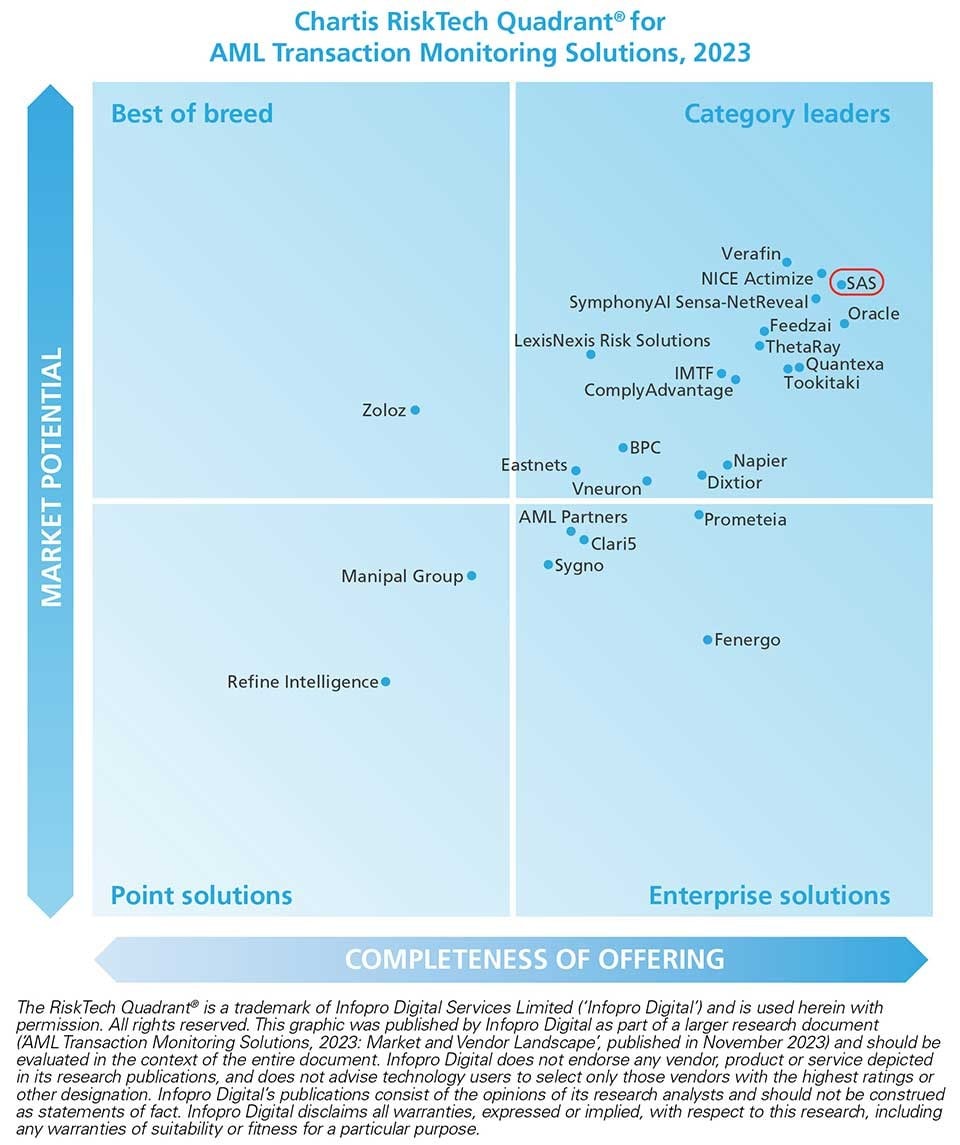

SAS IS A CATEGORY LEADER

Chartis RiskTech Quadrant® for AML Transaction Monitoring Solutions, 2023

SAS’ risk, fraud and compliance solutions team understands not only the business requirements for risk management, but also the steps required to satisfy model governance concerns that are top of mind during the deployment of AI. With its strength in analytics, SAS can help clients adopt more innovative strategies for managing AML compliance risks.

Explore More SAS Resources

To browse resources by type, select an option below.

-

- Select resource type

- RAPPORT D'ANALYSTE

- Ebook

- Livre blanc

- Livre blanc

- ARTICLE

- BLOG POST

- Extrait du livre

- ÉTUDE DE CAS

- Infographie

- Interview

- Recherche

- Série

- Vidéo

- Webinaire

- Témoignage client

- Témoignage client European Banking-as-a-Service leader strengthens its AML/CFT and fraud surveillance system with SASTreezor uses SAS Anti-Money Laundering to stay ahead of emerging risks, improve operational efficiency and expedite investigations.

- Témoignage client Treezor lutte contre le blanchiment d'argent et la fraudeTreezor a amélioré ses capacités de lutte contre le blanchiment d'argent et de surveillance des fraudes en déployant avec succès sa nouvelle plateforme.

- ARTICLE 4 strategies that will change your approach to fraud detectionAs fraudulent activity grows and fighting fraud becomes more costly, financial institutions are turning to anti-fraud technology to build better arsenals for fraud detection. Discover four ways to improve your organization's risk posture.

