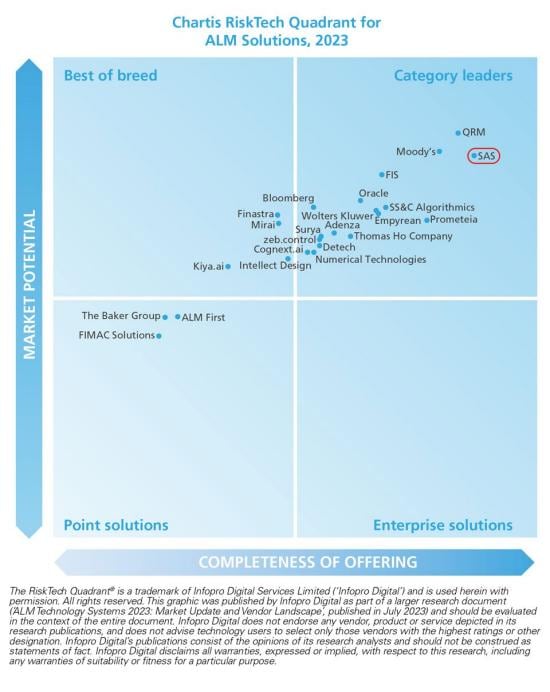

SAS IS A CATEGORY LEADER

Chartis RiskTech Quadrant® for ALM Solutions, 2023

SAS distinguishes itself as a strong category leader in analytics solutions for asset and liability management, as well as being recognized as a category leader with integrated solution offerings for funds transfer pricing, liquidity risk management, and capital & balance sheet optimization.

SAS’ acquisition of Kamakura has raised the vendor’s overall market presence and potential. The companies’ combined features and functionality provide considerable benefits to their existing customers, giving the firms a competitive advantage in the market. SAS’ customers can also benefit from integration with cloud-native solutions within the broader ALM ecosystem, including solutions for expected credit loss and regulatory capital. The acquisition of Kamakura’s quantitative expertise coincides with a renewed focus on analytics among institutions, in the face of considerable long-term volatility.