Digital Disruption in Telcos is still to come

I recently had the pleasure to meet Pilgrim Beart now the CEO of devicepilot at a TM Forum workshop about the Internet of Everything (IoE) business models and monetization. He shared his story about alert.me an early connected home start up founded in 2006 that was sold in 2015 to British Gas for 100 million €.

He said that they were in intensive discussion with three industries: utilities, retail (DIY chains) and Telcos, as he felt for all three of them there was a huge potential to build a platform on top of their core business. Despite trialing and piloting with all three industries only the efforts with Telcos never led to any real-life implementations. In the end, British Gas seized the opportunity and today offers the connected home system under the brand hive. Besides building a new stream of revenues it reinforced their position with existing customers and they can clearly demonstrate the effect as the NPV of customers that use hive is more than twice as high compared to those that do not use the platform.

Now again we have a lot of hype about IoT especially in conjunction with 5G. A bit sarcastically I could comment that is great as the commercial opportunity is at least 5 years away and that gives enough time to work with vendors on exciting trials to get the technology working and sign huge contracts. I agree with Andrew Entwistle, partner at independent research firm New Street Research, who stated according to a zdnet.com article:

"I'm perfectly prepared to accept that the Internet of Things is extraordinarily interesting to equipment makers and vendors, to systems integrators, to policy makers, and to people concerned with the social role of communications services in our lives, but there is an awful lot of noise about the Internet of Things that doesn't actually translate into, to put it strongly, a whole hell of beans for the telecoms operator who's looking to sell services to achieve revenue per customer or revenue per device"

Entwistle used the 5G hospital with tens of thousands of connected devices as an example to illustrate his point:

"The telecoms operator will not see a single penny from any one of those devices; they sell a 5Gbps fibre into the data room of the hospital today, and in 10 years' time they'll probably still be selling a 5Gbps connection, or 10Gbps fibre at half the price of today's 5Gbps fibre."

Source: Qualcomm

The attitude that if value is created on top of the networks Telco´s should get their “fair” share has often ben articulated. We heard the same argument when the so called “over the top players” started taking market share and making money on communication services and Telco´s claimed unbalanced regulation as a core reason. In this first digital disruption smartphones decoupled communication services from transport. An ecosystem of apps was created both by Apple and Google that catered for all kinds of communication needs. As a result, Telco´s “lost” their “monopoly” role providing those services to consumers to platform businesses like Facebook, Google and Apple.

A 2013 telecomcircle article gives a “historic” overview of what Telcos have tried to prevent this from happening like

- OTT blocking,

- creating own Telco communication apps or

- trying to define a new OTT standard for Rich Communication Services through the GSMA’s Joyn initiative – backed by Telcos such as Telenor, Orange, Telefonica, T-Mobile, Vodafone etc.

In hindsight, it becomes obvious that the traditional countermeasures of pipes towards new competitors do not work when applied to platform based business models. For example, when it comes to quickly evolving standards a traditional standardization approach that works well for long term stable standards like the communications industry has used to ensure interoperability does not work anymore. Therefore, it is no surprise that the GSMA Joyn initiative failed. Also blocking services which have huge economic benefits most of the time backfires to those that try to block them. It is interesting to note that the article does not deal with the characteristics that made the success of platforms possible like communities, network effects, the role of data and curation. Telcos run the risk of missing the point when they compare themselves on the principles of traditional value chains with platforms. Platforms do not compete for example on inputs to the business like labor and resources (network, shops, call centers) but instead can aggregate external resources at scale.

Source: Deutsche Telekom, Investor Day 2015

However Telcos on the average could live quite well with the first wave of digital disruption. Although they did not see the gains they were looking for and more than a decade ago the stock market thought were possible, Telcos managed to shift their service revenues (voice, messaging) to data or connectivity revenues keeping revenues relatively stable.

At this point I want to highlight another aspect of Entwistle´s prediction, which has received less attention in media headlines but in my view will be even more disruptive. The current business model for connectivity at least in mobile will fundamentally change latest with the widespread adoption of 5G:

"In the 5G world, you'll have no idea what your phone has been connected to, the decisions on your phone connection over the month will have been made by the phone and the network, and the opportunity to either overcharge somebody because of those decisions or to upsell them to a bigger data bundle because you think they ought to be paying more -- that opportunity really fades, and you could argue that's fading in the 4G world, but 5G really is a nail in the coffin.”

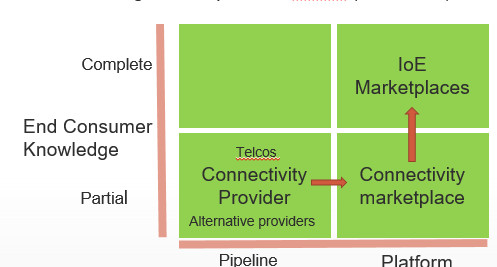

From these predictions, it is not hard to conclude that in the 2020´s the traditional mobile pipe business model will transform into a platform based business model with marketplaces for automatic trading of connectivity. Telcos if they do not move now will be at best suppliers to those new marketplaces. They will deliver data transport for transactions where they have the best connectivity to offer with no end customer relationship. It can get even worse as now nearly everybody can be a supplier. Alternative providers can offer local connectivity similar to what we have seen in the energy sector where decentralized power production from renewable sources has put big power plants in trouble.

