Revamped SAS® Anti-Money Laundering helps banks scrutinize suspicious activity more quickly

Rising regulatory pressures and transaction volumes require improved efficiency and accuracy

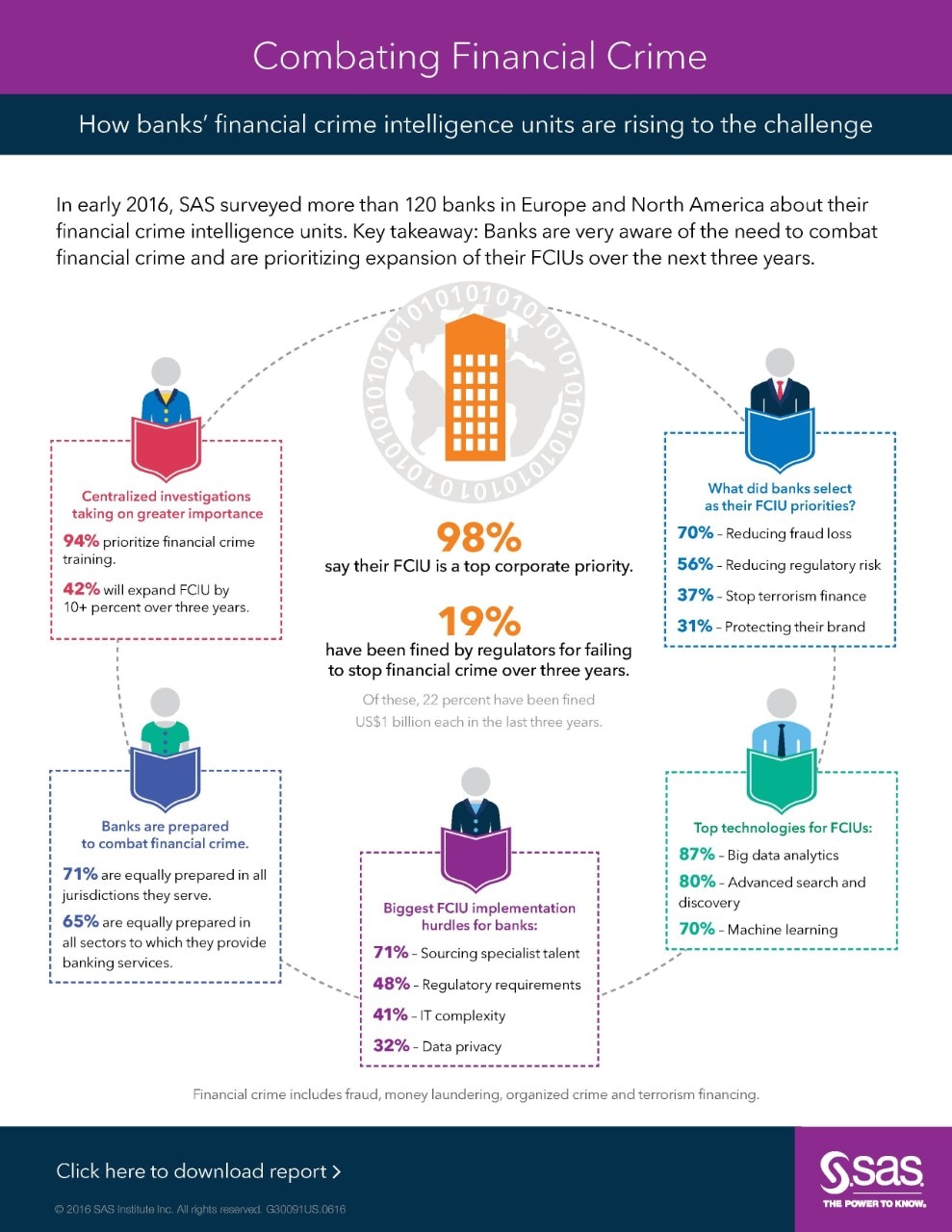

Leading banks are creating financial crimes intelligence units to help them proactively fight fraud

Faster validation of suspicious activities. Better, more accurate alerts. Quicker click-through to critical data. The newest release of SAS® Anti-Money Laundering goes further than ever to help analysts in financial institutions comply with anti-money laundering (AML) and counterterrorist financing regulations. The updates enable users to monitor more risks within even larger data volumes – and do so in minutes.

“A spotlight on efforts to stop the spread of terrorist activities plus increased regulatory pressure puts AML compliance as a top priority for financial institutions,” said Bill Fearnley, Research Director of Compliance, Fraud and Risk Analytics at IDC. “Deploying advanced analytics and visualization tools help compliance analysts uncover patterns and anomalies so they can quickly document cases.”

Among respondents to a 2016 SAS and Longitude financial crime survey of 120 banks, 19 percent had been fined by regulators or law enforcement agencies in the past three years – of those fined, 22 percent faced penalties of $1 billion or more.

Fines like these can cause serious reputational damage. They ramp up pressure on banks to investigate and address suspicious activity swiftly, a process complicated by high transaction volumes from online and mobile banking.

SAS Anti-Money Laundering is a complete solution that covers suspicious activity monitoring, customer due diligence, watchlist filtering and investigations case management. The software alleviates critical pain points for compliance departments:

- Transparency – Regulations demand banks explain their risk monitoring and prioritization strategies. SAS’ transparent environment clearly describes how alerts are generated and provides tools to analyze the distribution of data and efficacy of monitoring strategies.

- Visualization – SAS empowers users to change, author and test scenarios quickly. The streamlined user interface makes crucial information more readily available to analysts so they can quickly document cases and move work items through the decision-making process.

- Flexibility – SAS monitoring techniques are openly documented and backed by proven statistical methodologies for scenario deployment. The extendable and flexible SAS data model adapts to new lines of business, new client types or emerging risks.

- Consistency – SAS’ enhanced structure manages alerts and investigations centrally while preserving data security. This multitenant approach can reduce the cost of compliance and provide an enterprisewide view of risk exposure.

“One of the fastest ways to tarnish a bank’s reputation is media attention to a financial crimes scandal,” said David Stewart, Director of Banking Solutions in SAS’ Security Intelligence Practice. “Money launderers and organized-crime rings adapt quickly. So it’s vital for banks to deploy systems that not only monitor known risks, but can identify emerging patterns that may require coverage. SAS Anti-Money Laundering’s visual and behavioral analytics helps organizations avoid penalties related to noncompliance.”

To learn more, visit the SAS Anti-Money Laundering web page or download the white paper about the increasing importance of financial crimes intelligence units in banking.

Follow us on Twitter @SASsoftware for all the

latest news and views from SAS.

About SAS

SAS is a global leader in data and AI. With SAS software and industry-specific solutions, organizations transform data into trusted decisions. SAS gives you THE POWER TO KNOW®.

Editorial Contact:

- SAS Middle East

Abdelrahman Muneer +971 4 448 76 00 - PR Agency

Rose Manaog +971 4 390 2964