Designed to help you meet CECL requirements – including modeling, workflow templates and reporting.

Modeling and analytics

Speeds model development with prebuilt templates for common model types, including hazard models, Markov chains, PD curves, loss given default (LGD), Monte Carlo simulations and state transition models. Enables timely compliance with CECL requirements through fast creation, testing and execution of expected credit loss models.

Financial aggregation

Enhances accountability with automated disclosures and posting into ledgers. Aggregate or drill into results on the fly to understand drivers and assess financial impacts.

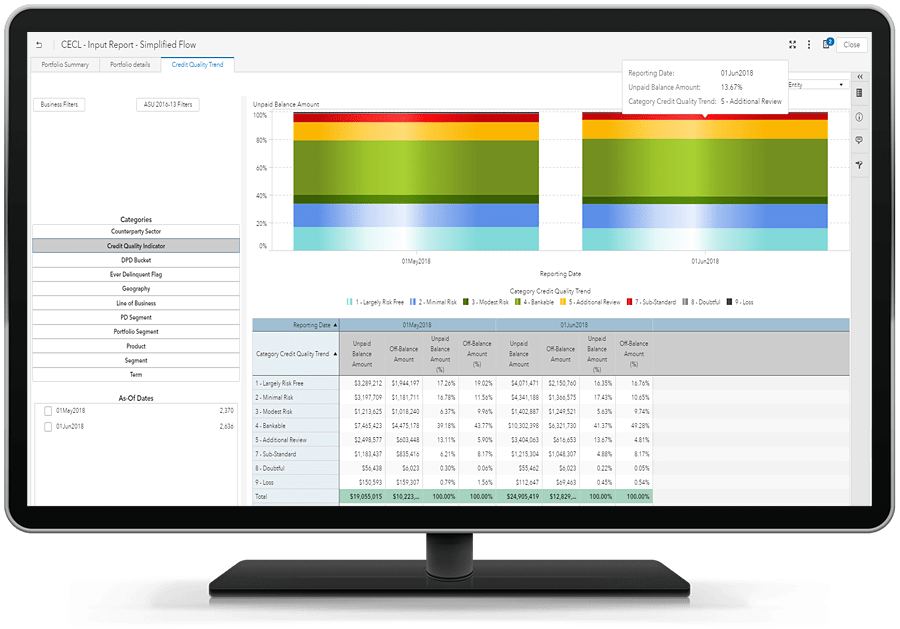

Self-service reporting templates

Enables you to quickly design and deploy CECL reports with easy-to-use reporting templates and out-of-the-box visualizations. Templates include Lifetime ECL, Credit Quality, Vintage Analysis, and Reconciliation to FAS 5 and FAS 14 – and can be modified as needed.

Unified workflows

Provides sample workflow templates for managing ECL estimation processes. Enables easy customization of accounting rules and data flows while synchronizing risk and finance processes for greater auditability, transparency and repeatability.

Tackle the additional complexity of CECL and meet delivery deadlines quarter after quarter.

Accelerate completion of your CECL implementation project.

Successfully implement CECL faster with custom model templates, sample workflows, business rules and reporting packages. As an add-on to SAS Expected Credit Loss, SAS Solution for CECL can help you meet the computational challenges and tight timelines of the new CECL standard while reducing implementation and execution risks.

Streamline ECL estimation processes.

Simplify CECL model creation and refinement through a point-and-click interface and prebuilt templates that greatly reduce coding requirements. Reduce ongoing maintenance costs and enable expert resources to focus on higher-value activities.

Get fast results.

Optimized model templates and distributed, in-memory processing enable you to perform calculations faster than ever. Then use prebuilt templates to create the most commonly used reports. You can also perform on-the-fly aggregations and drill down into results in near-real time.

SAS is named a category leader in the Chartis FinTech Quadrant for CECL Technology Solutions 2018.

Explore More on SAS® Solution for CECL & Beyond

Discover how risk-aware finance is becoming a matter of business survival to meet future regulatory demands.

Related Products

Check out these products related to SAS Solution for CECL, all based on the powerful SAS Platform.