Credit Scoring for SAS® Enterprise Miner™

Integrated scorecard development, deployment and monitoring for better decisions.

Build, validate and deploy better credit risk models using advanced predictive analytics and in-house expertise. Assess and control risk accurately within your existing consumer portfolios by understanding the specific risk characteristics that lead to delinquency, default and bad debt. Streamline your credit approval processes. And improve your acquisition, retention and collection strategies.

Shorten your data prep time.

Save time and resources by accessing, transforming, cleansing and preparing all prerequisite data – including third-party bureau, application, bill-payment and collections data. Quickly and easily examine data sets of all sizes for patterns, anomalies and missing values. Built-in, interactive nodes offer many options for exploration, transformation, missing value imputation, outlier analysis and correlation analysis.

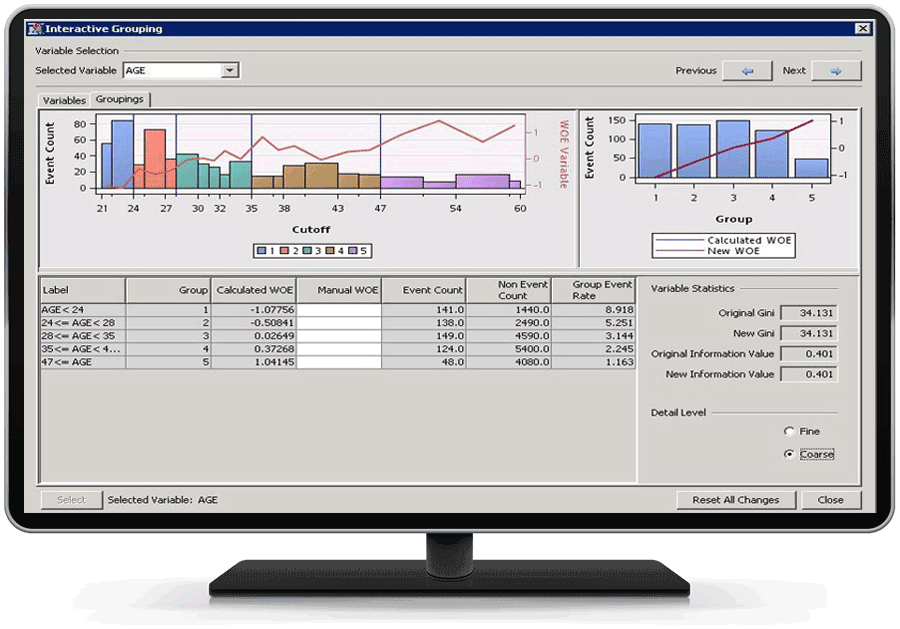

Develop scorecards quickly and easily.

Create and deploy credit scorecards for virtually all types of consumer lending products – accounts, cards, loans, mortgages – leading to better credit decisions and reduced losses. You can compute scorecard points for each attribute using either the WOE variables or the group variables that are exported as inputs for the logistic regression model, and you can manually assign scorecard points to attributes.

Understand relationships and behaviors.

Our solution purposely censors the data so you can more easily understand relationships and model nonlinear dependencies with linear models. This gives you control over the development process and provides insights into the behavior of risk predictors. The node also screens characteristics so that potentially predictive variables are used while other variables are not.

Automatically create target variables.

As a remedy for selection bias, unrealistic expectations and model overconfidence, we offer three industry-accepted ways to infer rejected data – fuzzy augmentation, parceling and hard cutoff. You can quickly make more robust estimates on how the credit risk model performs on both the known population and the entire "through-the-door" population.

Key Features

Flexible data preparation and management

Prepares data across disparate systems and sources for analysis with data access, integration and management capabilities.

Award-winning predictive analytics

Includes predictive and descriptive modeling algorithms, including scorecard, decision trees and logistic regression.

Patented optimal rigorous binning method

Patented optimal rigorous binning method yields true optimal bins based on constraints defined by the user.

Data partition node

Partitions data into training, validation or test data sets based on simple random, cluster or stratified random sample.

Interactive grouping node

Purposeful censoring of data and assessments on the strength of each characteristic individually as a predictor of performance.

Scorecard node

Fits a logistic regression model and computes scorecard points for each attribute, plus enables scorecard points scaling.

Reject inference node

Provides remedies for sample/population data selection bias through an augmented data set.

Seamless integration into SAS Credit Scoring for Banking

Comprehensive solution for developing, deploying and managing scorecards.