SAS Asset and Liability Management

Discover our solutions for effective asset and liability management (ALM) and liquidity risk management, with integrated balance sheet capabilities – in a powerful, cloud-native, modular and transparent solution.

Key features

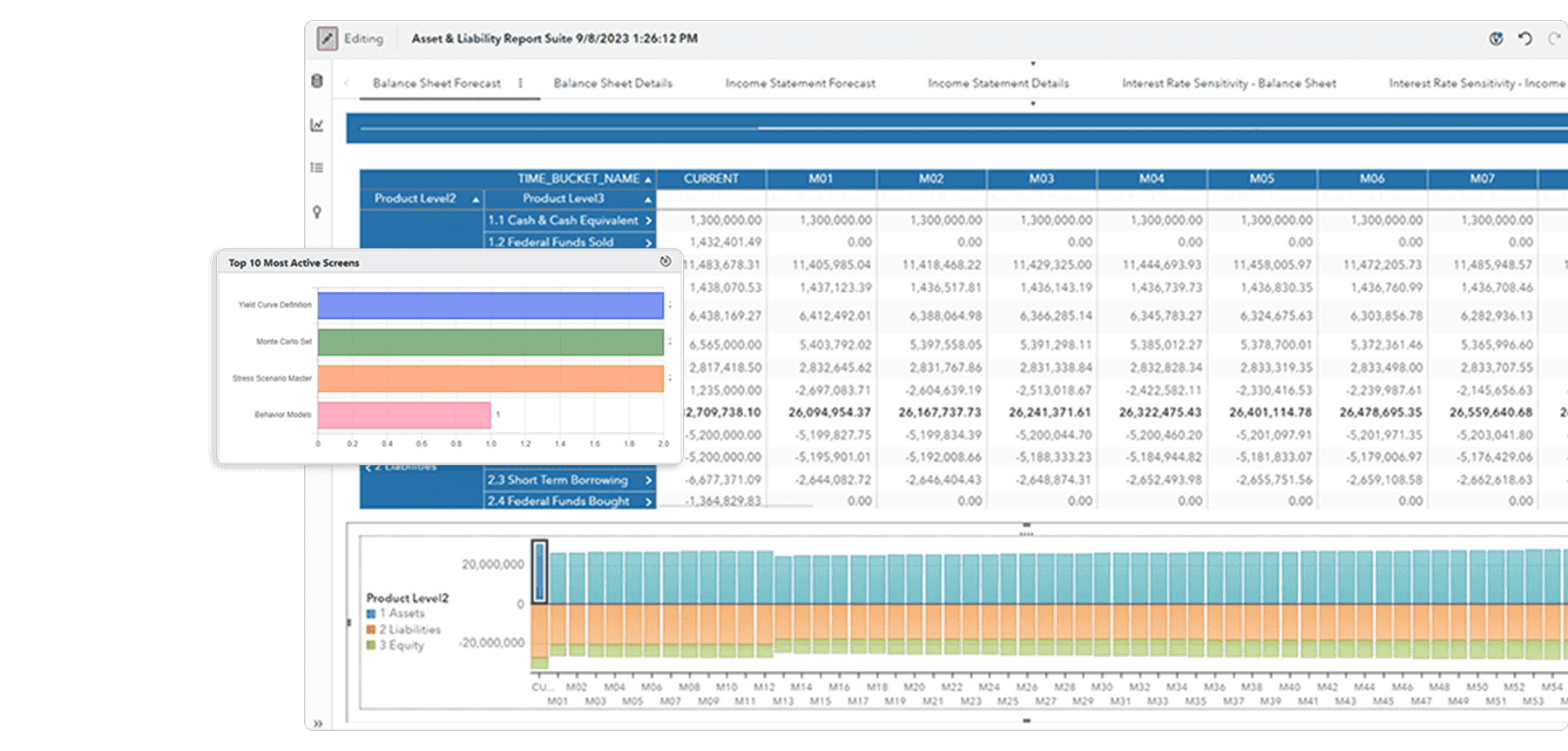

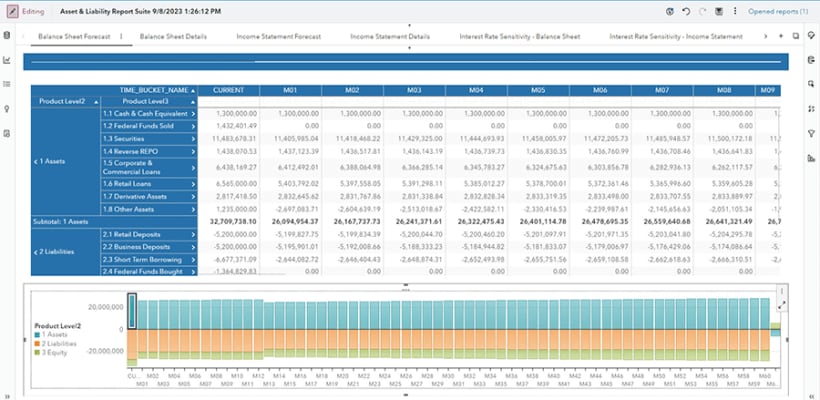

Expand beyond core ALM and liquidity risk management with enhanced, forward-looking interest rate risk measures and scenario-based balance sheet analytics.

Comprehensive ALM & liquidity risk management capabilities

Offers scenario-based ALM and liquidity risk management with both static and dynamic balance sheet assumptions.

Cloud native

