Where time is money, SAS Viya saves you both.

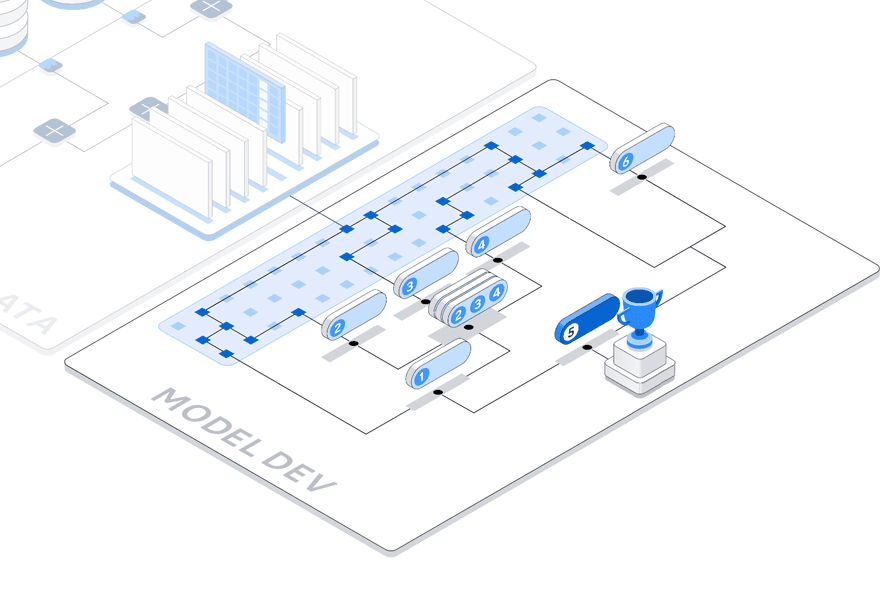

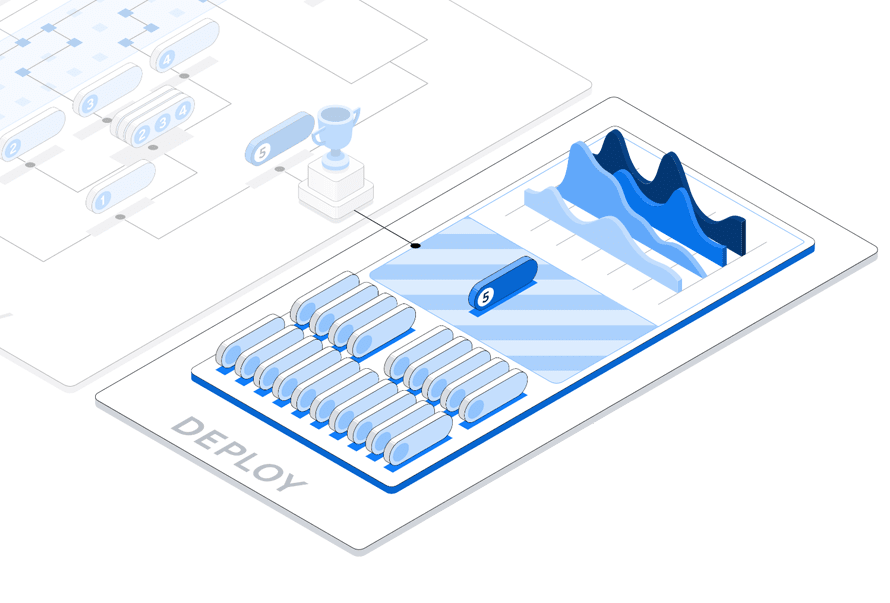

Build models faster. Scale further. The benchmarks bear it out – it’s productivity like never before.

30x

faster

On average, that’s how much SAS Viya outpaces the competition in executing data and AI tasks with endless scalability.

86%

cost reduction

Compared with alternatives, that’s how much working in SAS Viya can lower cloud operating costs.

Outpace tomorrow with SAS Viya.

