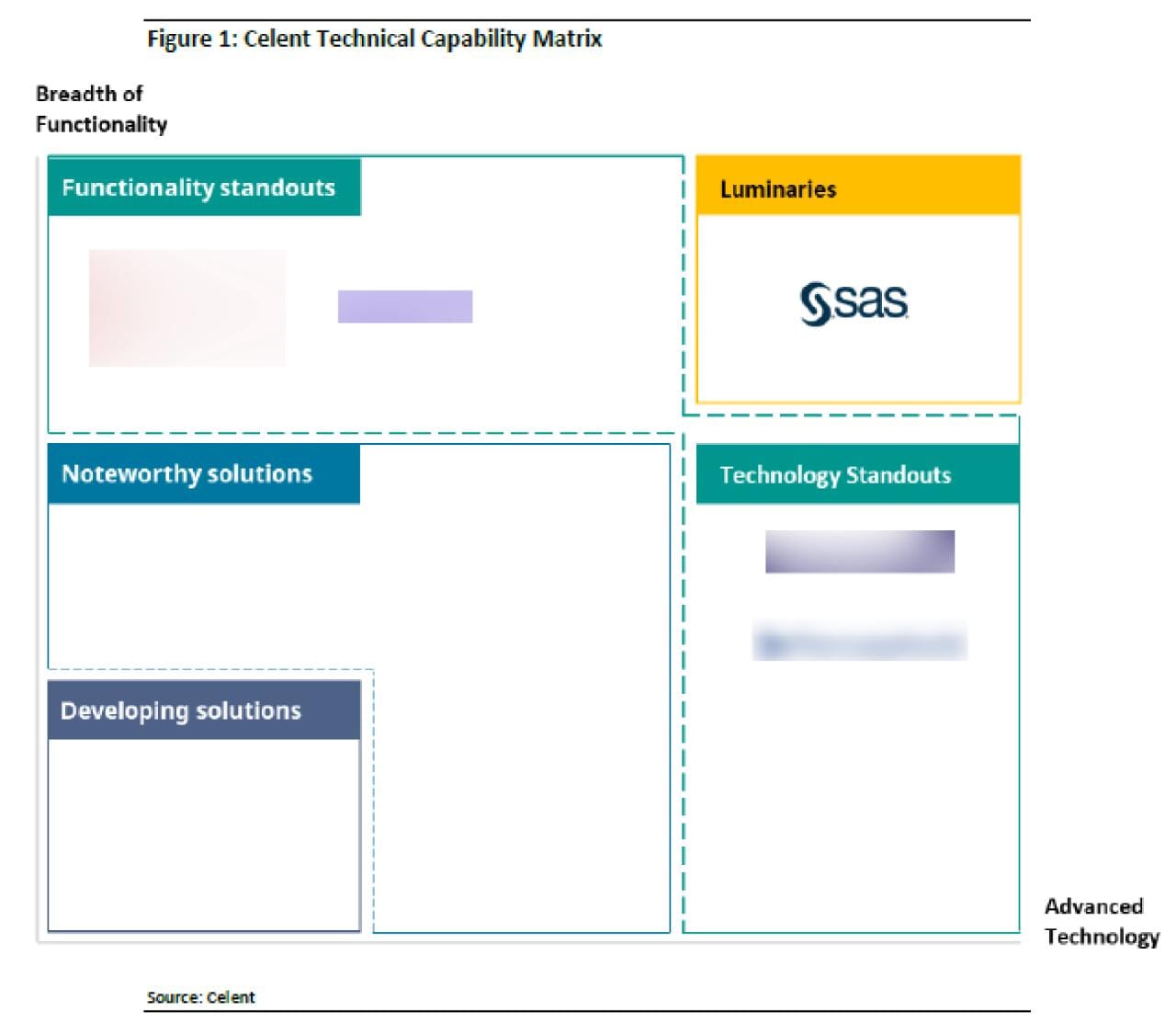

SAS IS A LUMINARY

Celent Insurance Fraud Detection Solutions: Health Insurance, 2022 Edition

Luminary: Excels in both Advanced Technology and Breadth of Functionality.

Explore More SAS Resources

To browse resources by type, select an option below.

