Model, forecast and simulate complex economic and business scenarios using huge amounts of observational data. SAS Econometrics provides a broad array of econometric techniques to help you understand the impact that economic and marketplace factors have on your business so you can plan better for the future.

Demo

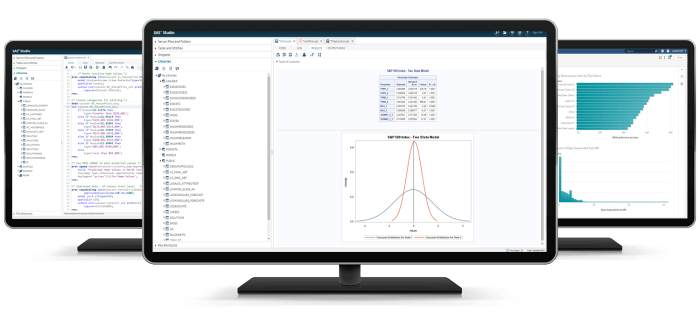

Explore the capabilities of SAS® Econometrics.

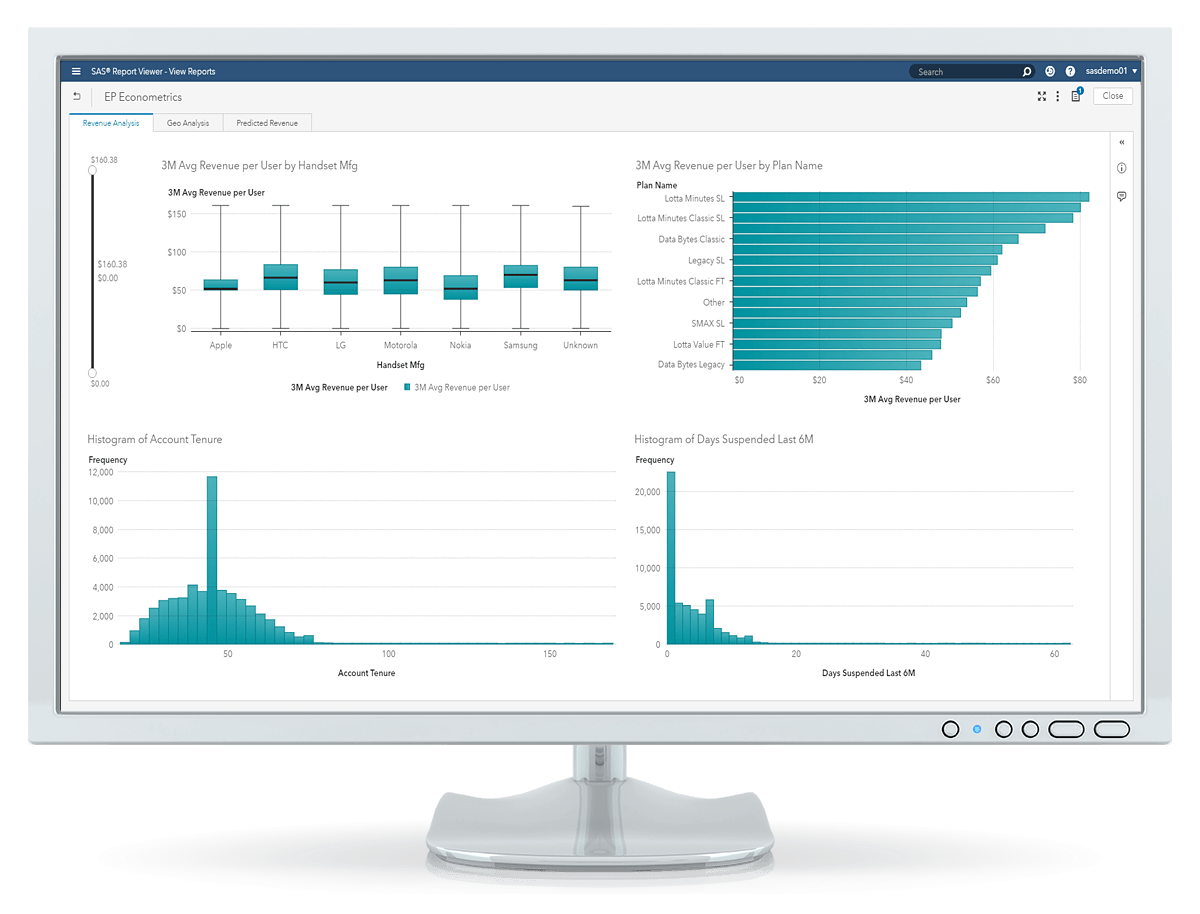

SAS Econometrics helps organizations model, forecast and simulate complex economic and business scenarios to plan for changing marketplace conditions. Learn about the software's powerful capabilities, including the new procedures and actions available in SAS Econometrics 8.2 – such as compound distribution modeling, regression models for spatial data, hidden Markov models and time series analysis. You'll also get an overview of how SAS works with open source technologies.