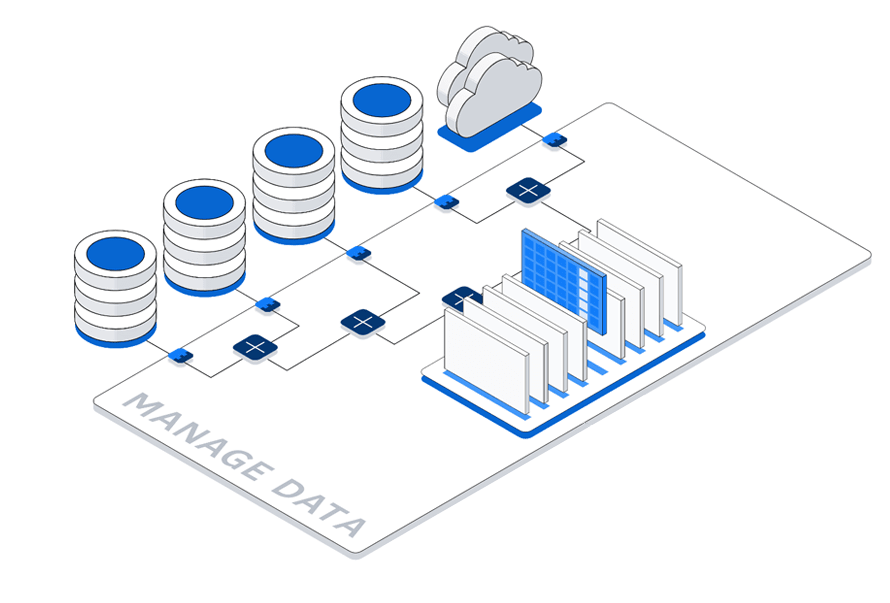

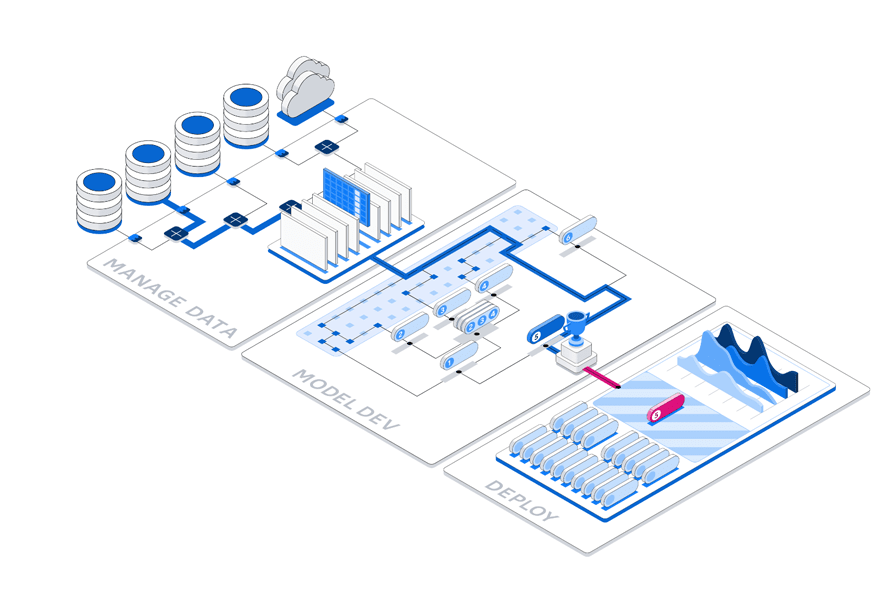

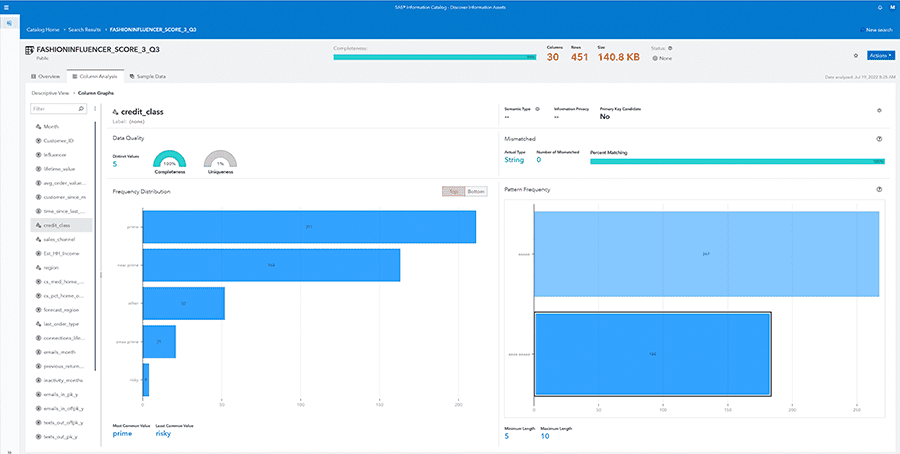

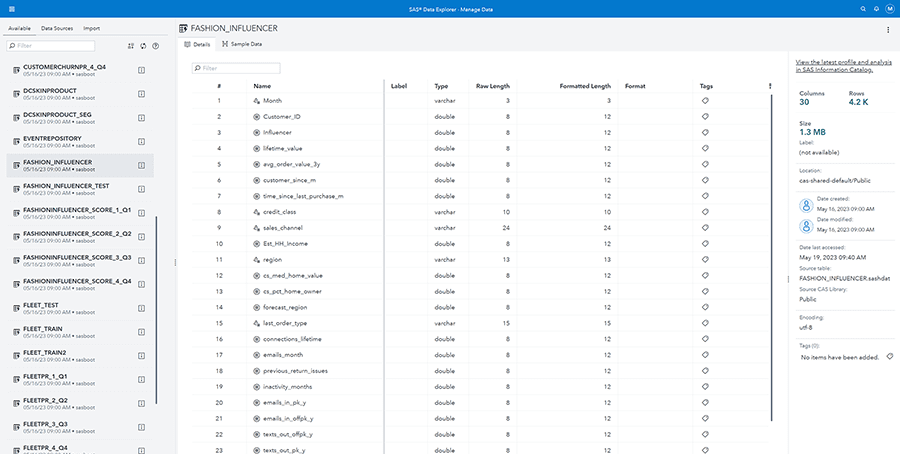