- Témoignage client Combating financial crime and terrorism financing with real-time sanctions screeningOrange Bank stays ahead of emerging risks and changing regulations with a cloud-based sanctions-screening solution from SAS and Neterium.

- Livre blanc Proactive anti-financial crime strategies to improve compliance and reduce riskIn today’s fast-changing landscape, become more effective across all stages of AML investigations by following this framework and shift to a proactive, risk-based approach.

- Témoignage client Stopping payment fraud in real timeThe Bank of East Asia uses SAS Fraud Management for payment fraud detection and prevention.

- Témoignage client Orange Bank déploie le filtrage des sanctions en temps réel avec SAS et NeteriumSAS et Neterium s’associent pour proposer les capacités de screening de nouvelle génération de Neterium sur la plateforme analytique de SAS mondialement reconnue.

- Livre blanc Next-generation AMLSix tips to modernize your fight against money laundering.

- Livre blanc Banking in 2035: global banking survey reportWhat trends do banking leaders consider to be the greatest risks and the greatest opportunities? What internal and external barriers stand in their way? What technologies will help them harness the opportunities ahead? Download the report to explore.

- Livre blanc Banking in 2035: three possible futuresThis paper explores how the major forces affecting banks may evolve between now and 2035, seen through the lens of three potential scenarios.

- RAPPORT D'ANALYSTE SAS is a Leader in The Forrester Wave™: Anti-Money Laundering Solutions, Q3 2022SAS Anti-Money Laundering, which helps fight money laundering and terrorist financing with AI, machine learning, intelligent automation and advanced network visualization, is named a Leader in The Forrester Wave.

- RAPPORT D'ANALYSTE Chartis RiskTech Quadrant for Trade-Based AML Solutions 2022SAS is named a category leader in the Chartis RiskTech Quadrant for Trade-Based AML Solutions, 2022.

- RAPPORT D'ANALYSTE Matrix: Leading Fraud & AML Machine Learning PlatformsAs a best-in-class vendor, SAS provides a cohesive, open, elastic, and scalable platform that enables high-performing advanced analytics, machine learning model development and deployment, and real-time decisioning across a diverse set of fraud and AML use cases.

- Témoignage client Fighting financial crime through a global anti-money laundering platformBangkok Bank uses advanced analytics from SAS to meet expanding anti-money laundering requirements for global operations and ensure compliance keeps pace with dynamic regulatory frameworks.

- Webinaire Making Next-Gen AML a Reality With AI and Machine LearningAI and machine learning have the ability to transform your AML programs, but only if you select a vendor with proven implementation capability. Join us for this webinar to learn how SAS expertly delivers next-gen AML.

- Témoignage client A risk-based approach to combat money laundering in IsraelSAS Anti-Money Laundering helps Ayalon Insurance monitor suspicious activity and meet challenging regulatory requirements.

- ARTICLE Next generation anti-money laundering: robotics, semantic analysis and AIAnti-money laundering taken to its next level is sometimes referred to as AML 2.0 or AML 3.0. What does this next wave of AML technology look like? What can it do that you can’t do with traditional AML? See the results innovative financial institutions around the globe are already getting.

- Témoignage client Preventing crime and ensuring compliance at 120 Nordic banksSDC enables small and medium financial institutions in four Nordic countries to stay compliant.

- Témoignage client Fast analytical defenseDeutsche Kreditbank AG combats fraud and money laundering with SAS.

- Témoignage client Analytics powers anti-money laundering effortsSAS® aide la banque Landsbankinn à réduire les faux positifs et à optimiser les investigations.

- ARTICLE Mobile payments, smurfs and emerging threatsM-payment remittances are replacing traditional banks and money services that have historically charged high fees for small transfers. Former US Treasury Special Agent John Cassara maps what he sees in the road ahead and gives advice for protecting your firm.

- ARTICLE Rethink customer due diligenceTo streamline compliance and protect against financial and regulatory risk, re-examine your customer due diligence processes and technologies regularly. With new analytical tools, you can monitor customer transactions or personal information in real time, and accurately segment customers by the risk they represent.

- Livre blanc Rethinking customer due diligenceHelp evaluate your organization's CDD processes and technology relative to current industry risks and regulatory requirements.

- Ebook Fight money laundering with these 5 next-gen game changers from SASEffectively battling dynamic financial crime threats requires new capabilities for AML defense – such as artificial intelligence, machine learning, intelligent automation and advanced visualization.

- Livre blanc Fighting Money Laundering with Intelligent AutomationThe world of money laundering and other financial crimes is changing rapidly. This International Institute for Analytics research brief shows how fraudsters and money launderers keep getting more sophisticated.

- Livre blanc How AI and Machine Learning Are Redefining Anti-Money LaunderingMachine learning can play a big role in the defense against money laundering, either to automate tasks that formerly required human intervention, such as managing the data to train models, or detect more financial crimes risk that rules and more basic analytic techniques might miss.

- Livre blanc AML ModernizationThis white paper explores current organizational challenges, outlines the benefits of new AML technology adoption, and identifies how to embark on a journey of discovery and modernization.

- Webinaire What Is a Next-Gen AML System?Learn how AI, machine learning and robotic process automation can help the global banking industry and financial firms transform the fight against money laundering.