Key Features

- Hidden Markov models. Model and predict hidden Markov models (HMM) with the powerful new HMM procedure. The initial (8.2) release supports discrete-state Gaussian models, and many more model types will be added in subsequent releases. This method can handle very big data, scaling to millions of time points.

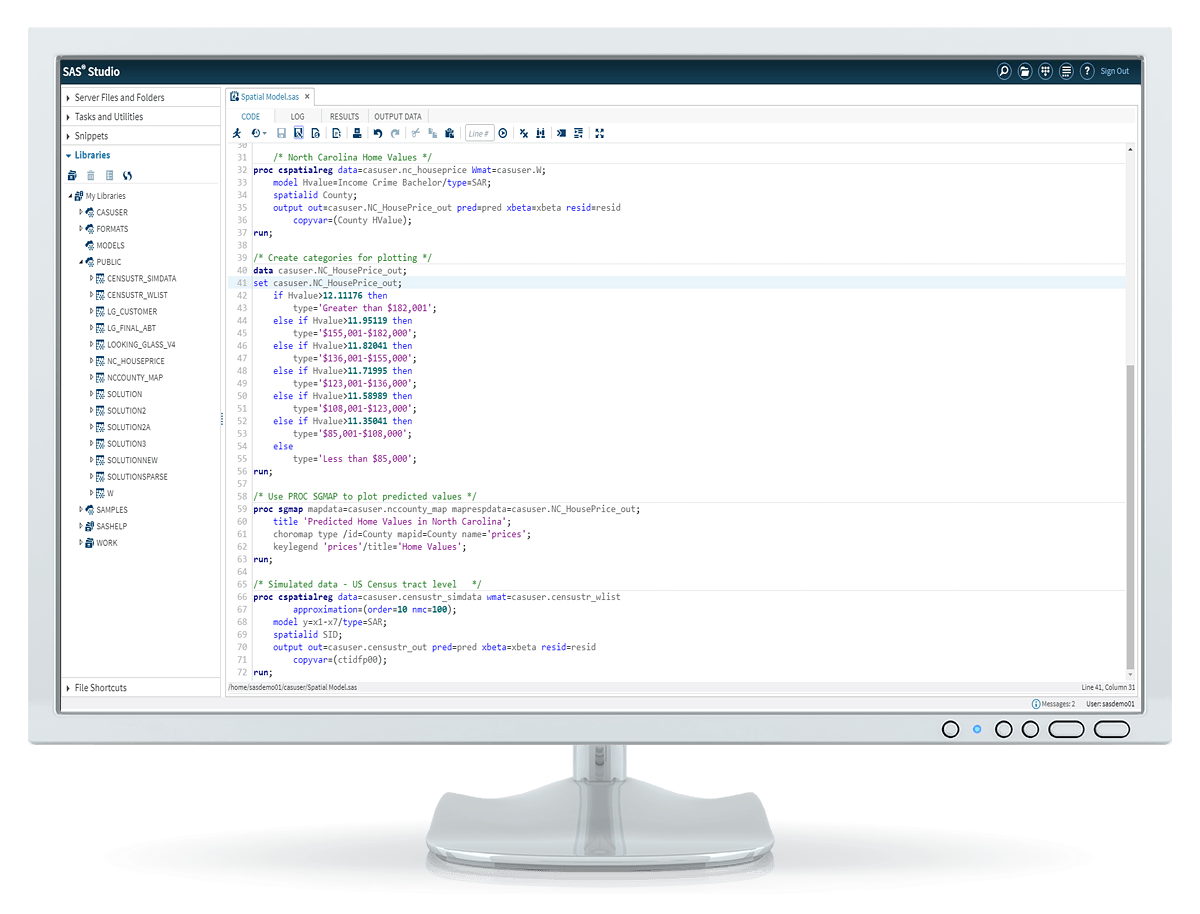

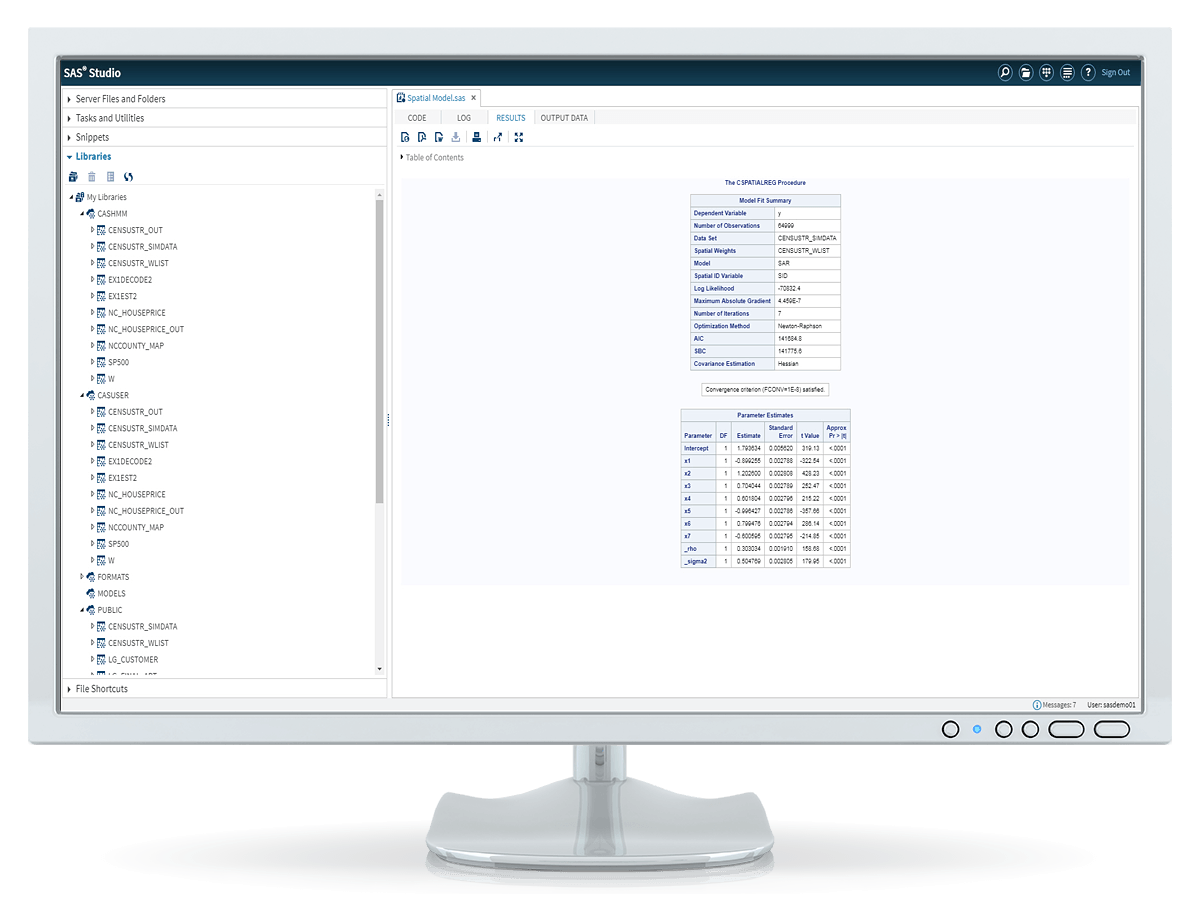

- Spatial econometrics modeling. Take advantage of data with a spatial element (e.g., location and mapping data) using the CSPATIALREG procedure to conduct spatial regressions. This enables you to include spatial information in your analysis, and improve the econometric inference and statistical properties of estimators.

- Econometric models for cross-sectional data. Conduct cross-sectional data analysis using the following included models: count regression, severity regression, qualitative and limited-dependent variables, and copula methods with compound distribution.

- Panel data econometric models. Analyze data that combines both time series and cross-sectional dimensions with these included models: panel data models, count regression models and regression models for qualitative and limited-dependent variables.