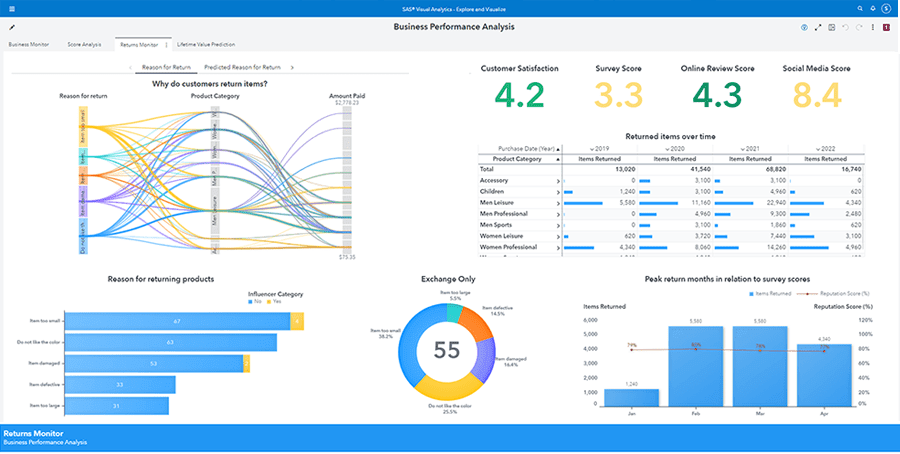

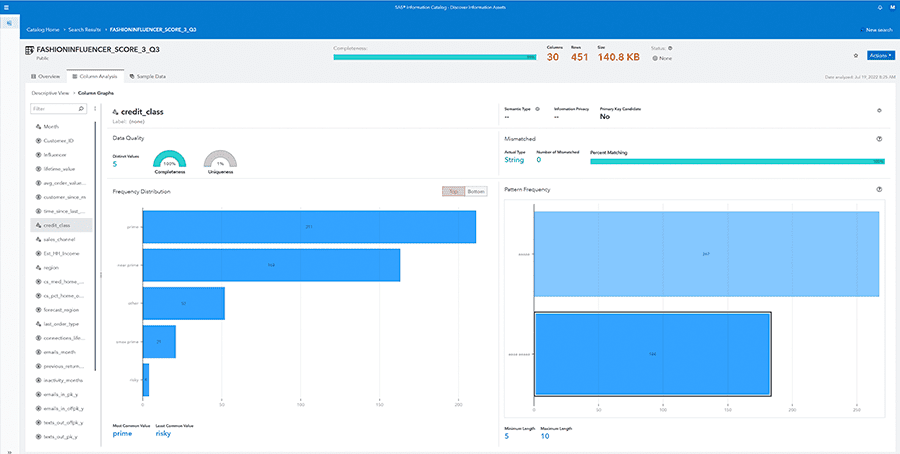

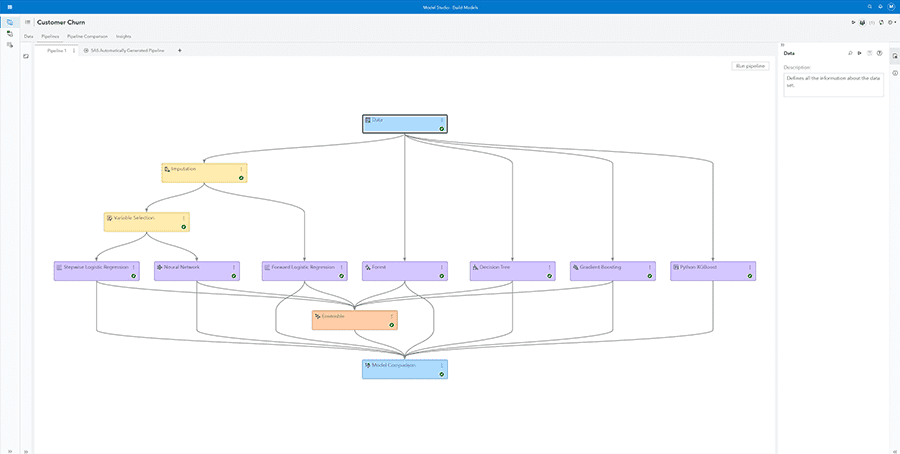

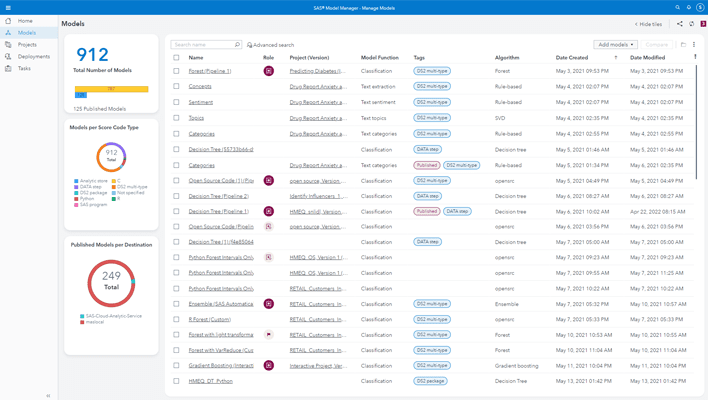

Discover the end-to-end platform that not only fulfills the promise of AI, but also brings you speed and productivity you never imagined possible. See how we take the computer science out of data science.

