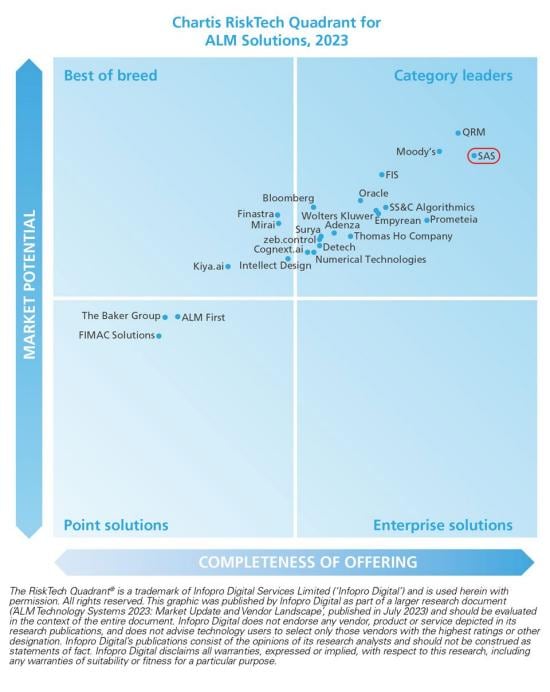

SAS EST UN LEADER DANS SA CATÉGORIE

Chartis RiskTechQuadrant® pour les solutions ALM, 2023

SAS se distingue en tant que leader dans la catégorie des solutions analytiques pour la gestion de l'actif et du passif, ainsi qu'en tant que leader dans la catégorie des solutions intégrées pour le prix de transfert des fonds, la gestion du risque de liquidité, et l'optimisation du bilan & du capital.

L'acquisition de Kamakura par SAS a renforcé la présence et le potentiel du groupe sur le marché. Les caractéristiques et fonctionnalités combinées des entreprises offrent des avantages considérables à leurs clients existants, ce qui leur confère un avantage concurrentiel. Les clients de SAS peuvent également bénéficier de l'intégration avec des solutions "cloud-native" au sein de l'écosystème ALM plus large, y compris des solutions pour les pertes de crédit attendues et le capital réglementaire. L'acquisition de l'expertise quantitative de Kamakura coïncide avec un regain d'intérêt des institutions pour l'analyse, face à une volatilité considérable à long terme.