Enterprise Stress Testing

Stress testing is evolving beyond supervision, driving strategic business management and capital planning. SAS offers a comprehensive solution that integrates risk and finance data, streamlining the stress test cycle and empowering informed decision-making.

How SAS supports enterprise stress testing

SAS delivers a comprehensive solution, focusing on integration, orchestration, workflows and governance.

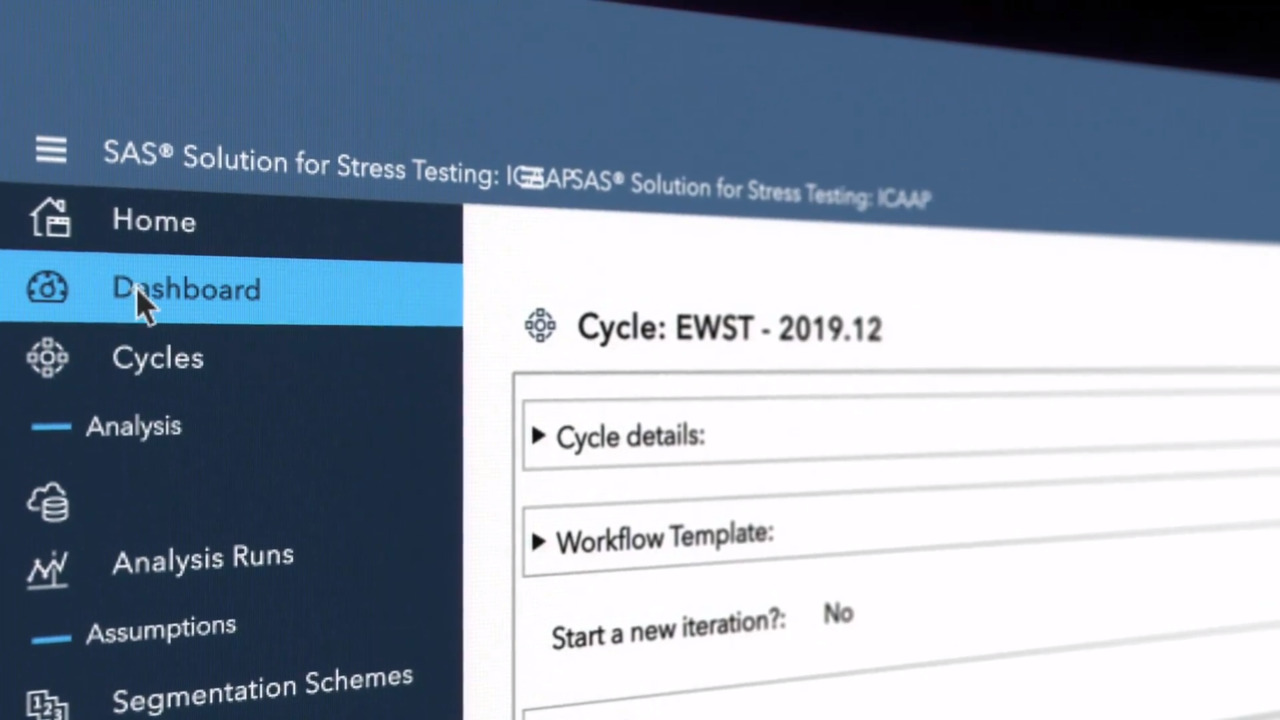

Configurable workflows & centralized orchestration

- An embedded workflow engine lets you specify tasks, timelines and approval paths.

- Centralized status monitoring enables you to track progress against plans, provide approvals, and include attachments and comments for each step.

- Centralized scenario management lets you import, export, store and change scenarios easily.

- Our solution includes configurable portfolio segmentation and business evolution plans.

Powerful data management with integrated governance & controls

- Preconfigured data quality rules are mapped to BCBS239 principles.

- A controlled, centralized model library automatically documents all changes to data and facilitates model control by enabling all models to be versioned and searched.

- The solution lets you promote models from development to production, as well as archive previous model versions.

- Security management capabilities protect project data, models, scenarios, hierarchies and configuration.

High-performance, adaptive architecture

- High-performance, in-database/in-memory execution enables timely, on-demand simulations, analysis and decisions.

- The solution scales to the size and complexity of your institution, up to the largest and most complex global enterprises, and is designed to adapt to changing business needs and market requirements.

Why choose SAS for enterprise stress testing?

SAS provides a comprehensive, integrated stress testing environment that can adapt to changing business needs and market requirements.

Significantly shorten cycle times

Produce results faster and become more responsive and influential to business decision making. Deepen analysis over a wider range of scenarios in less time.

Align stress tests with internal capital planning

Ensure consistency and alignment across internal budgeting and forecasting exercises, and with capital distribution and growth plans.

Integrate risk analytics

Stress testing is just one of multiple SAS offerings that sit on top of an integrated risk and finance platform that also includes components for CECL/IFRS9, ALM and model risk management.

Chartis RiskTech100® 2025 Awards

SAS ranks #2 overall – with six category wins

SAS is ranked second overall in the world's foremost ranking of the Top 100 risk management and compliance technology providers. SAS also bested six technology award categories, including AI for Banking, Balance Sheet Risk Management, Behavioral Modeling, Enterprise Stress Testing, IFRS 9 and Model Risk Management.

Recommended products & solutions for enterprise stress testing

Solutions that extend enterprise stress testing capabilities

- SAS® Model Risk ManagementSignificantly reduce your model risk, improve your decision making and financial performance, and meet regulatory demands with comprehensive model risk management.

- SAS® Risk ModelingQuickly develop, validate, deploy and track risk models in house – while minimizing model risk and improving model governance.

- SAS® Solution for CECLQuickly meet new US Financial Accounting Standards Board current expected credit loss (CECL) standards with best practices for modeling, workflow and reporting.

- SAS® Solution for IFRS 9IFRS 9 SAS Solution is a package of optional content for use with the Expected Credit Loss, including modelling, workflow frameworks as well as reporting.