Moving beyond the ad server

How intelligent advertising, software as a service can guarantee success for online publishers

Compared with other industries, online advertising is still in its early stages, yet it has grown by leaps and bounds. Two decades ago, it was just an idea. Today, it’s an industry – one that’s expanding fast and changing just as quickly.

From the humble beginnings of the banner ad and the later advent of pay-per-click models, to more recent

innovations in demand-side platforms and mobile and video ads (and their use in location-based devices, such as smartphones and tablets), online advertising continues to evolve and transform.

Of course, given the fluidity of the online world in general, change is to be expected. On the web, nothing stays the same for long, and advertising is no exception. While new approaches and mediums are exciting, the shifting landscape also presents challenges – to marketers, advertisers and, perhaps most significantly, publishers.

Overall, owners of online properties are finding that the old ways of managing and selling inventory simply aren’t keeping pace with the market and medium. While there are a number of challenges facing online ad publishers, let’s take a look at three of the most significant ones.

Challenge No. 1:

Technology that hinders insight

Major ad serving technologies are aging. Product updates are few and far between. In some cases, popular but older platforms are being phased out altogether. Cloud computing capabilities have been available for years, but most ad serving technologies have neglected to take advantage of this and other advances in information collection and processing.

In short, older technology is preventing communication among the applications used in the ad sales and delivery process – and that, in turn, is preventing publishers from seeing the big picture. For instance, an ad server can report impressions delivered, but if it doesn’t integrate with analysis tools, a publisher has difficulty knowing if those impressions were sold at the right price – or how inventory could be better packaged to maximize value and performance.

Challenge No. 2:

Complex inventory management

Traditionally, ad servers haven’t recognized visitors as members of specific demographics and have missed the opportunity to serve ads accordingly. Now, management is infinitely more complex. Behavioral and contextual targeting allows publishers to tailor the ad experience for specific demographics, meaning that inventory can be sold hundreds of different ways, with equally different results. Add to this the expanding types of ad content being produced – including floating and interstitial ads, streaming video and mobile, which are expected to grow vastly in the coming year – and inventory management becomes cumbersome at best and nearly impossible at worst.

Challenge No. 3:

Increased competition

Unlike the print media industry, where the cost of entry is often prohibitively high, websites are comparatively inexpensive to publish. With new properties launching every day, competition for advertising dollars is increasing. In addition, online advertising is highly skewed, with the top 10

ad-carrying web properties earning as many as a third of all Internet page views in any given month, leaving smaller properties fighting for their share. And traditional publishers are no longer the only players – popular social media sites and mobile applications are offering lucrative advertising opportunities as well.

Simply put, online advertising is moving fast. Systems and management processes that were good enough five or 10 years ago aren’t keeping pace with the needs of the industry. And while a variety of applications are available to assist publishers in managing various aspects of their work – targeting, market research, inventory analysis, workflow, sales performance and more – a piecemeal approach is not ideal.

To optimize processes and maximize profits, publishers need solutions that offer true advertising intelligence. In the simplest terms, advertising intelligence is any system, approach, method or application that takes data from the digital ad delivery process and:

- Makes the data accessible.

- Turns the data into insight.

- Gives users a simple way to take action on what they learn.

Here’s how three businesses are using SAS® Intelligent Advertising for Publishers, a software-as-a-service offering that does all these things, to solve the challenges outlined above.

Making mobile easy to manage

Online family organizer Cozi uses SAS Intelligent Advertising for Publishers to maximize advertisers’ ROI. The solution targets the right ad with the right message to its online and mobile users, comprised of tech-savvy moms and their families. It also helps Cozi move quickly to deliver unique products to the market and develop new product functionality. With a custom software development kit, the online ad publisher can serve synced roadblocks with multiple ads and place its “Add to Cozi” buttons adjacent to ad banners.

Taking an integrated approach

After using three independently managed applications to meet its ad serving needs, an online real estate advertising company opted instead for an end-to-end platform via SAS Intelligent Advertising for Publishers. The solution provides the granular reporting and yield analysis needed to improve the effectiveness of its in-house sales team, and the tight integration across all multiple business areas provided for smoother operations overall. As a result, the company is better equipped to take advantage of big data and monetize its ad inventory.