-

- Select resource type

- Analyst Report

- E-Book

- White Paper

- White Paper

- Article

- Blog Post

- Book Excerpt

- Case Study

- Infographic

- Interview

- Research

- Series

- Video

- Webinar

- Customer Story

- White Paper Effective fraud analytics: 10 steps to detect and prevent insurance fraudInsurers that follow the 10 steps outlined in this paper offer the best chance for detecting both opportunistic and organized fraud.

- Article 6 ways big data analytics can improve insurance claims data processingWhy make analytics a part of your insurance claims data processing? Because adding analytics to the claims life cycle can deliver a measurable ROI.

- Article Shut the front door on insurance application fraud!Fraudsters love the ease of plying their trade over digital channels. Smart insurance companies are using data from those channels (device fingerprint, IP address, geolocation, etc.) coupled with analytics and machine learning to detect insurance application fraud perpetrated by agents, customers and fraud rings.

- Customer Story Advanced analytics can detect and prevent insurance fraud before losses occur

- Article How AI and advanced analytics are impacting the financial services industryTop SAS experts weigh in on topics that keep financial leaders up at night – like real-time payments and digital identity. See how advanced analytics and AI can help.

- Article Are you covering who you think you’re covering? Payers often don't focus enough on healthcare beneficiary fraud in public and private healthcare plans. Before paying a claim, payers need to ensure beneficiaries are eligible. Advanced analytics applied to a broad range of data can help them accurately detect and prevent beneficiary fraud.

- White Paper Fraudsters love digitalBy incorporating fraud analytics as a first line of defense, insurers can build in safeguards for all of their digital programs. In turn, they can spot emerging fraud rings, emerging fraud trends, and make real-time decisions on claims recovery to reduce leakage.

- White Paper 2021 State of Insurance Fraud Technology StudyAs fraud continues to frustrate survey respondents, it's not surprising that the adoption of insurance anti-fraud technologies among respondents grew since the 2018 survey.

- Analyst Report Chartis RiskTech Quadrant for Watchlist and Adverse Media Monitoring 2024

- Customer Story A risk-based approach to combat money laundering in IsraelSAS Anti-Money Laundering helps Ayalon Insurance monitor suspicious activity and meet challenging regulatory requirements.

- Customer Story Turkish insurer achieves real-time fraud detectionAksigorta uses advanced analytics to increase fraud detection rate by 66 percent.

- White Paper Fighting Insurance Application Fraud Learn about the advantages of using analytics-driven methods for authenticating applicants to reveal customer gaming, agent gaming and potential future claims fraud.

- Analyst Report Celent: Insurance Fraud Detection Solutions: Health Insurance, 2022 EditionSAS was named a Luminary in Celent's Insurance Fraud Detection Solutions: Health Insurance, 2022 Edition, excelling in both Advanced Technology and Breadth of Functionality.

- Customer Story Protecting policyholders through better fraud analysisEthniki Insurance prevents fraud, reduces costs and increases customer satisfaction with SAS Detection and Investigation for Insurance.

- Analyst Report SAS is a Leader in The Forrester Wave™: Enterprise Fraud Management, Q2 2024

- Article Analytics for prescription drug monitoring: How to better identify opioid abusePrescription drug monitoring programs (PDMPs) are a great start in combating abuse of prescription drugs, but they could be doing much more. Better data and analytics can inform better treatment protocols, provider education and policy decisions – and save lives.

- E-Book On the Road to Accelerating Claims AutomationMore than ever, insurance companies need to provide customers with seamless interactions that save them time, minimize hassle, and make them feel seen, understood, and cared for. Many are also exploring the use of AI for claims prevention – for example, by creating new risk mitigation services. All of this requires investment in digital technologies that work together to enable intuitive, Amazon-like customer experiences. This ebook explores how insurers can make the leap to digitally transformed, intelligent claims processes that customers love and increase operational efficiency and reduce costs.

- Analyst Report Celent Insurance Fraud Detection Solutions: Property and Casualty Insurance, 2022 EditionSAS is a Luminary in Celent's Insurance Fraud Detection Solutions: Property and Casualty Insurance, 2022 Edition.