SAS® Anti-Money Laundering

Monitor suspicious activity. Make fast decisions. And stay in compliance.

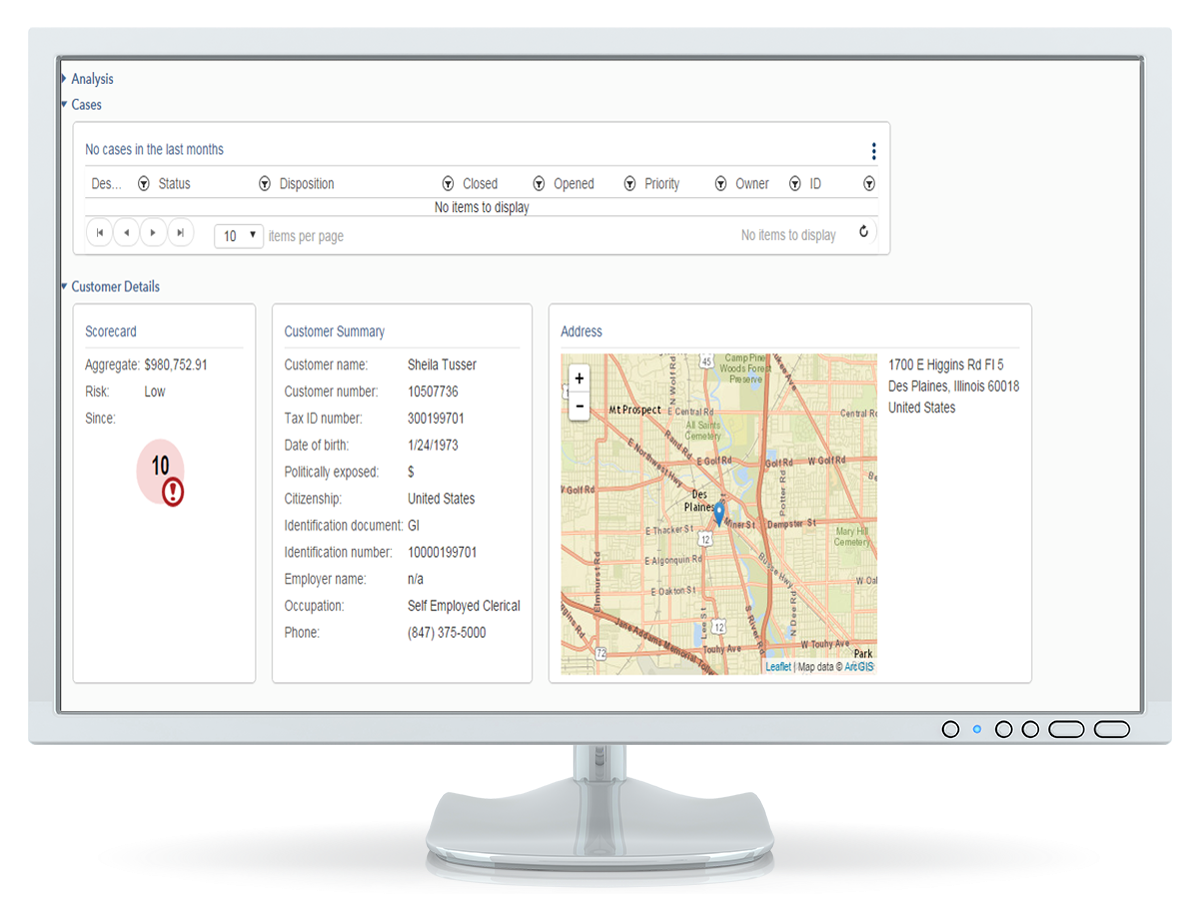

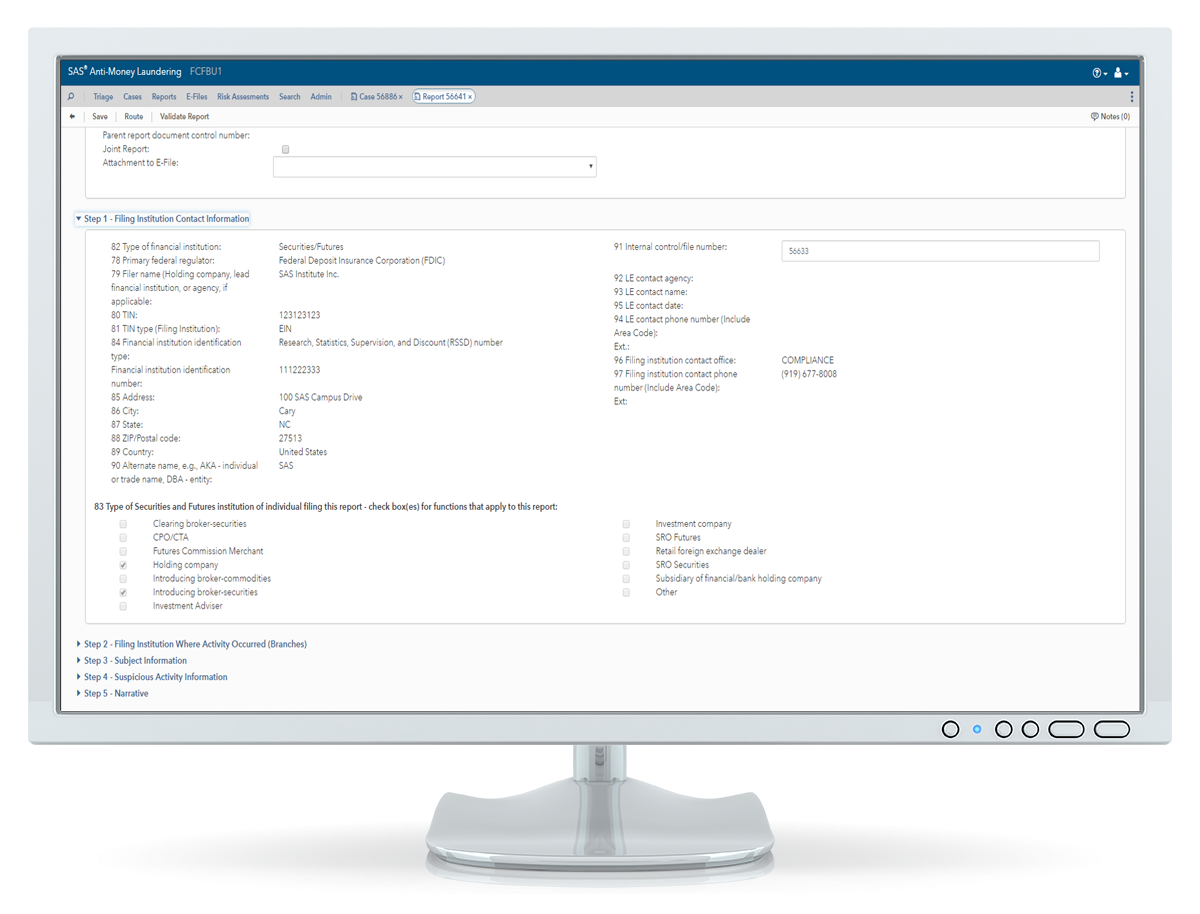

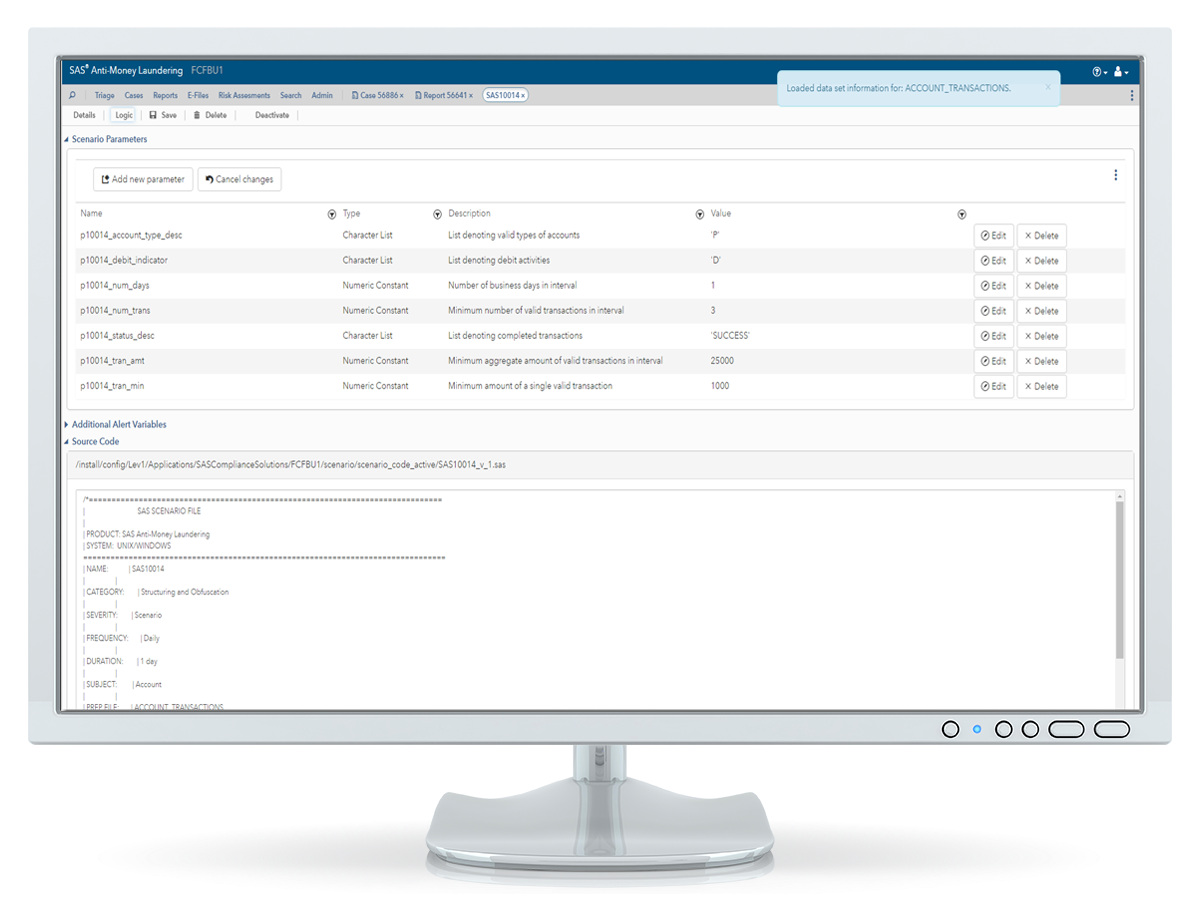

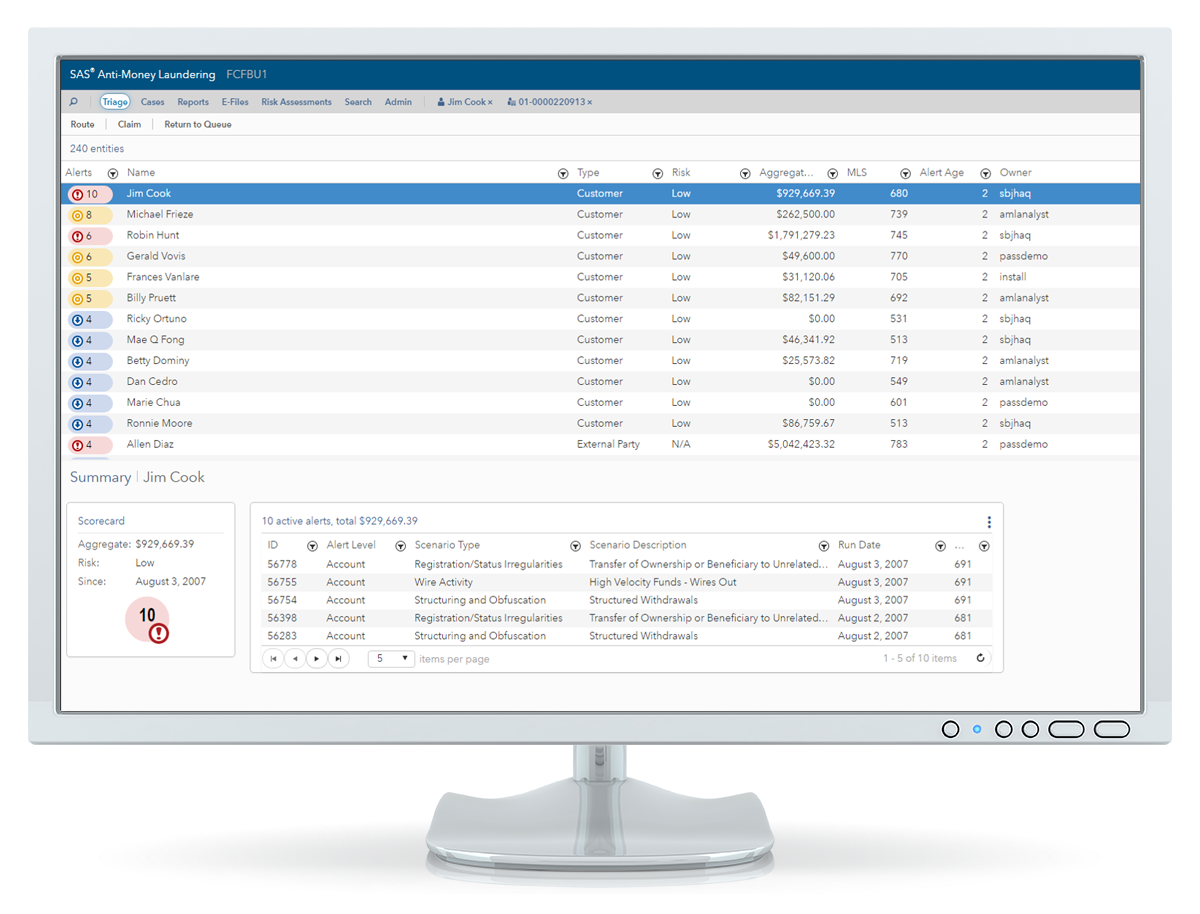

Rapidly increasing risk – combined with evolving government regulations – requires an advanced strategy when it comes to monitoring data for illicit activity. SAS helps you take a risk-based approach, making it easier to manage alerts, test scenarios and comply with industry regulations.

Video

Improving Anti-Money Laundering Operations

David Stewart, Director of the Banking Security Intelligence Practice at SAS, discusses why financial organizations looking to modernize their anti-money laundering operations are looking beyond baseline regulatory requirements to include financial intelligence teams tasked with actively reducing exposure and improving operations.

Recommended Resources

Learn how to blend quantitative and qualitative methods to better identify high-risk activity.