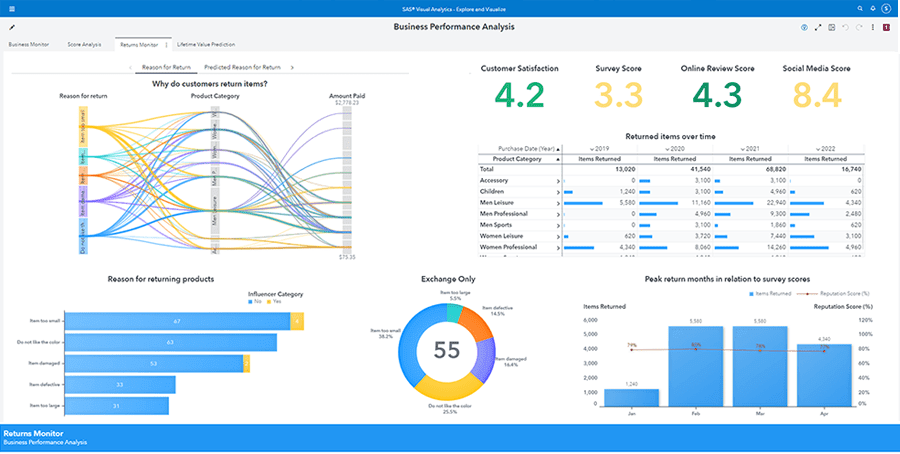

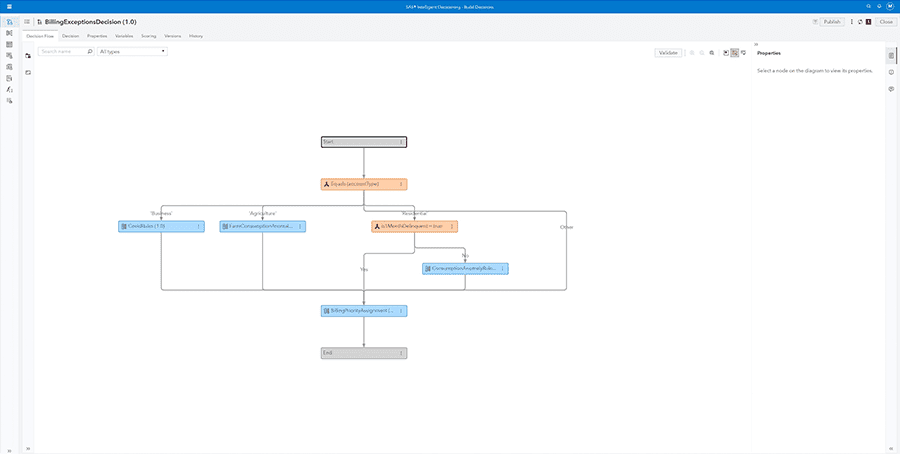

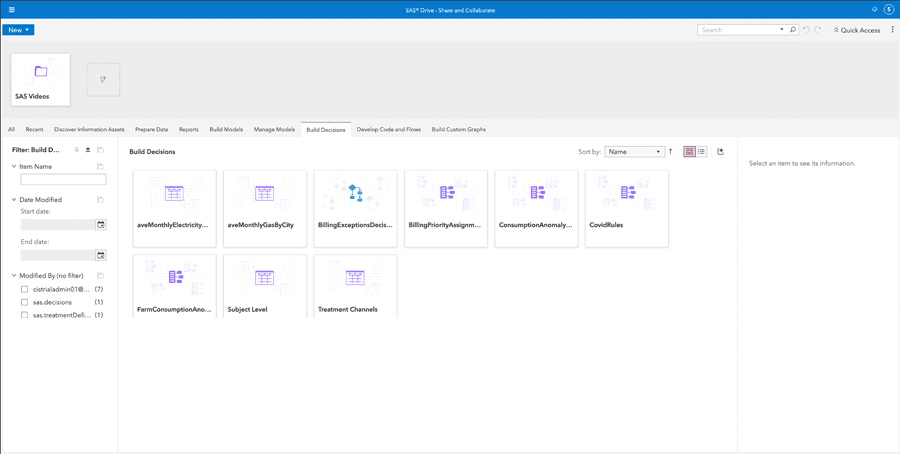