- Forecasting models for time series data. Use state-of-the-art techniques for modeling complex economic and business scenarios to analyze the impact that specific events might have over time. Time series models include user-defined ARIMA and exponential smoothing models. Time series analysis includes decomposition capabilities and diagnostic testing.

- Open, cloud-enabled, in-memory engine. Take advantage of high availability, faster in-memory processing and native cloud support of the SAS Viya engine. SAS Econometrics procedures are available for both public and private cloud delivery in a scalable and elastic environment. And all analytical assets are managed within a common environment to provide a single, governed model inventory across applications.

- Includes all SAS/ETS® procedures. SAS Econometrics provides access to all procedures in SAS/ETS, enabling you to address virtually any econometrics and time series analysis challenge.

이 새로운 솔루션은 폭넓고 깊이 있게 모든 분석 과제를 해결할 수 있는 최첨단 오픈 아키텍처인 SAS Viya를 기반으로 실행됩니다. 단일 클라우드 환경인 SAS Viya는 확장 가능하고 안전할 뿐만 아니라 애자일 IT 환경에 없어서는 안 될 분석 관리 및 거버넌스를 통해 데이터 사이언티스트에서 비즈니스 분석가까지, 그리고 애플리케이션 개발자에서 기업 임원에 이르기까지 누구나 이용할 수 있습니다. 분석 분야를 선도하는 세계적 리더인 SAS와 함께 여러분이 기대해왔던 성능을 경험해보세요.

Recommended Resources

Learn why SAS was named a Leader in The Forrester Wave™: Predictive Analytics and Machine Learning Solutions, Q1 2017.

Ask questions, share tips and more in the SAS Forecasting and Econometrics Community.