Provides scalable, resilient analytics with reduced maintenance overhead using a modular, microservices-based architecture.

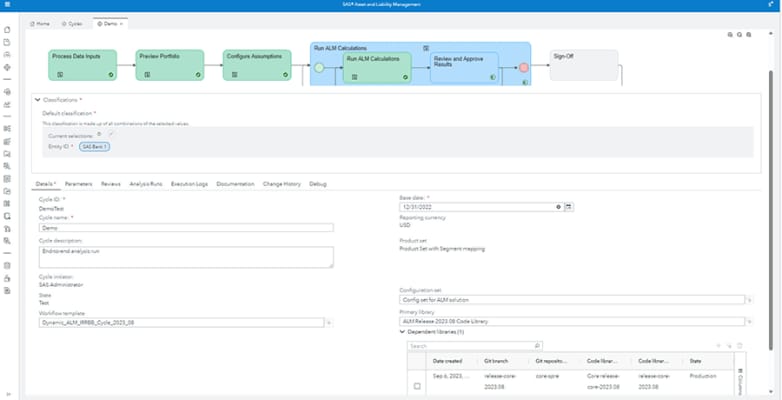

Highly automated

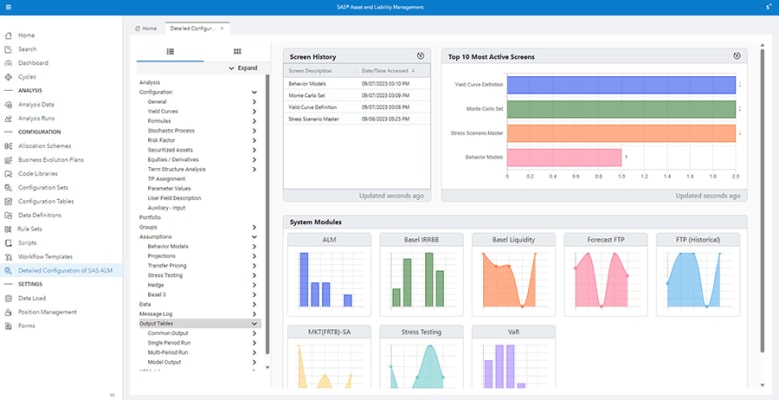

Enables both ad hoc analyses and fully automated daily production runs with sophisticated error detection, process monitoring and calculation transparency for meeting regulatory requirements.

Open & flexible

Provides a robust analytics architecture with built-in cash flow generation logic. Supports integration of open source, in-house proprietary, and third-party libraries and risk models.

SAS Viya is cloud-native and cloud-agnostic

Consume SAS how you want – SAS managed or self-managed. And where you want.