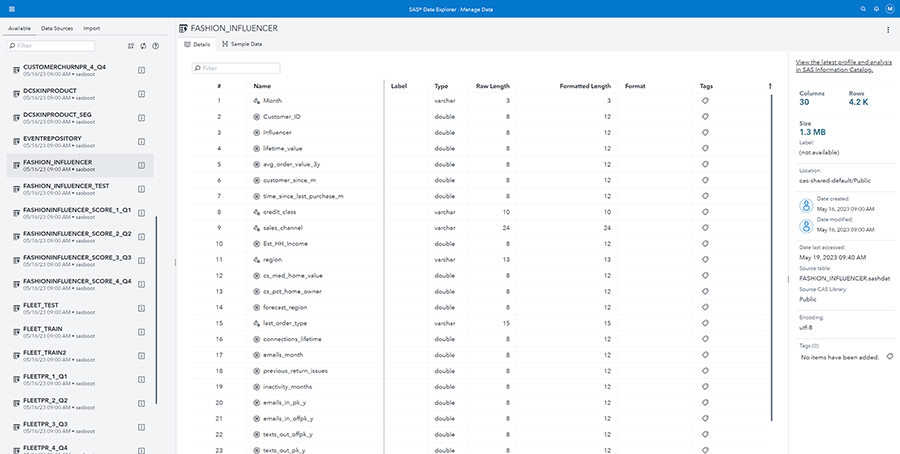

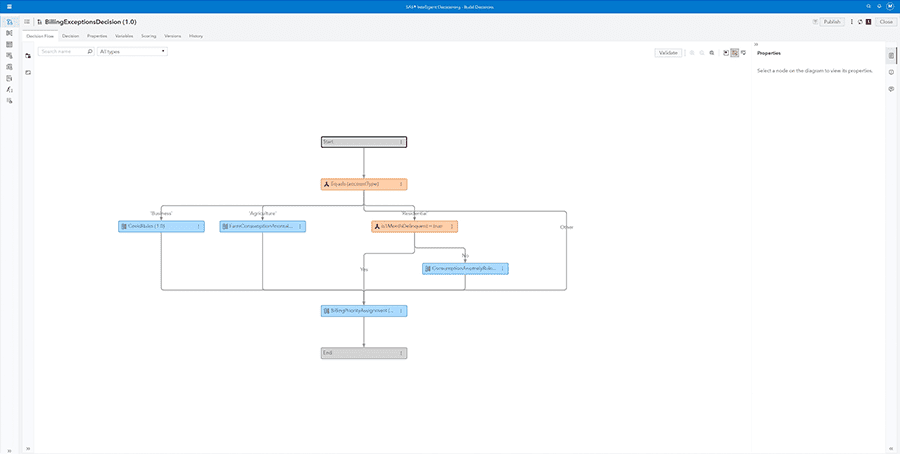

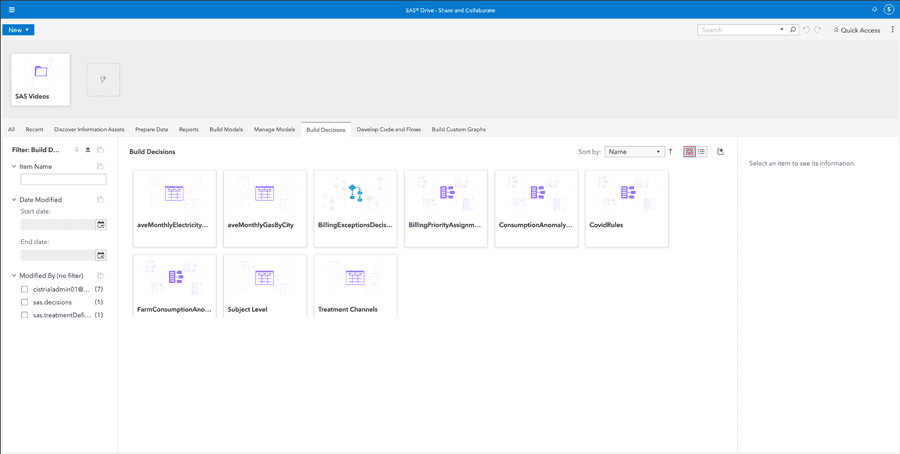

Deliver better decisions from data.