Owning the data

Similar to the previous company, an Internet-auction website wanted to move away from traditional ad serving platforms to an entirely new ad serving environment. After a rapid, six-week transition to SAS Intelligent Advertising for Publishers, the company’s improved reporting and yield analysis capabilities provided deeper insight than was previously possible. And by bringing the ad serving process back in house, the company gained complete ownership of its data, thus increasing its ability to derive more value from the data associated with selling ad space.

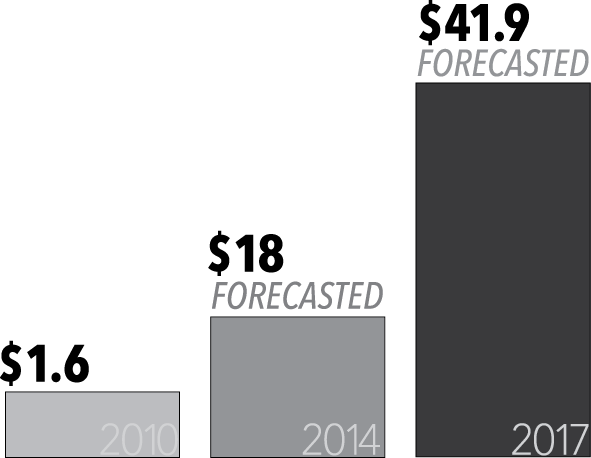

Why mobile technology matters

Worldwide mobile advertising revenue (in billions)

Sources: Gartner Says Mobile Advertising Spending Will Reach $18 Billion in 2014, Gartner, January 2014.Gartner Says Worldwide Mobile Advertising Revenue Forecast to Reach $3.3 Billion in 2011, Gartner, June 2011.

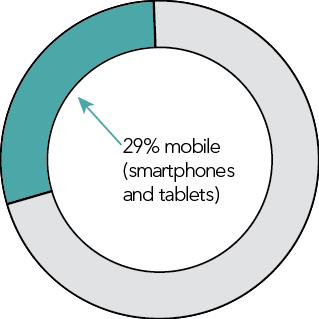

Online ad spending in the US by 2018

Source: 29% of Online Ad Spend in the US Will Be From Mobile by 2018, Forrester Research Inc., May 2013

Worldwide tablet and smartphone count by 2017

900,000,000

tablets

3,000,000,000

smartphones

Source: 2013 Mobile Trends for Marketers, Forrester Research Inc., February 2013.

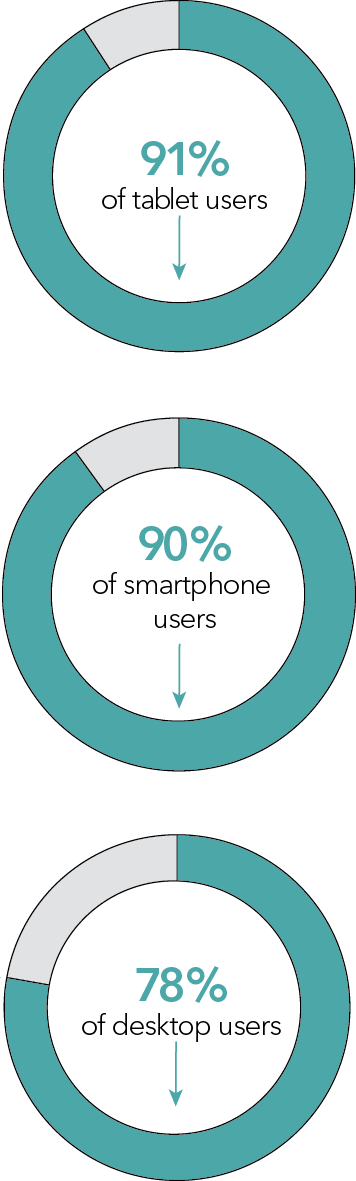

E-commerce site access: Mobile vs. web

The percentage of mobile device users that accessed mobile e-commerce web properties compared with the percentage of desktop web users that accessed e-commerce sites.