As a consequence, my prediction is that the real Tsunami for Telcos is yet to come. Now Telcos are still at the edge of the digital vortex when it comes to the core business of providing access. The next lever of disruption will be at the connectivity layer and that will be the real disruption. The good news is there is time to prepare for this disruption. To quote Andrew Entwistle again:

"In a little burst of usage at 1Gbps, you could blow your entire bundle in eight seconds, and probably flatten your battery as well. So we really go as far here as to say that in the 5G era, we don't envisage the current cellular business model surviving."

If my analysis is right, then the next question is how can Telco´s seize the opportunities that come along with the shift from pipes to platforms. One thing at least is certain just as in first digital disruption through the so called “OTT” players. Telcos will get the money for what they provide and if that is basic connectivity they get revenues for basic connectivity independently from how much value is created on top of this connectivity and 5G is not changing that principle but might even make matters worse. If Telco´s want to benefit from the value created on top of access they must create an interaction first business: platforms.

To outline high level strategies, I will use the same framework that I already introduced in illustrating the 1st and 2nd digital disruption for Telco´s. It is an adapted framework from four business models for the digital era published in Sloan Management Review:

Source: Weill / Wörner, Thriving in an Increasingly Digital Ecosystem, SMR 2015

I would argue that optimizing the value chain through digitization is often the first step and thus efficient pipes eat not so efficient pipes. The second shift however is when real disruption happens and platforms start eating pipes as Sangeet Paul Coudaray puts it in his books “Platform Scale” and “Platform Revolution”. I have given typical incumbents examples like Nike adding the Nike+ platform to its core products and British Gas creating a marketplace for the connected home with the hive platform. On the supplier / B2B the same happens with companies like SAP moving form and pipe system of producing and selling on premise software to a cloud based business model with an ecosystem of third party extensions or General Electric creating their platform.

If we apply this framework to Amazon we can see an additional move. Amazon started as an e-commerce retailer for books based on an efficient pipe model. In a second step Amazon created a market place allowing other retailers to sell its products. An additional aspect of this step is that successful platforms in the beginning operate in a very focused area (books in this example) and later expand into adjacent areas. The same is true with hive. At the start the focus was on energy management as this is very close to what British Gas does. But once the platform is established, it is much easier to expand into neighboring territory like home security.

Amazon did not only create a retail marketplace but in addition created an external offering around the capabilities it built for that marketplace. It created amazon web services a cloud infrastructure other businesses can use. Amazon competes with companies like Microsoft, IBM and many Telco´s that provide cloud services as well. This is a theme we will see more and more as platforms get more sophisticated and demanding and rely on components other partners provide. It is no surprise that Pilgrim Beart after selling alert.me to British Gas founded his next start up devicepilot building on his experiences to scale an IoT platform and offers now a service to locate, monitor and manage IOT devices at scale making it easier for IOT platforms that can use this service rather than going through the same learning curve. It is important to note that Amazon stays in all three areas and is not abandoning its presence in any of those quadrants.

One of the challenges Telco´s have is that there are endless opportunities to extend from the core in new directions as nearly everything people do has a connectivity angle. Thus, many Telco´s engage in an enormous amount of activity and in the end despite their huge resources spend too little on each one of them to make them successful. As I illustrated before the point is to focus first to get a platform to scale and then expand rather than trying multiple initiatives at the same time hoping a few will succeed. This might work as an investment strategy but I have never seen it work for incumbents.

While writing down my thoughts on digital transformation of Telco´s I realized that it was too ambitious for me to cover the topic in one post and reach the level of depth I would be comfortable with. I split my post in three parts and will continue with the question “What are the mistakes Telcos need to avoid in Digital Transformation” in my second post. As always let me know your thoughts and if you agree or disagree with my assumptions and conclusions. Stay tuned and click the follow button below to receive notification of my next post:

(1) Digital Disruption in Telecommunications is still to come (This post)

(2) Telco mistakes in Digital Transformation

(3) Telco success in Digital Transformation

Software Development Manager, Frontier Networking Core Services at Amazon Web Services

6yExcellent article - some very interesting thinking points - very interested to see how TelCos can shift their thinking - 'Pipes' are very much a 'safety' net - ultimately more content, more traffic, more dependency on the Telco's infrastructure and the backhaul provided by the communication players - 5G is going to require backhaul - the content has to come from somewhere and go somewhere - but very interesting analogies with the power grid and how the 'intelligent edge' will become more interesting. I think the point about Platforms and Ecosystems and 'how' Telcos and communication providers can move horizontally and vertically is well made .. but Telco's tend to be comfortable in the infrastructure space making large bets on capital intensive projects - a fail fast mentality and agile approach is required to deal with the technical and organizational debt that the sector struggles with.. Exciting times

Non-Profit | Direct & Digital Marketer | Gerontologist

7yTelcos and Insurance are still stuck in the pipes model. Interesting observation on Amazon's evolution and sustained presence in all three quardrants.

Global Sales Leader | Strategist | Passionate about technology and business transformation and growth | Telecom | Cloud | AI | Customer Success | Organizational Design

7yWhat do you think about TelCos buying content (mainly TV, pictures and sports) to bundle it with ubiquous access (fix, mobile, ...)? Increasing stickiness by adding components to the bundle is working in some markets.

Business Planning

7yfantastic insight, great articulation of a complex topic.

Product Development & Innovation - Strategy - Marketing 🚀

7yThank you Dirk for this fantastic read. If I read you well the future of telcos is in the upper right quadrant...which happens to be also the turf of the GAFAM! Not really "Blue Ocean" at first sight ;-) Solution in your part 2? To be cont'd...