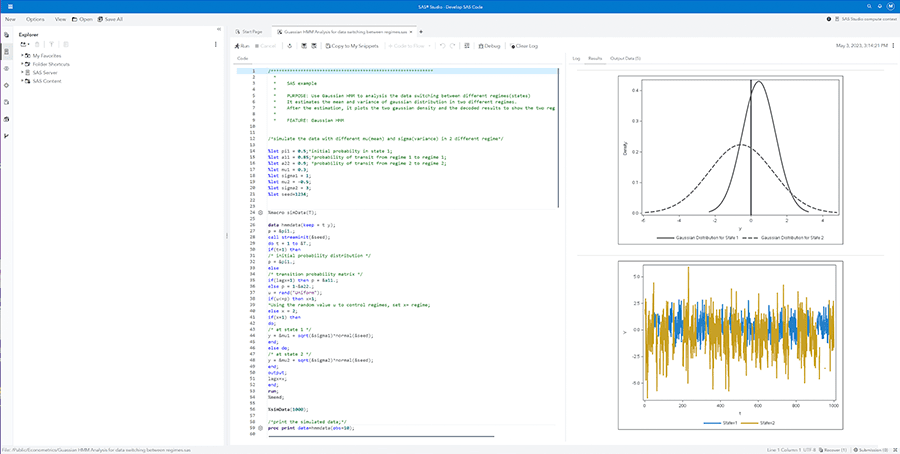

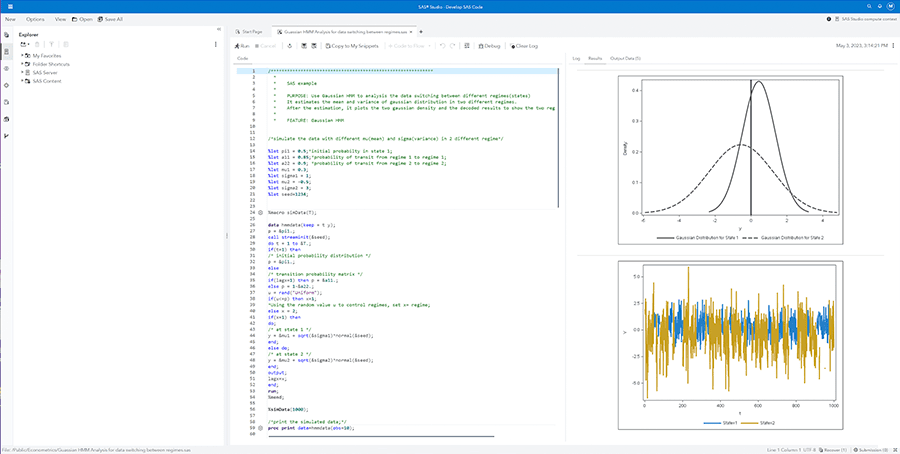

Be more productive in any – and every – language.

“SAS integrates seamlessly with other open source languages. … This saves us time and effort and allows us to focus on solving problems rather than learning and switching between different tools.”

Baha Arfaoui, Data Scientist

Positive Thinking Company

2023 SAS Hackathon participant

Thrive with any skills in any role.

