Econometrics

SAS Econometrics

Proactive, strategic and tactical planning for shaping a more profitable future.

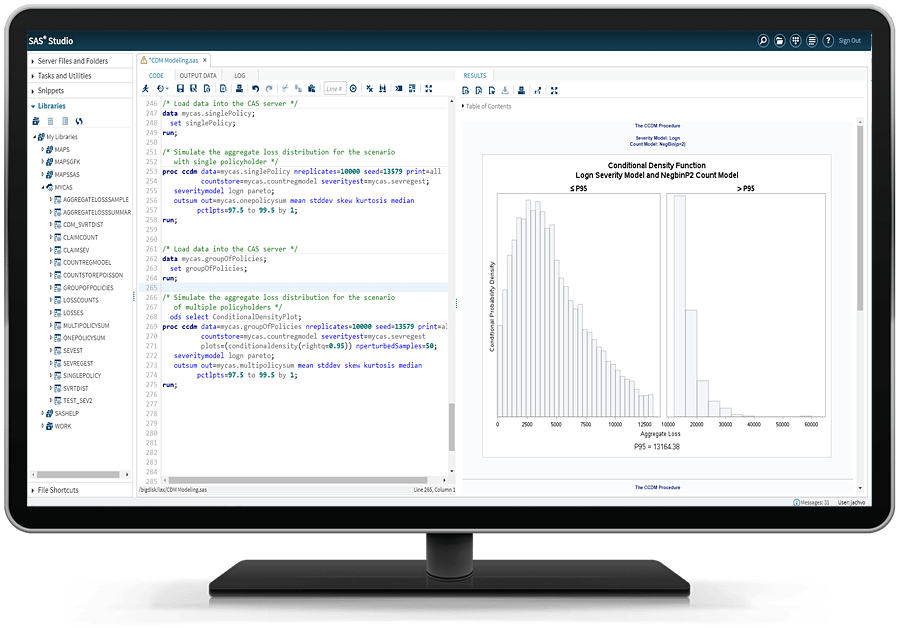

SAS Econometrics lets you model, forecast and simulate complex economic and business scenarios using huge amounts of observational data.

Get faster answers to your time- and event-specific questions.

Run large-scale, multivariate simulations that you can fit using different specifications. Perform count regression, cross-sectional analysis, panel data analysis and censored event estimation for both discrete and continuous events. The SAS® Viya® scalable, distributed in-memory engine delivers econometric modeling results on even the largest data sets at exceptional processing speeds. And in-memory data persistence eliminates the need to load data multiple times during iterative analyses.

Empower users with programming language options.

Python, Java, R and Lua programmers can experience the power of SAS Econometrics without having to learn SAS. The SAS Viya engine enables programmers to access powerful, trusted and tested SAS algorithms from their preferred coding environment.

Make better, more scientific decisions.

Understand how varying economic and market conditions, customer demographics, pricing decisions, marketing activities and more can affect your business. Analyze risks and respond to regulatory requirements. The solution enables you to model and simulate any business process, no matter how complex – even when time dependencies, simultaneous relationships or dynamic processes complicate the analyses. By combining forecasting processes with econometric analysis, you can proactively shape a more profitable future.

Key Features

Plan better for the future by using a broad array of econometric techniques to understand the impact of economic and marketplace factors on your organization.

Data access, preparation & quality

Access, profile, cleanse and transform data using an intuitive interface that provides self-service data preparation capabilities with embedded AI.

Deep neural networks

Estimate the average causal effect, and perform policy evaluation and policy comparison, by using deep neural networks.

Data visualization

Visually explore data and create and share smart visualizations and interactive reports through a single, self-service interface. Augmented analytics and advanced capabilities accelerate insights and help you uncover stories hidden in your data.

Hidden Markov models

Model and predict hidden Markov models with the powerful HMM procedure.

Spatial econometrics modeling

Use the CSPATIALREG procedure to perform spatial regressions. Incorporate data with a spatial element (e.g., location and mapping data) into analyses, and improve the econometric inference and statistical properties of estimators.

Econometric models for cross-sectional data

Perform cross-sectional data analysis with count regression, severity regression, qualitative and limited-dependent variables, and copula methods with compound distribution.

Forecasting models for time series data

Model complex economic and business scenarios to analyze the impact of specific events over time. Time series models include user-defined ARIMA and exponential smoothing models. Time series analysis includes decomposition capabilities and diagnostic testing.

Economic capital models

Simulate portfolio risks and estimate VaR, TVaR, etc., by combining frequency, severity and copula modeling. This enables you to model the need for capital reserves and comply with prudential regulation and capital adequacy directives.

Panel data econometric models

Analyze data that combines both time series and cross-sectional dimensions using panel data models, count regression models, and regression models for qualitative and limited-dependent variables.

Includes all SAS/ETS® procedures

Access to all procedures in SAS/ETS so you can address virtually any econometrics and time series analysis challenge.

Market attribution models

Identify which marketing channels drive customer conversions and optimize your investment in those channels.

State space model scoring

Scoring can be used for efficient, model-based scenario analysis and stability monitoring of an ongoing data stream.

Moody's Analytics Data Buffet

Access more than 600 sources of global historical statistical data and 40 forecast databases – over 220 million time series.

Seamless access to the US Bureau of Economic Analysis (BEA) data

Access the most timely, relevant, accurate data on the US economy, with information about personal income, corporate profits, government spending, fixed assets and changes in the net worth.

Cloud native

SAS Viya's architecture is compact, cloud native and fast. Whether you prefer to use the SAS Cloud or a public or private cloud provider, you'll be able to make the most of your cloud investment.

Custom chatbot creation

Create and deploy custom, natural language chatbots via an intuitive, low-code visual interface for chatbot-enabled insights and conversational user experiences.

SAS Viya is cloud-native and cloud-agnostic

Consume SAS how you want – SAS managed or self-managed. And where you want.

Related Offerings

Check out these products and solutions related to SAS Econometrics.