model risk management program for regulatory compliance and business benefits. Begin the planning by clearly defining what a risk model is.

- Article Model risk management: Vital to regulatory and business sustainabilitySloppy model risk management can lead to failure to gain regulatory approval for capital plans, financial loss, damage to a bank's reputation and loss of shareholder value. Learn how to improve model risk management by establishing controls and guidelines to measure and address model risk at every stage of the life cycle.

- White Paper Managing Models and Their RisksComputational and technological challenges present opportunities for a fast-evolving risk management discipline.