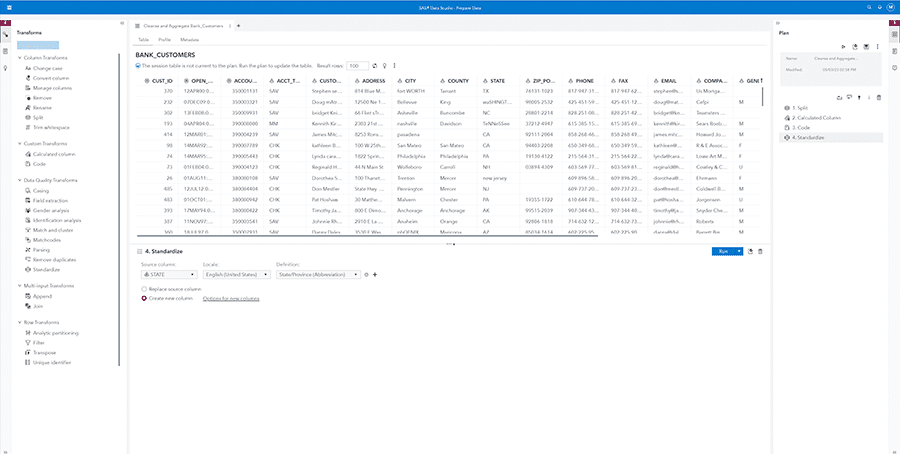

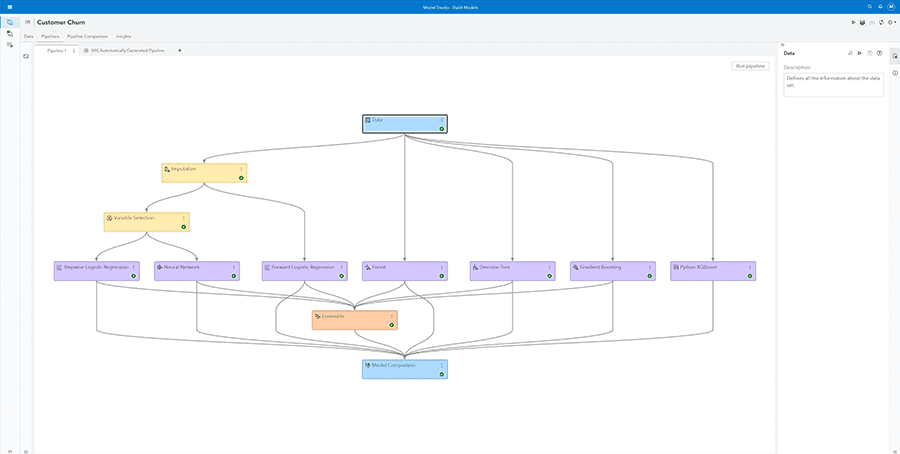

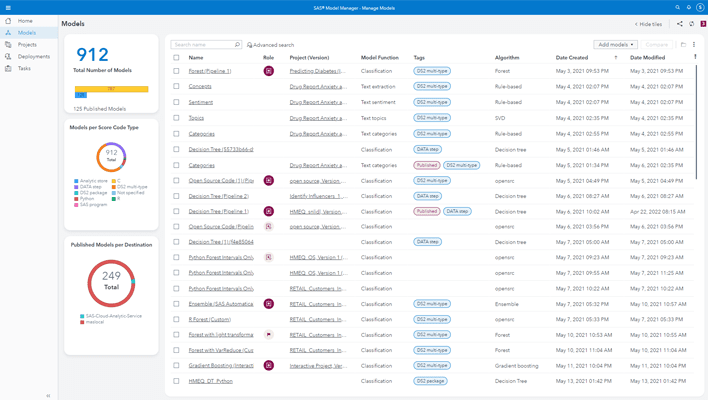

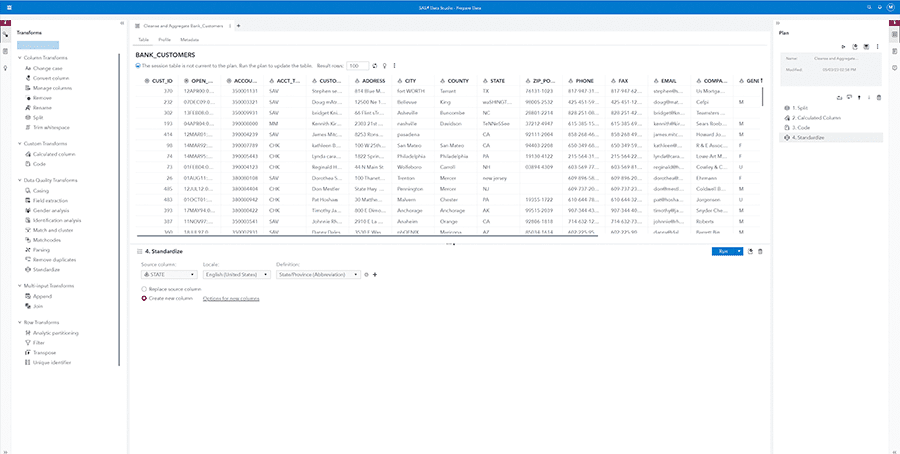

Innovate faster with automation. Feel the flexibility of no-code and low-code UI. Get trusted results and avoid bias using built-in accountability tools. Elevate everyone in your organization on the AI and analytics platform that makes your code – and your shared workspace – more accessible and integrated than ever.

The AI and analytics platform analysts love.

“SAS’s flagship Viya platform includes beautifully designed interfaces across the entire data-to-decision lifecycle.” The Forrester Wave™: AI Decisioning Platforms, Q2 2023

The proof is in the productivity.

See why SAS Viya is the platform Georgia-Pacific and others count on.